Bitcoin reserves on centralized cryptocurrency exchanges have reached their lowest level in recent years, according to data from CryptoQuant. Over the past month, more than 51,000 BTC were withdrawn from major trading platforms, signaling a reduction in the liquid supply of the leading cryptocurrency.

Decline in Liquid Supply

Currently, Bitcoin reserves on exchanges total about 2.6 million BTC, significantly lower than the 3.2 million BTC recorded in October 2021 when CryptoQuant began tracking this metric. This suggests that market participants prefer to use non-custodial wallets for long-term storage.

Reasons Behind the Decline in Reserves

“Bitcoin reserves on exchanges have decreased this year, partly due to the distribution of Mt.Gox funds to creditors. Our reserve data also included the assets from that exchange. Additionally, the significant decrease in reserves on Coinbase has reduced potential selling pressure on Bitcoin,” said Julio Moreno, Head of Research at CryptoQuant, in an interview with The Block.

According to him, a significant portion of funds is being transferred from Coinbase to long-term storage, indicating activity from institutional players such as companies and funds offering Bitcoin spot ETFs.

Bitcoin Accumulation by Institutional Investors

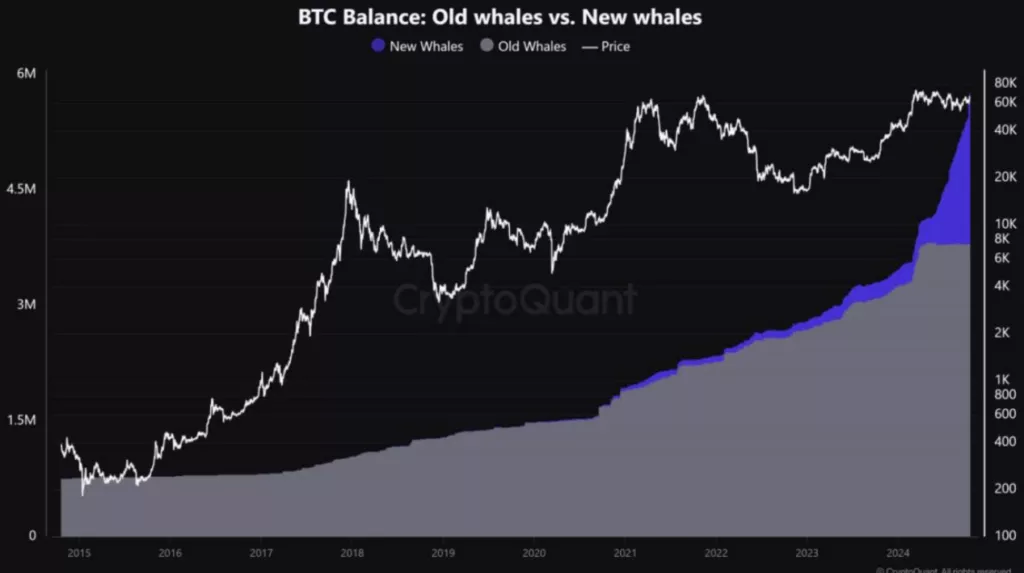

According to analysts, “new whales” — large investors — are actively purchasing Bitcoin, creating buying pressure and pushing the asset’s price up. Currently, these investors hold 1.97 million BTC.

“The new wave of Bitcoin accumulation has intensified buying pressure. We see whales buying coins, which supports the price increase. This process is not only linked to the activity of spot ETFs but also to other major players,” noted CryptoQuant analyst J.A. Maartunn.

According to the data provided, platforms like Coinbase and Bitfinex are seeing predominant buying pressure, while Binance and Bybit are experiencing more short positions.

Separation Between Large and Small Players

Analysts also note that institutional investors continue to accumulate Bitcoin, while smaller players are reducing their holdings. This often leads to smaller investors being forced to buy assets at higher prices once the market recovers.

“Institutional investors are strengthening their positions before the market improves, which may lead to asset distribution during the next price rise,” explained CryptoQuant experts.

The “new whales” are wallets not associated with miners or exchanges, holding over 1,000 BTC, and aged no more than 155 days.

Earlier, CryptoQuant author Axel Adler noted that investors with balances exceeding 1,000 BTC have accumulated an additional 1.5 million coins over the past six months.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.