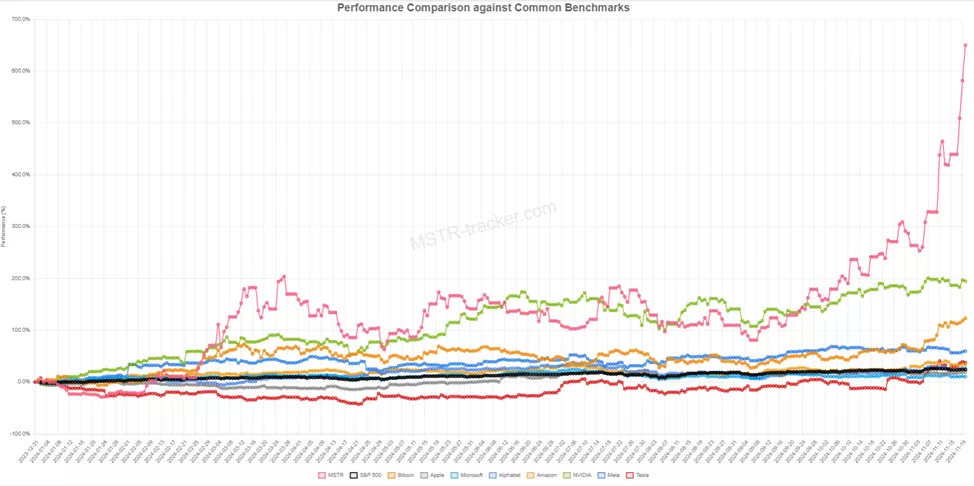

Since the beginning of 2024, MicroStrategy‘s stock has surged by 650.2%, while Bitcoin has increased by 123.1%. These figures come from MSTR Tracker.

The chart also highlights how MSTR has outpaced the S&P 500 index (24.2%), Nvidia stock (194.6%), and other members of the “Magic Seven.”

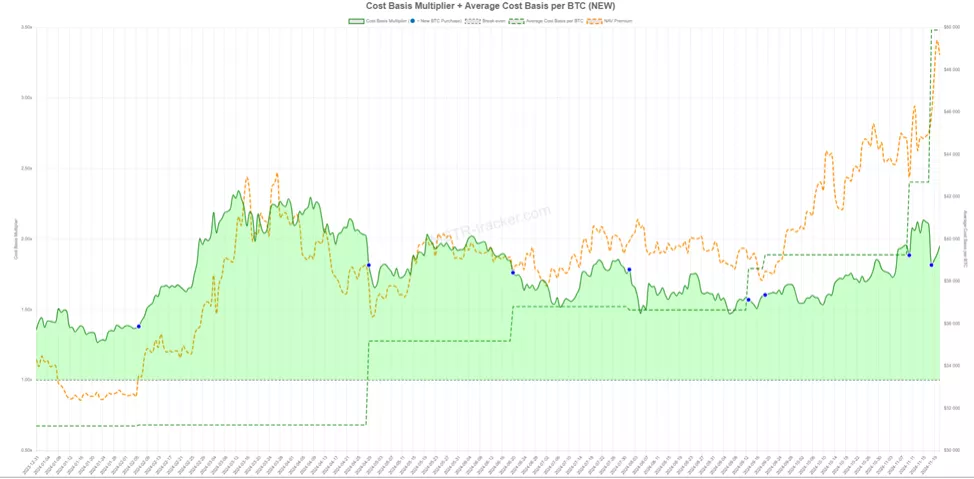

The company’s market capitalization has surpassed $96 billion, reflecting a jump in NAV based on the 331,200 BTC held on its balance sheet, which has increased to 3.3x, compared to 1.15x at the beginning of the year.

This growth shows the gap between the company’s market cap and Bitcoin’s price increase over the same period.

On November 20, following Bitcoin’s new highs, the unrealized profit from MicroStrategy‘s Bitcoin investments exceeded $16 billion at one point. The market value of these coins was double their book value.

The day before, MicroStrategy announced plans to issue $1.75 billion in 5-year senior convertible bonds to purchase more Bitcoin. Later, the firm increased the issuance amount to $2.6 billion.

Earlier, Cryptol reported that MicroStrategy CEO Michael Saylor had prepared a proposal for the board of Microsoft to be presented on December 10, which suggests using Bitcoin as a reserve asset for the company’s treasury.

In October, MicroStrategy unveiled its “21/21 Plan,” aimed at raising $42 billion over the next three years to purchase more Bitcoin.

It’s worth noting that Saylor has expressed his ambition to transform MicroStrategy into a Bitcoin bank with a market cap of $1 trillion.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.