In December 2024, inflation in the United States rose by 0.4%. On an annual basis, the CPI increased by 2.9%.

Core inflation, which excludes food and energy, climbed by 3.2% year-over-year and 0.2% month-over-month.

Service prices (excluding housing and energy) grew by 0.3%.

Data released by the U.S. Bureau of Labor Statistics (BLS) matched analysts’ forecasts.

“Today’s CPI could help the Federal Reserve feel slightly more comfortable. It won’t change expectations of a pause this month, but it should temper some chatter about the possibility of higher rates. […] Judging by the market’s initial reaction, investors appear relieved after several months of tighter inflation,” commented Ellen Zentner, Chief U.S. Economist at Morgan Stanley Wealth Management.

According to Tom Porcelli, Chief U.S. Markets Economist at PGIM Fixed Income, December’s numbers also eased investor concerns about accelerating inflation.

“This is exactly, I think, what we needed,” PGIM Fixed Income chief US economist Tom Porcelli says on the December CPI report, adding: “We’re really close to getting toward neutral.” pic.twitter.com/q7qRSqKoZe

— Yahoo Finance (@YahooFinance) January 15, 2025

“I think this is exactly what we needed. […] We are very close to a neutral level,” he told Yahoo Finance.

MN Trading founder Michaël van de Poppe noted that both the CPI and PPI came in slightly different from expectations.

Core CPI slightly lower than expected, after PPI being significantly lower yesterday than expected.

— Michaël van de Poppe (@CryptoMichNL) January 15, 2025

Yields & $DXY showing weakness, crypto continues to show strength.

“Treasury yields and the U.S. Dollar Index show weakness, while the crypto market appears strong,” he said.

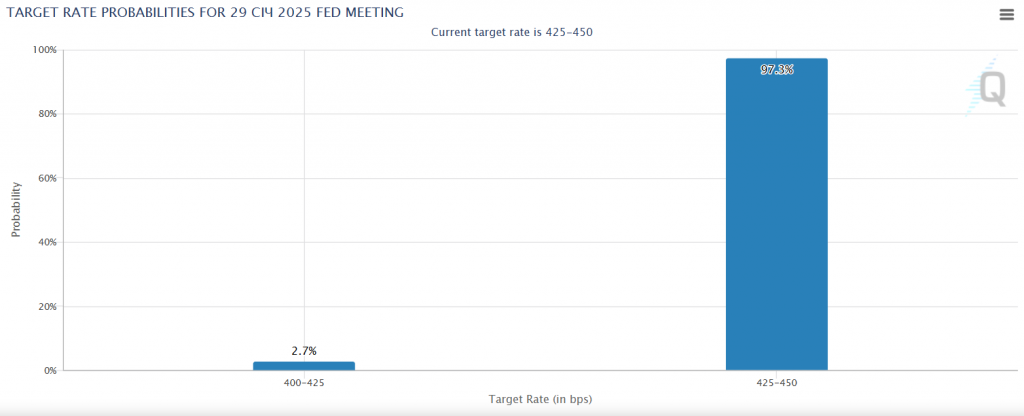

CME FedWatch data shows that 97.3% of traders expect no change to the current interest rate.

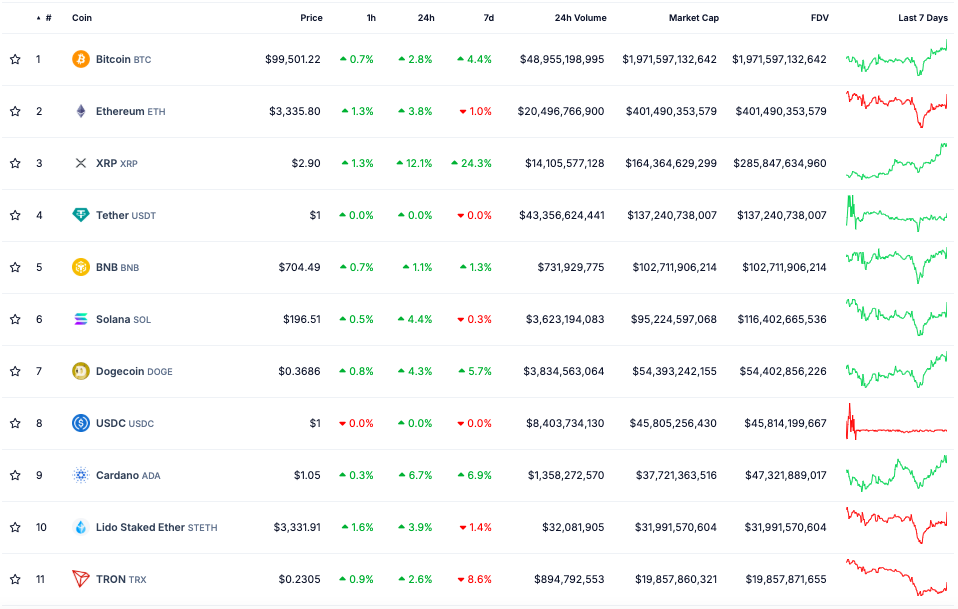

Bitcoin reacted to the macro data with a sharp surge—from about $97,000 to nearly $100,000—but failed to break that psychological barrier. The leading cryptocurrency now hovers just above $99,000.

CoinGecko data indicates that all of the top 10 digital assets by market cap are in the green. Ethereum jumped by 3.8% over the past 24 hours, surpassing $3,300.

XRP leads in daily gains, having already been on an upswing prior to the CPI release. At press time, the token tested the $3 mark and trades around $2.98.

The stock market also responded positively to the report: the S&P 500 climbed 1.7%, while the Nasdaq 100 gained 2.2%.

Context

- On December 18, the Fed lowered the target range for its key rate by 25 basis points to 4.25–4.5% annually, prompting a market correction in crypto.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.