Experts have highlighted potential local bottom levels for Bitcoin ahead of the US elections, which may be accompanied by price fluctuations due to expectations in the options market. Traders predict a possible retracement of the leading cryptocurrency to the $65,000 level before a rebound begins.

Titan of Crypto, an analyst, believes Bitcoin could reach $66,200 before any growth starts:

#Bitcoin Local Bottom at $66,200 Before a Bounce? 💥#BTC couldn't close above Tenkan 🔴, signaling a possible more profound pullback.

— Titan of Crypto (@Washigorira) November 3, 2024

If the breakout is confirmed, we might see a retest of Kijun 🔵 around $66,200, which could mark a local bottom. pic.twitter.com/a3M1YBh7vA

“The price hasn’t stayed above Tenkan on the Ichimoku Kinko Hyo indicator. This suggests the possibility of a deeper retracement. A breakout could lead to retesting Kijun around $66,200, marking the local bottom,” the trader noted.

Trader Credible Crypto also pointed to a range between $65,000 and $69,000 as a zone where a significant rebound could occur:

A quick look at some of our back-end data on $BTC here:

— CrediBULL Crypto (@CredibleCrypto) November 2, 2024

The good:

OI has nearly completed reset from the most recent rise as we are seeing some de-leveraging into support (65-69k) on this drop. This is a good sign for bulls.

In addition, the perp premium that had spiked at our… https://t.co/1uDt2cL7EZ pic.twitter.com/omjV5T9f4n

“Based on high-timeframe analysis, there’s a chance of updating the ATH before a deeper correction. Let’s see if we get a rebound and move higher,” he explained.

Bitcoin’s price decline began after an unsuccessful attempt to reach the previous peak. Ahead of the US presidential elections, traders started reducing their positions, adding volatility to the market.

Signals from the Options Market

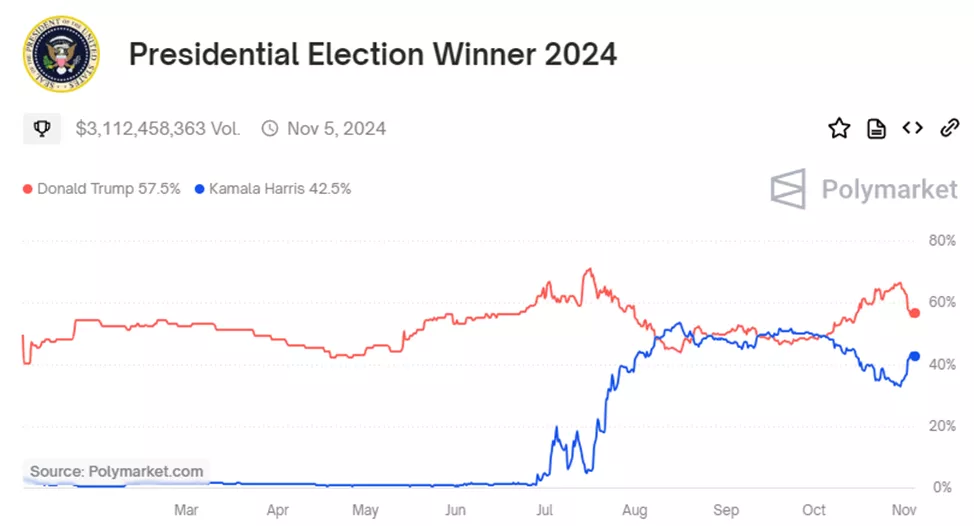

Analysts from QCP Capital have observed shifts in voter preferences. The probability of Donald Trump winning is estimated at 55%, down from 66% a week earlier.

Analysts suggest Bitcoin may fluctuate within a range until clarity emerges from the election results, with potential growth in case of Trump’s victory and a possible correction if he loses.

Asia Color – 4 Nov 24

— QCP (@QCPgroup) November 4, 2024

1/ Polymarket odds are converging with recent polling, showing Trump narrowly leading at 55%—down from 66% just a week ago. Market signals remain cautious: weekend price action was flat, and leveraged perpetual positioning has decreased from $30B to $26B.

“We’re seeing an increase in call positions on Bitcoin with strike prices around $75,000 for the end of November, reflecting optimism in the mid-term,” the analysts stated.

Nick Forster from DeFi Derive.xyz noted that the increase in volatility in the derivatives market indicates a potential for 10% price fluctuations in Bitcoin and Ethereum after the November 5 elections.

“The total open interest in Bitcoin calls is 1,179 contracts versus 885 puts, indicating a positive market sentiment despite expected price fluctuations,” Forster added.

Earlier, experts from Tyr Capital and Bitget Research, as well as analysts from Standard Chartered, also forecasted volatility following the US elections.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.