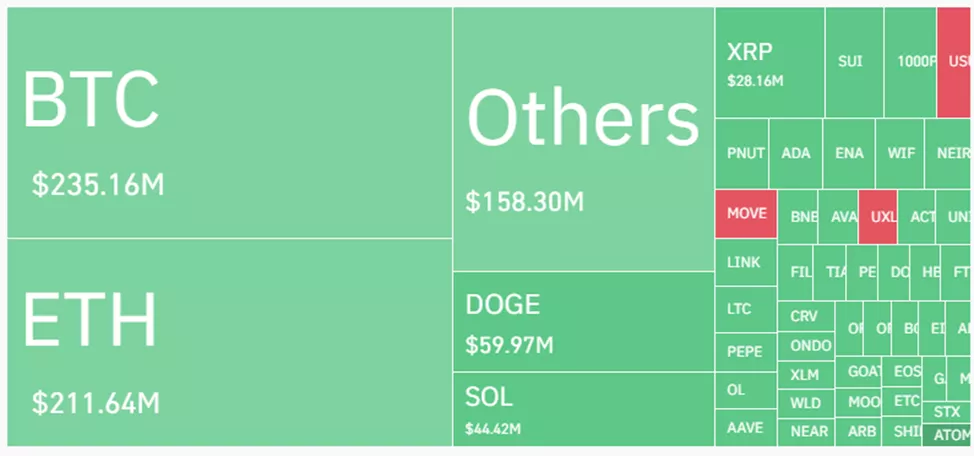

On December 19, cryptocurrency markets recorded $1.01 billion in forced liquidations, including $844 million in long positions, according to Coinglass.

The scale of liquidations was smaller than those on December 5 ($1.1 billion) and December 10 ($1.7 billion).

In a conversation with Cointelegraph, Swyftx analyst Pav Hundal highlighted the possibility of a “Santa Claus rally.”

“This isn’t the Christmas rally we hoped for, but it looks more like short-term discontent,” he explained.

The analyst believes market focus remains on expectations of pro-crypto policies from Donald Trump’s administration.

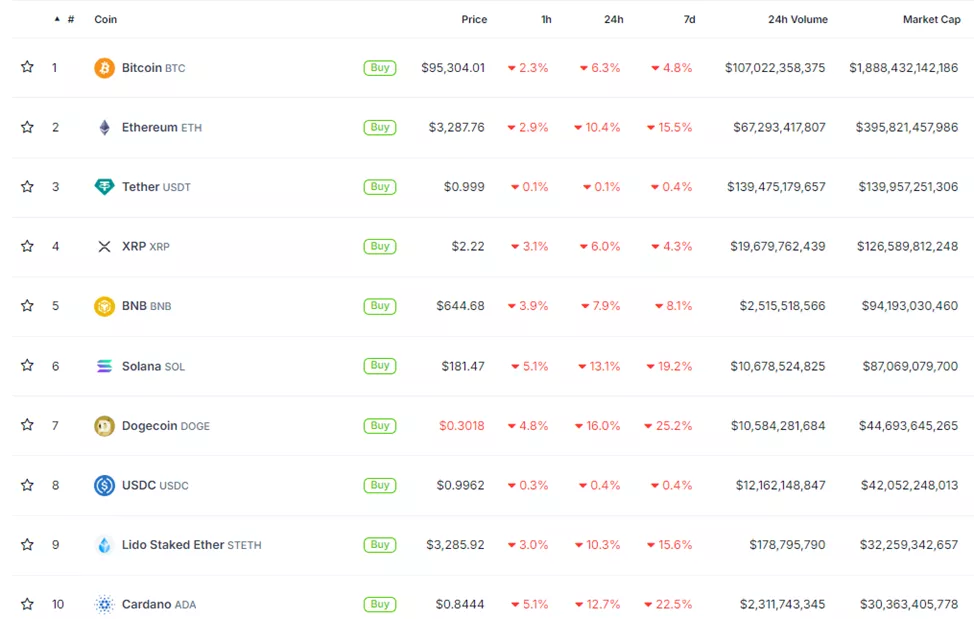

At the time of writing, Bitcoin is trading at $95,300, reflecting a 6.2% daily decline. Among the top 10 assets by market capitalization (excluding stablecoins), losses range from 5.9% to 15.9%.

Notably, Syncracy Capital co-founder Daniel Chung recently predicted a sustained “buy-the-dip” trend for Bitcoin.

Earlier, Real Vision’s Chief Analyst Jamie Coates anticipated a correction in Bitcoin within two to three months.

Glassnode analysts have detected signs of the late-stage bull run for the leading cryptocurrency.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.