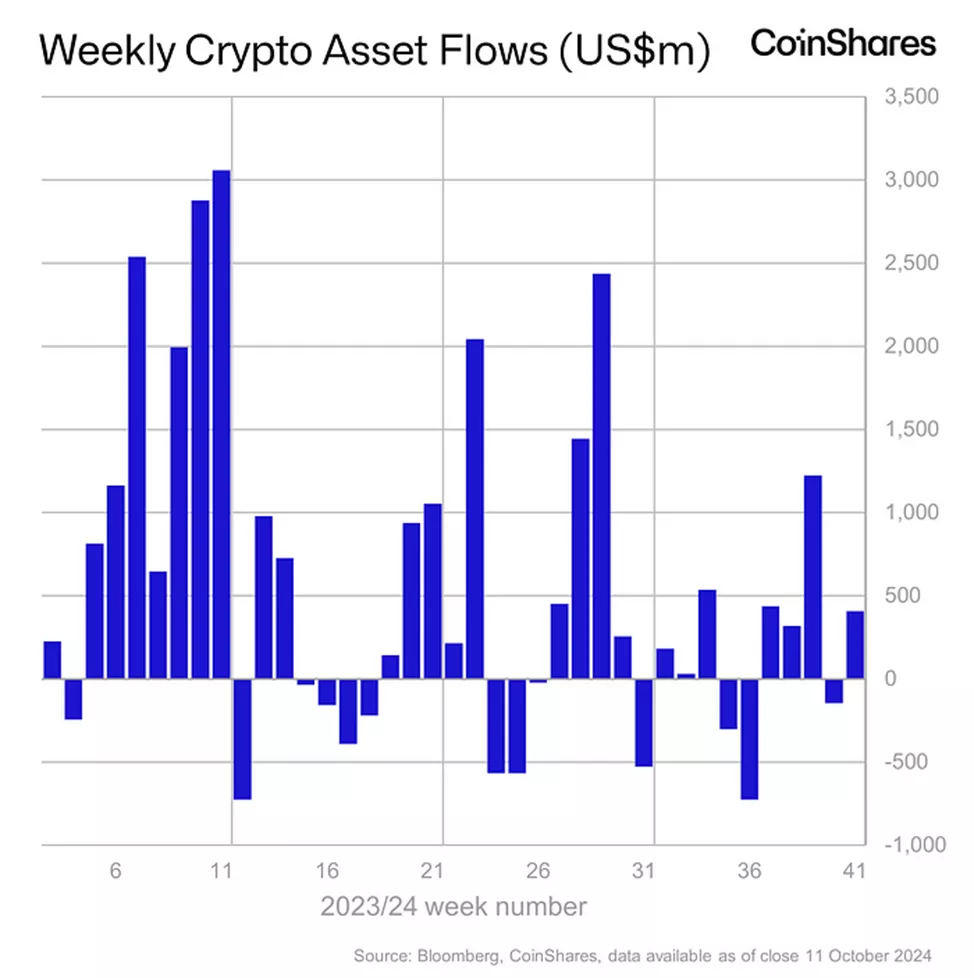

From October 6 to October 12, inflows into cryptocurrency investment funds totaled $407 million, a stark contrast to the $147 million outflow the previous week, according to data from CoinShares.

Analysts believe that the primary factor influencing investors’ decisions was the shift in the U.S. presidential race, rather than macroeconomic data or Federal Reserve policy. Specifically, the increasing chances of Republican candidate Donald Trump winning the election boosted interest in cryptocurrencies, as he is seen as more favorable towards digital assets compared to Democratic candidate Kamala Harris.

Bitcoin Fund Inflows

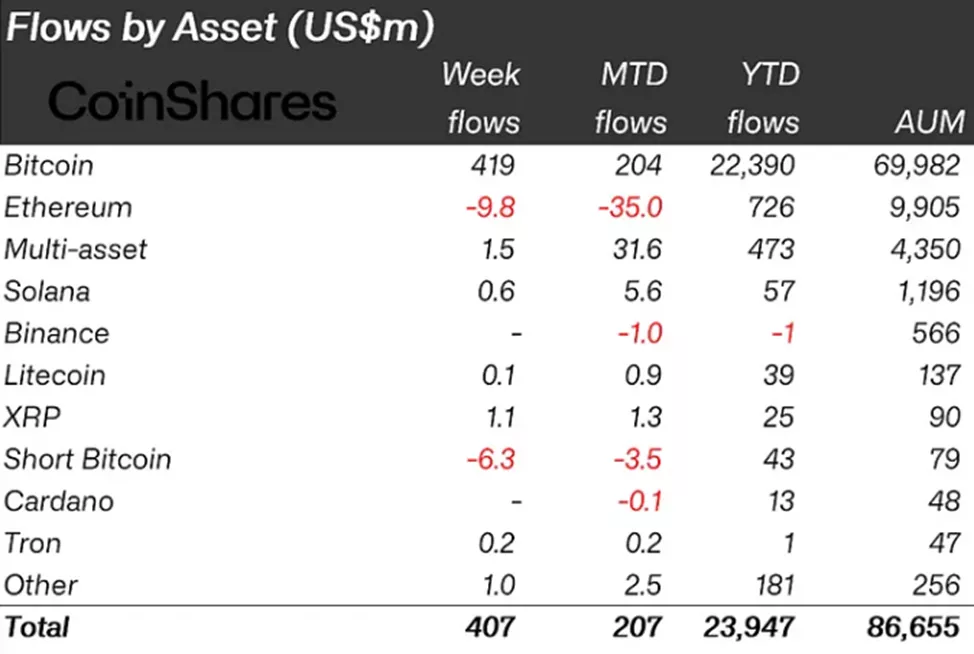

The largest inflow of funds — $419 million — was directed towards Bitcoin-related products, following a $159 million outflow the previous week. At the same time, $6.3 million was withdrawn from products that allow shorting Bitcoin, after a $2.8 million inflow the previous week.

Ethereum and Altcoin Products

Ethereum continues to experience outflows, with $9.8 million withdrawn this week, following $29 million the previous week. However, Solana and XRP-based products attracted $0.6 million and $1.1 million, respectively.

Other altcoin-based products saw inflows of $1.7 million, extending their streak of consecutive inflows to 17 weeks.

Pre-Election Market Expectations

Analysts at Bernstein predict sideways movement in the market until the conclusion of the U.S. elections, as uncertainty remains regarding the identity of the future SEC chairman.

Earlier, the media published a list of potential candidates for the role of SEC head in the event of a Trump victory.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.