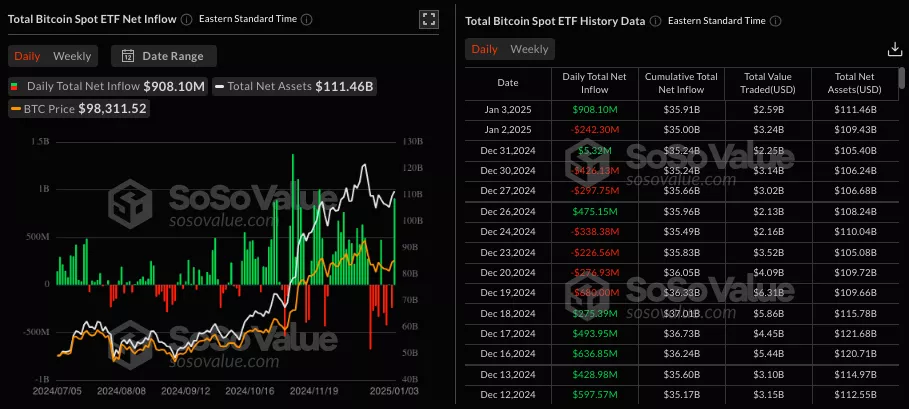

On January 3, the daily inflow into U.S. spot Bitcoin ETFs reached $908 million—its highest level since late November 2024.

Breakdown by Funds

- FBTC (Fidelity): $357 million

- IBIT (BlackRock): $253 million

- ARKB (ARK Invest and 21Shares): $222 million

- BITB (Bitwise): $61 million

- BTC (Grayscale): $8.7 million

- HODL (VanEck): $5.5 million

Another six funds saw no trading activity. The net inflow for the post-Christmas week totaled $244 million.

Bitcoin spot ETFs closed the 1st week of January strong!

— Patric H. | CryptelligenceX (@CryptelligenceX) January 4, 2025

On January 3rd, 2025, BlackRock bought $253M, and all $BTC spot ETFs combined bought $908M.

Big money is back to buying after the Christmas/year-end sell-off.

Not a bad way to start the year. 🚀

Bitcoin Price Movement

Around midnight on January 3–4, Bitcoin rose to $98,000, gaining 2% over 24 hours.

“If we fail to break above $99,000 and flip it into support, I think we’ll see lower prices in January,” said a trader known as Scient. Under a bearish scenario, he expects a pullback to the $88,000–$90,000 range.

Another investor, Crypto Tony, also predicted a “relief bounce” followed by “one more drop” to around $90,000.

$BTC / $USD – Update

— Crypto Tony (@CryptoTony__) January 3, 2025

Relieve wave then another drop is what i am looking for on #Bitcoin pic.twitter.com/lwllpUcbvF

“I don’t expect major changes over the weekend. […] The first full week of 2025 will give us a better sense of where things are headed in the short term,” added Daan Crypto Trades.

Context

Earlier, CryptoQuant analyst Burak Keshmechi highlighted that the Coinbase premium had dropped to a 12-month low of 0.237. He noted that this signals insufficient institutional demand and caution among U.S. investors.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.