Despite heightened trading activity in the Bitcoin market, the share of “young” UTXOs has not yet reached historically high levels, according to CryptoQuant contributor IT Tech.

Young UTXOs and Cycle Peaks

In previous cycles (labeled 1–5 on the chart), whenever the market peaked, most UTXOs were “young,” meaning between 1 day and 3 months old. The proportion of recently moved coins hit maximum levels during market tops, as seen in 2013, 2017, and 2021.

“Current values are still far from the extreme levels recorded at peaks of previous cycles,” analysts emphasized.

They added that, prior to distribution (i.e., active selling), the market is likely to see another leg higher.

“If long-term holders maintain their positions, this upward movement could have even more room to grow,” IT Tech noted.

Glassnode Data

According to Glassnode, the share of “young” UTXOs is currently 50.2%.

At 50.2%, the proportion of wealth held by new #Bitcoin investors (24H to 3 months), is still well below the levels seen during previous ATH cycle tops:

— glassnode (@glassnode) January 28, 2025

🔺2018 peak: 85%

🔺2021 peak: 74%https://t.co/hkTSpFVAPG pic.twitter.com/6gcOgIIlvM

At the peak of the bull market in 2018, the metric reached 85%, and in 2021 it was 74%.

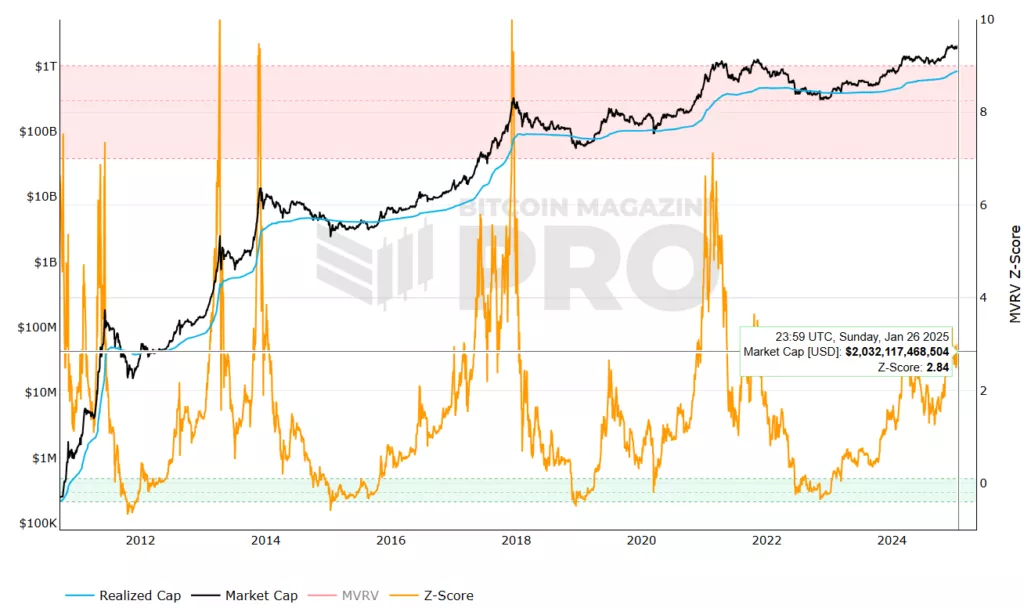

MVRV Indicator

The MVRV ratio remains slightly below 3.

A “red zone” of overbought conditions — historically a signal for potential selling — starts around 7. In 2017’s bull market peak, the indicator reached 10.

Context

- Experts at Copper predict Bitcoin’s price will peak at the end of May 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.