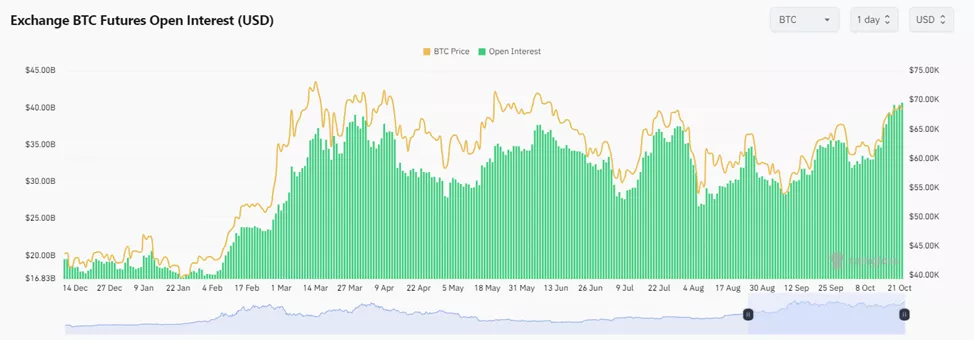

On October 21, the total open interest (OI) in Bitcoin futures reached an all-time high of $40.6 billion, surpassing the previous record set in March during the asset’s price peak. This data was provided by Coinglass.

The OI volume in Bitcoin totaled 592,000 BTC, marking the highest level since December 2022, when the cryptocurrency traded below $20,000 amidst pessimistic market sentiment.

40% of the total open interest in dollar terms is concentrated in futures contracts traded on the CME Group, a platform popular among institutional investors, equivalent to $11 billion.

“Bitcoin’s breakthrough above $68,000 was accompanied by an inflow of approximately $2.4 billion into BTC ETFs over the past six trading sessions. This, along with rising OI, indicates a constructive environment for opening new long positions,” said Augustin Fan, head of analytics at SOFA.org.

Experts from QCP Capital highlighted that economic factors in Japan and China, as well as the upcoming US elections, are driving Bitcoin’s price growth.

4/ Japan’s inflation dipped to 2.5% from 3.0%, and the BOJ is likely to keep rates low. Meanwhile, US equities are near all-time highs, and the USD/JPY rally continues. All signs point to strengthening risk-on sentiment as the US election nears.

— QCP (@QCPgroup) October 20, 2024

“US stocks are at historic highs, while the Japanese yen is weakening. Expectations regarding the US elections boost optimism, which will support risk assets and continue the so-called Uptober trend,” noted the specialists.

Notably, BlackRock CEO Larry Fink stated that Bitcoin’s growth will persist regardless of the outcome of the US presidential election.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.