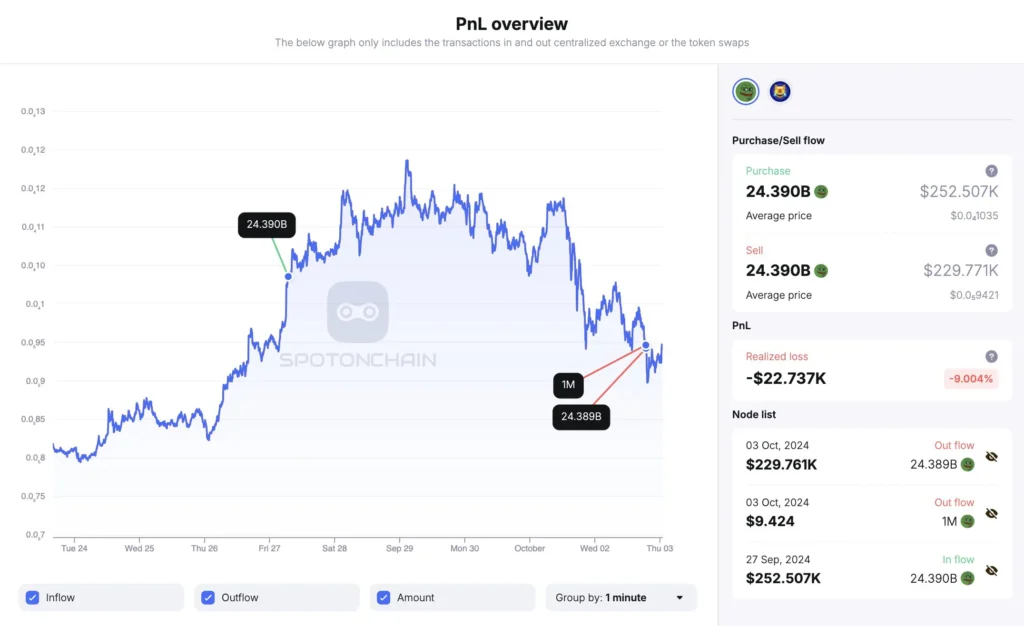

Arthur Hayes, the former CEO of BitMEX, suffered a loss of $47,000 due to the price drop of meme tokens. On September 27, he invested $503,000 in purchasing 24.39 billion PEPE for $230,000 and 167.5 billion MOG for $223,000. By October 2, the value of these assets dropped to $460,000, leading to an unrealized loss of $47,000.

Arthur Hayes already accepted a $47K loss from two memecoins $PEPE and $MOG after 6 days!

— Spot On Chain (@spotonchain) October 3, 2024

6 hours ago, @CryptoHayes deposited all 24.39B $PEPE ($230K) and 167.5B $MOG ($223K) back to #Binance and #Bybit.

Notably, he spent $500K in total on those tokens just on Sep 27, after… https://t.co/IMxEPYZ0LY pic.twitter.com/v2hBWrf8Yd

Price Drop and Its Impact on the Market

Meme tokens like PEPE and MOG are known for their high volatility and lack of fundamental support, making them especially vulnerable to sharp price fluctuations. Despite recent optimism surrounding meme tokens, the market demonstrated its unpredictability, resulting in significant losses even for experienced traders like Hayes.

Hayes’ Investment Strategy

These investments are part of Hayes’ broader strategy involving high-risk assets, which is typical of his approach to the cryptocurrency market. Earlier in September, he closed a short position on Bitcoin with a 3% profit, demonstrating his risk management experience. However, the current situation with meme tokens highlights the risks associated with more volatile assets.

Risks and Opportunities for Traders

Hayes’ story with meme tokens emphasizes both the risks and opportunities for those choosing to invest in high-volatility assets. On one hand, meme tokens can provide high returns due to rapid growth, but on the other hand, sharp price drops can lead to significant losses. Traders are advised to consider this factor when developing their investment strategies.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.