Cryptocurrencies remain under pressure from a negative macroeconomic backdrop, with the key event for the market being Nvidia‘s earnings report, set for release on the night of February 27.

In Ethereum options, demand for contracts with a $2,000 strike price is increasing, while a rotation out of calls is observed. MakerDAO faces a liquidation risk for three major positions worth $340 million if ETH falls below certain levels.

Bitcoin’s price recovered to $89,000 after dipping to $86,000 amid large liquidations and record outflows from ETFs.

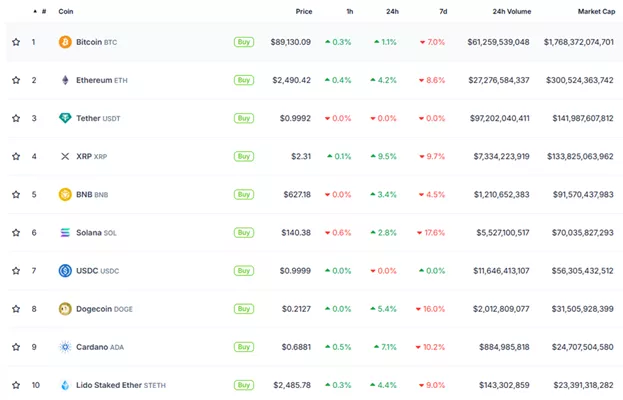

The altcoin sector is experiencing a more significant rebound, with the top 10 cryptocurrencies by market capitalization rising between 2.8% and 9.5%.

CoinDesk noted that expectations for the Fed to ease its monetary policy in May have risen due to a decline in the U.S. consumer confidence index.

QCP Capital warned that in volatile markets, cryptocurrencies are among the first assets to be liquidated as traders seek to reduce risks.

Asia Colour – 25 Feb 25

— QCP (@QCPgroup) February 25, 2025

1/ #BTC has finally broken out of its range, dipping below $90K for the first time in a month, triggering over $200M in liquidations. Despite this, skews remain steady, and 1M IV hovers around 50v.

Macro pressures are mounting.

Experts highlighted the importance of Nvidia‘s upcoming earnings report. Given the current conditions, analysts recommend exercising caution, noting that recent demand for bitcoin has primarily come from institutional players like Strategy through allocated funds.

Asia Colour – 24 Feb 25

— QCP (@QCPgroup) February 24, 2025

1/ Just 2 days after the @Bybit_Official hack—where ~$1.4B in #ETH was stolen—crypto markets have barely reacted. Prices & implied vols remain stable, a sign of how much the market has matured since FTX’s collapse in 2022.

According to their estimates, around 19% of newly raised capital over the past 14 months has flowed into cryptocurrencies. QCP Capital suggested that the market might be approaching saturation, potentially reducing institutional purchases if spot demand remains weak.

“The rise in bitcoin dominance and declining altcoin prices indicate that altcoin bulls have already positioned themselves. Any new capital inflow will likely be directed toward digital gold,” analysts predicted.

Ethereum at $2,000?

Thomas Erdei, Head of Product at CF Benchmarks, pointed out the growing open interest in Ethereum options with a $2,000 strike price, reflecting increased investor caution. At the same time, a rotation out of calls suggests weakening expectations for a breakout.

“Traders are shifting positions toward downside risks around $2,000,” the expert commented.

Elvin Kan, COO of Bitget Wallet, warned of a $340 million liquidation risk for MakerDAO positions if ETH drops to $1,926, $1,842, or $1,793.

“The sell-off has put leveraged long traders in a difficult position. […] If forced liquidations accelerate, downward pressure will intensify,” he noted.

The specialist added that the next market moves depend on changes in leverage and whether spot demand can absorb the shock.

“If bulls step in or liquidity stabilizes, the market could experience a sharp rebound,” Kan concluded.

Earlier, Binance CEO Richard Teng stated that the current crypto downturn is temporary.

Previously, Eric Trump, son of former U.S. President Donald Trump, urged investors to buy bitcoin on the dip. On February 4, he also recommended purchasing ETH after a major correction.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.