Bitcoin serves as a portfolio hedge against “sovereign defaults,” and its fair value is around $219,000, according to Bitwise experts.

“Sovereign default risks are rising globally amid record levels of government debt as a percentage of GDP. Particularly worrying signals are coming from France and the UK, where the fiscal situation is alarming bondholders,” the analysts wrote.

They noted that the U.S. national debt recently topped $36 trillion, about 123% of GDP—an all-time high that raises doubts about the government’s ability to meet fiscal obligations.

Further deterioration in the macro environment could trigger severe economic consequences, including heightened risks in the bond market. Historically, uncertainty has had mixed effects on Bitcoin’s price: times of increasing fear often see interest in cryptocurrencies grow as an alternative asset class.

Bitwise estimates that if G20 sovereign bonds, totaling $69.1 trillion, have a 6.2% chance of default, the theoretical “fair price” for Bitcoin exceeds $200,000.

“In theory, Bitcoin—with its current ‘fair value’ around $219,000—could serve as a ‘portfolio insurance’ against default on a basket of top sovereign bonds,” Bitwise stated.

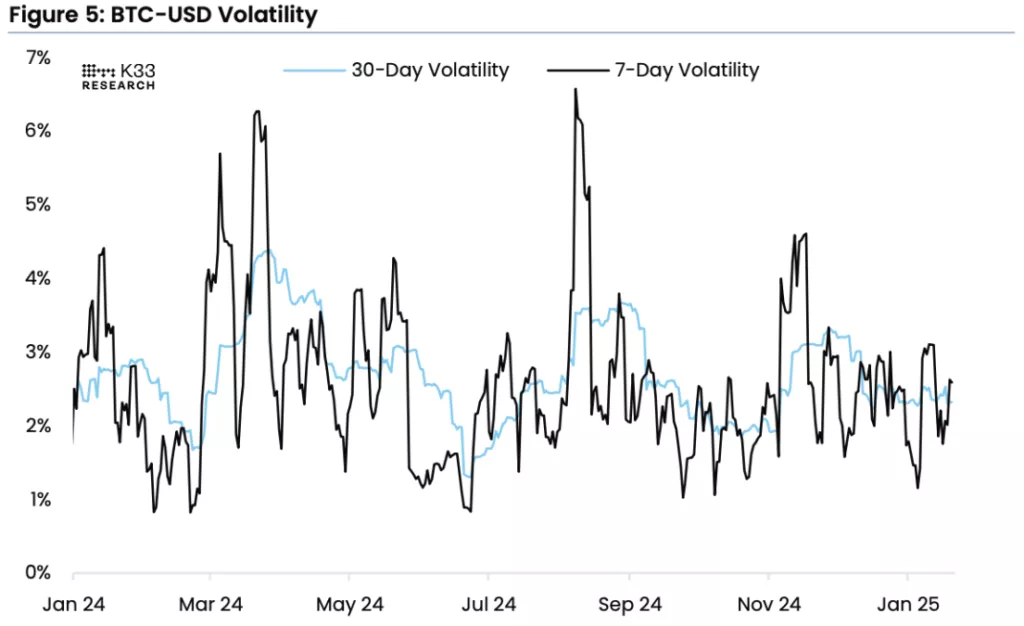

Volatility Remains a Hurdle

The firm emphasized that Bitcoin’s limited supply and absence of counterparty risk reinforce its status as a reliable defensive asset. However, high volatility continues to be an inherent characteristic of cryptocurrencies: rapid downturns during uncertain times pose a challenge for investors seeking stability in crisis periods.

On the other hand, Bitcoin’s decentralization makes it independent of government or financial-institution actions, attracting market participants wary of inflation or currency devaluation.

Context

- Bitwise analysts previously predicted that corporate investments in Bitcoin will keep gaining momentum, evolving into a global “megatrend.”

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.