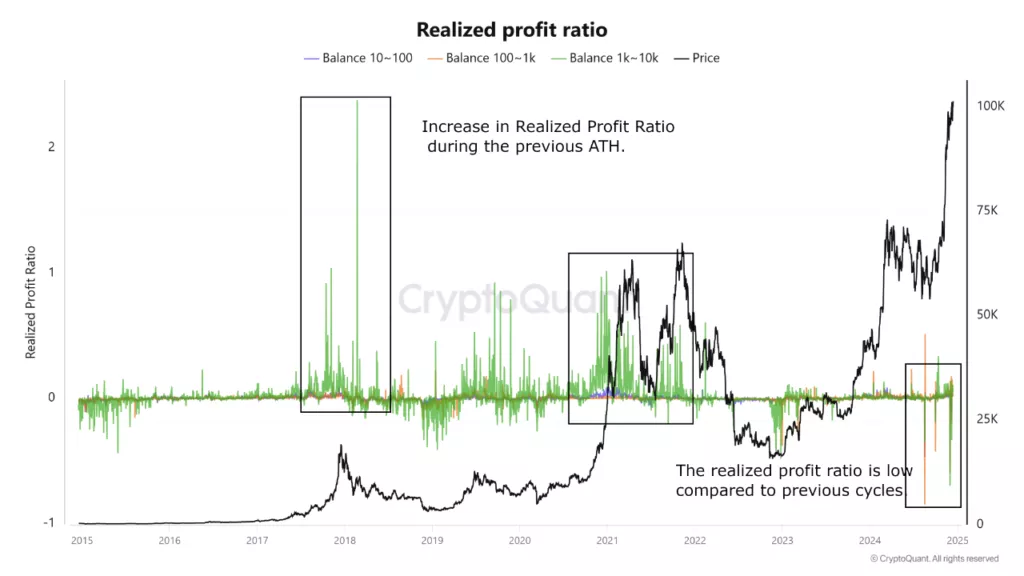

Large Bitcoin holders have not yet begun active selling, according to CryptoQuant contributor CryptoOnchain.

This conclusion is supported by low realized profit ratio values, especially when compared to levels seen during all-time highs in previous cycles.

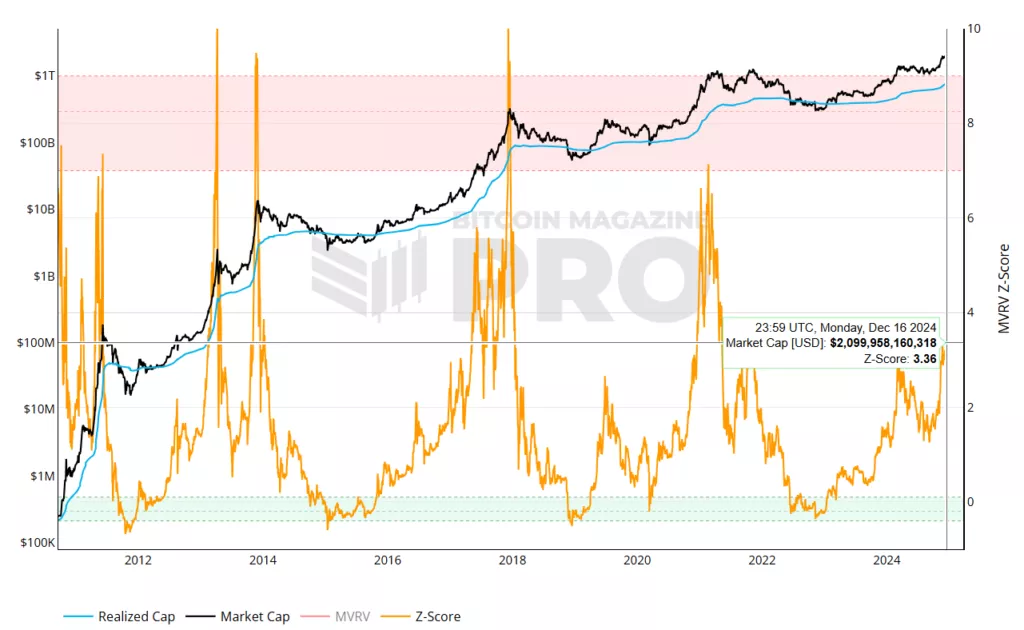

“This may suggest that whales believe we are still not in the ATH range of this cycle,” noted CryptoOnchain. Supporting this view are current values of the on-chain metric MVRV Z-score, which are just above level 3. These values remain far from the “red zone” of strong overbought conditions, which typically signal an imminent market phase reversal.

Another analyst, Avocado_onchain, highlighted the dominance of demand from spot market participants:

“With decreasing activity in futures, demand on the spot market continues to grow. This indicates a cooling of speculative overheating in futures and increasing buying pressure on spot platforms.”

He believes the derivatives segment is nearing “cycles of overheating and liquidations,” which, according to Avocado_onchain, will contribute to Bitcoin’s continued growth and drive capital inflows into the spot market.

Previously, analysts at Bitfinex predicted that Bitcoin would reach its price peak of $200,000 in the second half of 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.