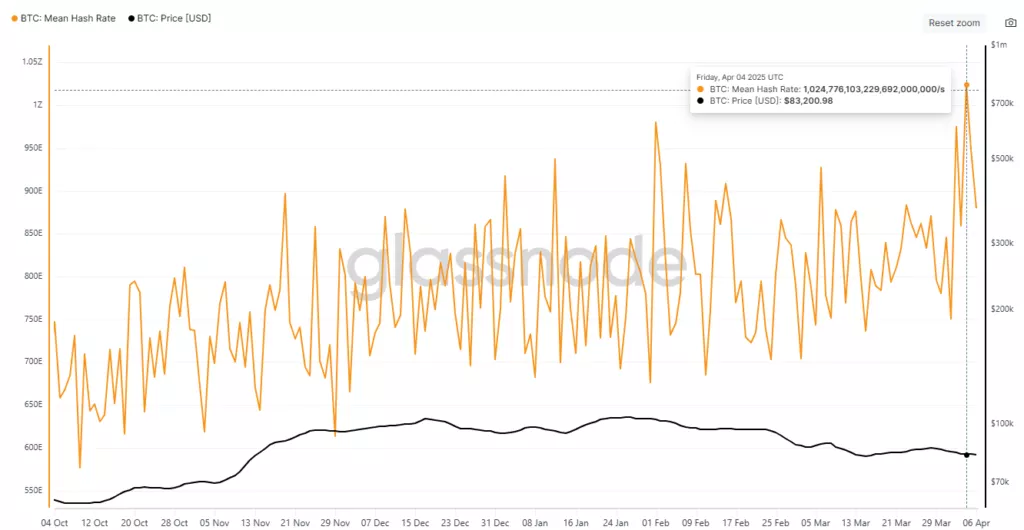

On Friday, April 4, Bitcoin’s network hashrate crossed the 1 ZH/s mark for the first time in history. Intraday peak levels reached approximately 1025 EH/s, according to Glassnode data.

As of April 6, the seven-day moving average reached a record high of 897.6 EH/s.

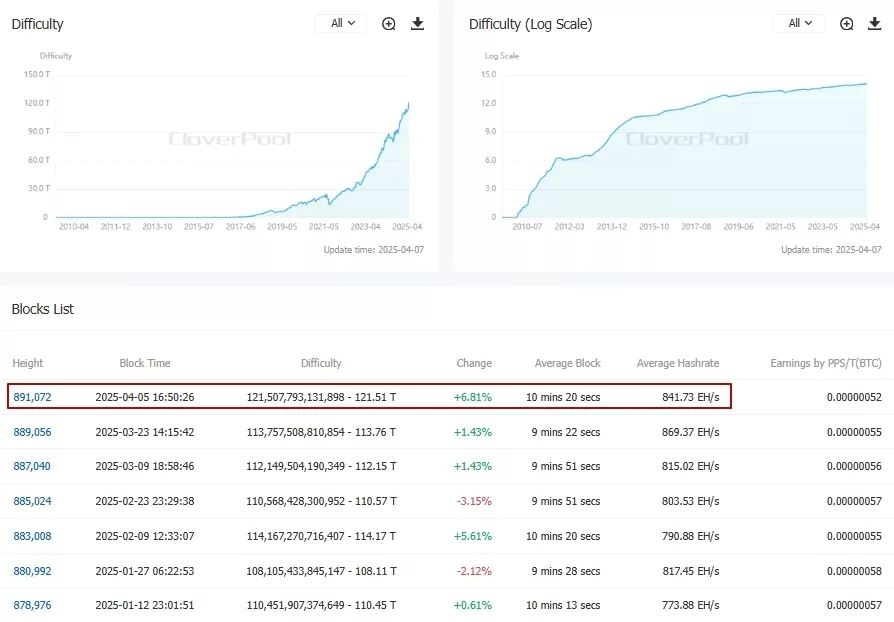

On April 5, mining difficulty hit a new all-time high of 121.51 T, jumping by 6.81%.

According to current forecasts, the next adjustment—expected in about 11 days—may see difficulty drop by roughly 0.5%.

On April 7, Bitcoin briefly dipped below $75,000 before recovering to trade around $80,000, per CoinGecko.

Mining Profitability Under Pressure

Analysts have flagged a troubling trend: while network hashrate continues to climb to historic highs, Bitcoin’s price is moving in the opposite direction. It now sits nearly 30% below the all-time high reached in January.

Data from Hashrate Index shows that the hashrate price has dropped to around $40 per PH/s per day—its lowest level since the start of the year and more than half of what it was a year ago, ahead of the April 20 halving.

“To remain profitable and cover both operating and capital expenses, miners depend on a high BTC price, full blocks, and elevated transaction fees,” said CoinDesk senior analyst James Van Straten.

Currently, Bitcoin is struggling on all three fronts. In Q1, transaction fees made up just 1.33% of total miner revenue.

In response, many industry players are shifting toward the more lucrative high-performance computing (HPC) sector, especially for AI-related infrastructure.

Bitfarms, for example, reached a preliminary agreement with Macquarie Group for a $300 million credit facility to fund the Panther Creek HPC project. The mining firm inherited the site through its merger with Stronghold.

🚨 JUST IN: Bitfarms announced we have entered into an initial agreement for a private debt facility with Macquarie Group for up to $300 million to fund initial #HPC project development at Panther Creek, PA.

— Bitfarms (@Bitfarms_io) April 2, 2025

• Initial draw at close of $50 million, with up to $300 million…

Galaxy Digital has signed a 15-year contract with CoreWeave to provide 200 MW of infrastructure at the Helios data center in Texas, which was acquired from Argo.

The deal is expected to bring Galaxy up to $4.5 billion in revenue.

Previously, industry analysts warned that U.S.-based miners would be directly affected by the “freedom tariffs” on imports announced by President Donald Trump.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.