On the night of October 7, Bitcoin rose to the $64,000 mark, driven by positive U.S. labor market data and expectations of a rate cut by the Federal Reserve in November, according to The Block. Experts noted that the ongoing geopolitical tensions in the Middle East pose a risk to further growth of the leading cryptocurrency.

“Optimism has increased regarding a ‘soft landing’ for the U.S. economy,” said Min Zhong, an analyst at Presto Research.

Macroeconomic Factors

Rachel Lucas from BTCMarkets added that the anticipated easing of Federal Reserve policy is boosting interest in Bitcoin. She also pointed to the reduction in exchange coin balances as a sign of diminishing selling pressure.

Technical Analysis

“To sustain this recovery, Bitcoin needs to break and hold the $64,500 level, after which a test of the $66,000 mark may be possible,” Lucas added.

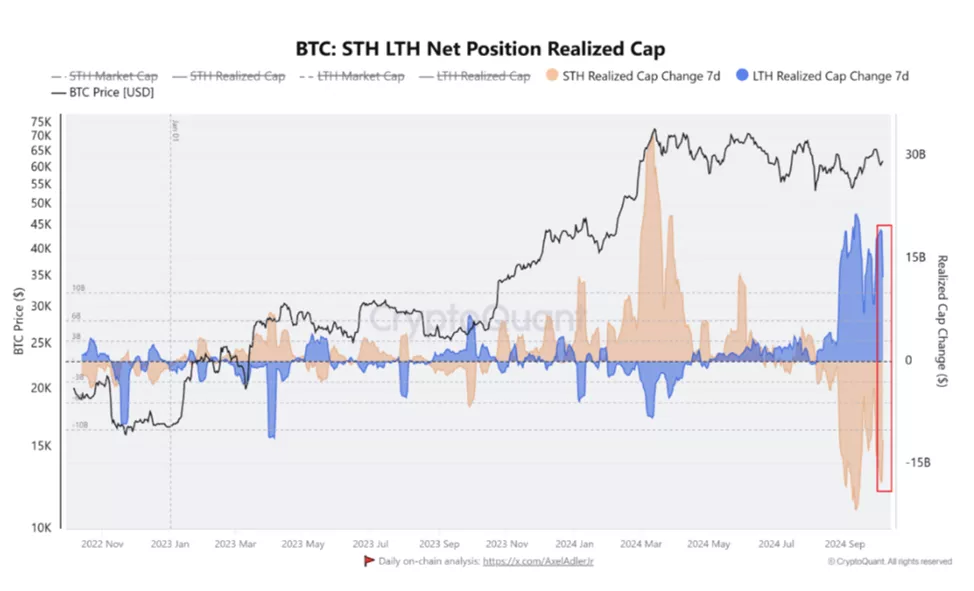

Specialists from CryptoQuant observed an increase in activity from short-term investors. Since October 5, the realized market cap for this group of participants has increased by $6 billion over the last seven days. This suggests that short-term holders are building long positions, while long-term investors are locking in profits.

Recovery Drivers

CryptoQuant analysts also identified signs of a “golden cross” forming in Coinbase’s premium, which could signal continued short-term growth. Canaccord analysts are confident that Bitcoin’s rally is inevitable.

Previously, Canaccord noted that Bitcoin’s volatility might rise in anticipation of a rate cut by the Federal Reserve, which will have a significant impact on its future price movements.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.