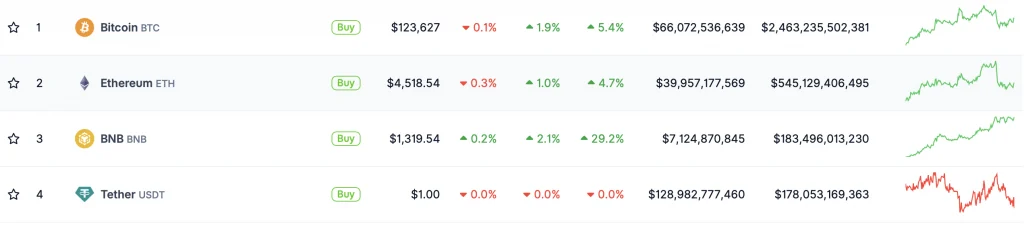

Cryptocurrency BNBcreated for the ecosystem BNB Chain (Layer-1 blockchain from Binance) has become the third largest asset in the marketahead of Ripple’s XRP token.

After the BNB exchange rate for the first time exceeded the mark $1 100, the token continued to grow and on Tuesday it was fixed at the level $1,326, increasing by almost 30% per week. According to Coingecko, the market capitalization of the coin has reached $182 billion.

Source: Coingecko

BNB’s growth coincided with the overall positive dynamics in the market, but the pace of the leading cryptocurrencies significantly overtook − Bitcoin and Ethereum.

A breakthrough of $38 billion against the backdrop of the general growth of the market

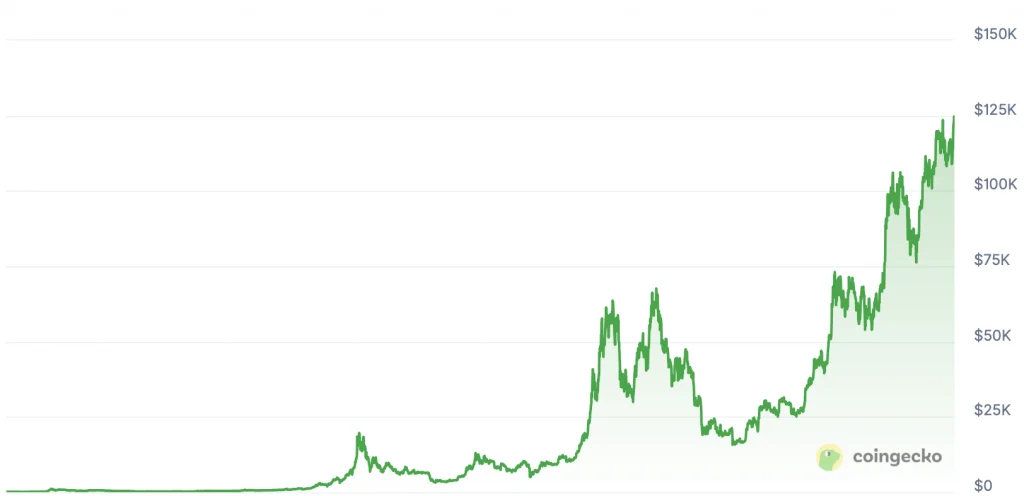

Since the beginning of October, capitalization Bitcoin increased by about 5%, a BNB – Immediately on 28%, adding about $40 billion to its cost in just seven days.

Source: Coingecko

For comparison: earlier in 2025, BNB took more than two months to show similar growth when its capitalization was kept at a level around $100 billion.

The total market capitalization of cryptocurrencies over the same period increased by only 5.5%, while The share of BTC and ETH is gradually decreasing.

The community discusses the reasons for growth

The unusually fast rise of BNB caused a wave of discussions on social networks. Some users reddit and X (Twitter) expressed doubts about the naturalness of growth, hinting at possible market manipulation.

“BNB essentially repeats the FTX token path. I’m waiting for evidence of price manipulation will be available,” wrote one of the popular Reddit commentators.

User Defracer on X also accused Binance of the fact that the exchange allegedly Buys millions of BNBs to eliminate shortswhich could artificially push the price up.

CZ stores 64% of BNB tokens?

Against the backdrop of these rumors Binance and its founder Changpeng ‘CZ’ Zhao So far they haven’t commented on what’s going on.

CZ just published a short post in X:

“Keep building on BNB Chain.”

official account BNB Chain He also supported a wave of positive by reposting the analysis of Momin Sakiba’s enthusiast:

“While the market is looking for a direction, BNB shows the best results in the industry.”

According to last year’s data, Zhao may own up to 64% of BNB circulating volumewhich, with the current capitalization, is estimated at approximately $116 billion.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.