According to CoinDesk, signs of weakening selling pressure after Bitcoin touched the 200-day moving average (DMA) may indicate an imminent rebound.

Experts pointed to candlestick patterns observed on February 28 and March 4, both featuring long lower wicks and small bodies. This structure typically signals a shift in market control from bears to bulls.

If Bitcoin surpasses the $95,000 resistance level, the next key target could be $100,000. However, a decisive breakdown below the 200 DMA may trigger a new wave of selling.

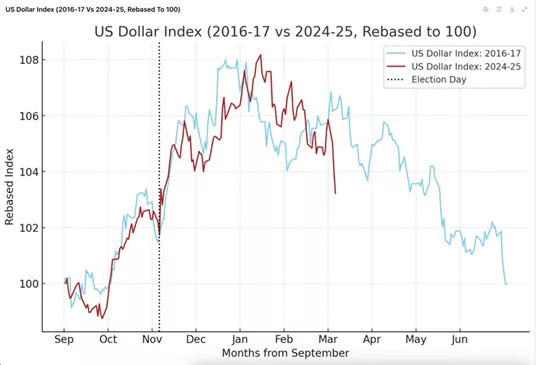

Additionally, analysts highlighted the decline in the U.S. Dollar Index (DXY), which creates favorable conditions for Bitcoin’s recovery.

“When DXY is above 100, risk assets usually face pressure, but as the index fell below 105, Bitcoin climbed above $88,000. A similar situation occurred in 2017 when the index dropped below 90, pushing the first cryptocurrency’s price to $20,000,” the report stated.

Experts also reminded that the U.S. Department of Labor will release its employment report on Friday. If the unemployment rate remains at 4%, it could lower Treasury yields and increase the likelihood of the Federal Reserve easing monetary policy at its March meeting.

According to the CME FedWatch Tool, traders estimate a 43.1% probability of a rate cut by the Fed in May.

Previously, former BitMEX CEO Arthur Hayes predicted that the Federal Reserve’s shift to a looser monetary policy in response to a U.S. recession could push Bitcoin’s price to $1 million.

Meanwhile, CryptoQuant CEO Ki Young Ju suggested that Bitcoin might remain in a wide range of $75,000–$100,000 for an extended period, similar to its behavior in early 2024 before resuming an upward trajectory.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.