Bitcoin is expected to pull back to the $70,000-$75,000 range. The key driver behind the price decline will be the realization that the policies of the current U.S. president are not significantly different from those of his predecessors, former BitMEX CEO Arthur Hayes stated.

Be careful what you wish for…

— Arthur Hayes (@CryptoHayes) February 5, 2025

"The Genie" is an essay on my idea for how to devalue US treasuries against $BTC, while maintaining the USD as the global reserve ccy. Also why I think the US #Bitcoin reserve is a terrible idea.https://t.co/Dm8UVEHpJ8 pic.twitter.com/jwAsTzLmVR

This scenario could be avoided if liquidity expands from the Federal Reserve, the U.S. Treasury, China, Japan, and other major economies, or if specific legislation is passed to unconditionally support innovation in the crypto industry.

In his new essay The Genie, the expert discussed the idea of establishing a U.S. National Bitcoin Reserve (SBR).

The fundamental problem with this initiative is that authorities aim to accumulate assets primarily for political goals rather than financial benefits.

Hayes doubts that digital gold will serve the Trump administration well, given the current structure of the global financial system.

Even if the president follows through on his campaign promise to purchase 1 million BTC within the next two to four years, the situation could completely change.

If the Republican leader fails to curb inflation, end wars, and ensure stable food supplies by 2026, Democrats could regain control of the House of Representatives, and by 2028, [California Governor] Gavin Newsom could find himself in the White House.

Hypothetically, political opponents might “punish” crypto investors who supported Trump, Hayes pointed out.

“There will be 1 million BTC ready for sale; all it takes is a signature on a piece of paper. […] Finding easy money piles to spend on gifts for their supporters is the first directive,” he added.

In his view, launching the SBR could be a “net negative” for the industry, as digital gold would turn into a “political weapon.”

The BitMEX co-founder is convinced that the U.S. will buy or sell Bitcoin primarily for financial gain.

In December, Hayes expressed doubts about the approval of the SBR. The administration will likely prefer to use freshly printed “empty” dollars for the benefit of voters rather than acquiring the first cryptocurrency, he predicted.

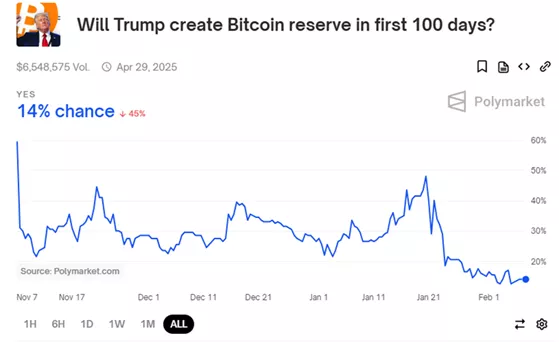

Probability of Bitcoin Reserve Creation

According to the Polymarket prediction platform, the chances of the national Bitcoin reserve being approved within Trump’s first 100 days in office are estimated at 14%.

At its peak, the probability reached 48%, with the total volume of trades increasing to $6.5 million.

In February, Senator Cynthia Lummis announced progress on her initiative to establish the SBR at the federal level.

Earlier, VanEck estimated that the approval of the SBR could help the U.S. reduce its national debt by 35% by 2050.

Reminder: Fidelity Digital Assets believes that national-level adoption of Bitcoin in 2025 will serve as a powerful catalyst for the digital asset.

Analyst Thomas Farrer predicted a $50,000 price surge within a minute if U.S. authorities confirm the creation of a Bitcoin reserve.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.