The imposition of new U.S. trade tariffs has triggered an extremely cautious market environment, altering Bitcoin’s correlation profile with both equities and traditional hedging assets, according to analysts at Binance Research.

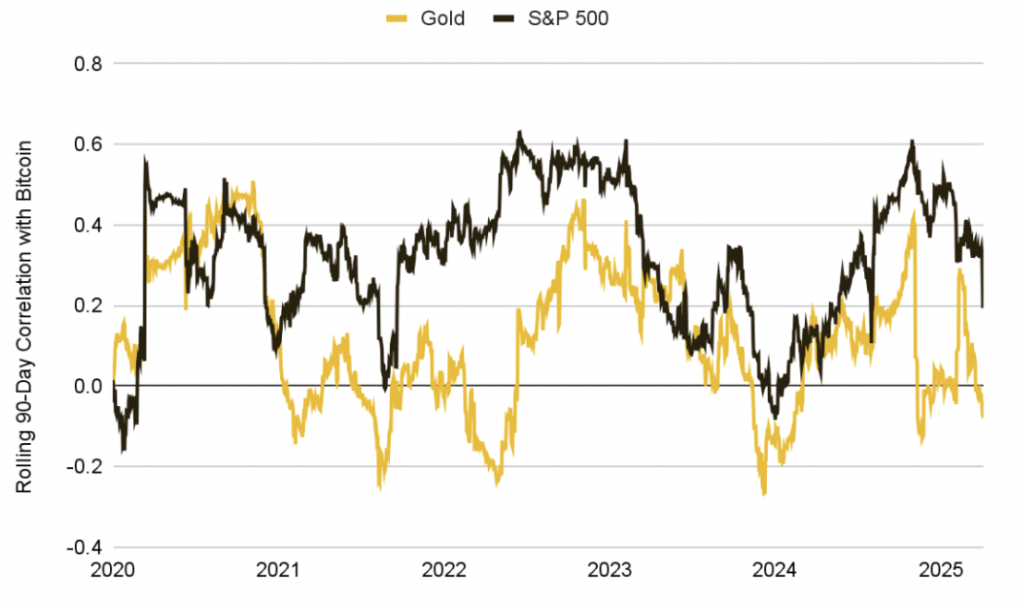

They observed that while Bitcoin initially reacted in a fragmented manner, it later aligned more closely with the S&P 500 as the trade conflict deepened. This development contrasts with a continued decline in gold’s correlation with the same index.

“These shifts suggest that macroeconomic factors—especially trade policy and rate expectations—are increasingly shaping the behavior of the crypto market, temporarily overshadowing the underlying demand dynamics,” the report noted.

Historically, Bitcoin’s correlation with traditional finance tends to rise during periods of acute stress and weakens as market conditions stabilize.

Despite recent volatility, Bitcoin has shown signs of resilience, often holding its ground or recovering on days when traditional risk assets faltered. Long-term holder supply also continued its upward trend, reflecting strong conviction and limited capitulation amid short-term turbulence.

“This behavior implies that, despite short-term fluctuations, Bitcoin still holds the potential to assert a more independent macro identity,” the analysts stated.

Binance Research also suggested that if the Federal Reserve shifts toward rate cuts while inflation remains elevated, Bitcoin could attract renewed interest as a form of “hard money,” resistant to devaluation—or at least be positioned as such within broader market narratives.

An extended trade war may test the crypto sector’s resilience by potentially reducing retail flows, slowing institutional allocation, and constraining venture capital investment, the report warned.

To assess the industry’s outlook in the coming months, Binance Research recommends monitoring key macroeconomic indicators, including core inflation data, global growth trends, and central bank policies.

Binance CEO Richard Teng added that the resurgence of trade protectionism is injecting significant volatility into global markets.

“In the short term, such macroeconomic uncertainty tends to trigger risk-off behavior, with investors stepping back while awaiting clarity on growth, policy, and trade developments. However, looking ahead, this environment may also enhance interest in crypto as a non-sovereign store of value,” Teng said.

He emphasized that many long-term holders continue to view digital assets as resilient instruments during periods of economic stress and shifting political dynamics.

Earlier, analysts at Standard Chartered identified Bitcoin as a hedge against tariff-related risks.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.