On October 30, BlackRock’s iShares Bitcoin Trust recorded a massive inflow of $872 million, surpassing its previous high of $849 million set in March.

“This influx is driven by several key factors, including global central bank rate cuts, which have increased liquidity and made capital more accessible to investors,” crypto analyst Rachel Lucas from BTCMarkets told The Block.

Lucas also noted that investor expectations of Donald Trump’s potential victory in the upcoming US presidential elections may have further boosted interest in Bitcoin ETFs.

Broader ETF Market Performance

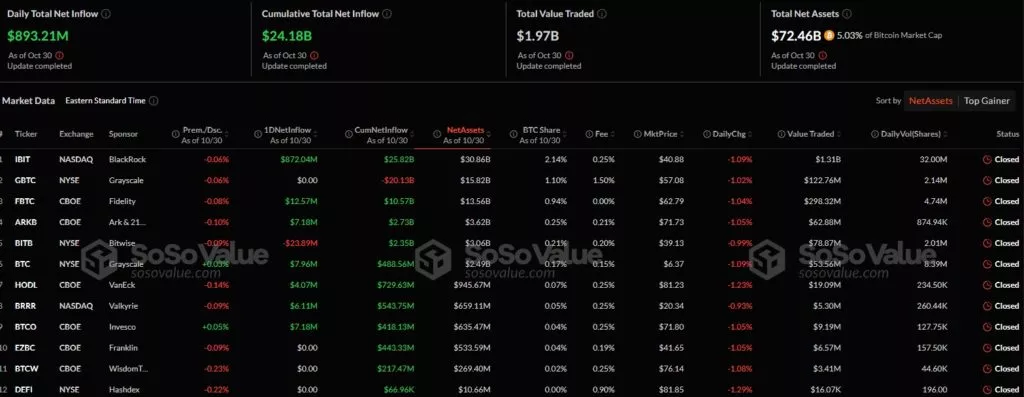

On the same day, US spot Bitcoin ETFs collectively attracted $893.2 million, distributed as follows:

- FBTC (Fidelity): $12.57 million

- GBTC (Grayscale): $7.96 million

- ARKB (Ark and 21Shares): $7.18 million

- BRRR (Valkyrie): $7.18 million

- BTCO (Invesco): $4.9 million

- HODL (VanEck): $4.07 million

BITB (Bitwise) was the only ETF to record outflows.

Cumulative Growth of Bitcoin ETFs

Since their launch in January, US Bitcoin ETFs have amassed $24.18 billion, bringing their total assets under management (AUM) to $72.46 billion.

According to Bloomberg analyst Eric Balchunas, ETF issuers collectively hold 995,663 BTC. He predicts that by the end of November, this figure could surpass 1.1 million BTC, a quantity comparable to the estimated holdings of Bitcoin’s creator, Satoshi Nakamoto.

Ok we gonna need to move up our predictions as yest alone the btc ETFs gobbled up over 12k coins like Pac-Man on a bender, now hold 996k btc- good chance to pass 1 million today (as the ridic volume yest likely to translate to big flows tonight). Legit shot to get to Satoshi by… https://t.co/Ua9GzhsBwE pic.twitter.com/84bBprhi6I

— Eric Balchunas (@EricBalchunas) October 30, 2024

Market Outlook

Lucas forecasts that capital inflows into Bitcoin ETFs are likely to increase before the November 5 US elections, as investors seek to hedge against potential economic and political shifts.

“During this period, heightened volatility is expected as markets react to polls, political statements, and discussions on digital asset regulations,” she added.

Options Market Anticipation

Market participants in Bitcoin options are preparing for potential post-election growth. This is evidenced by the increasing open interest in options with strike prices above $80,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.