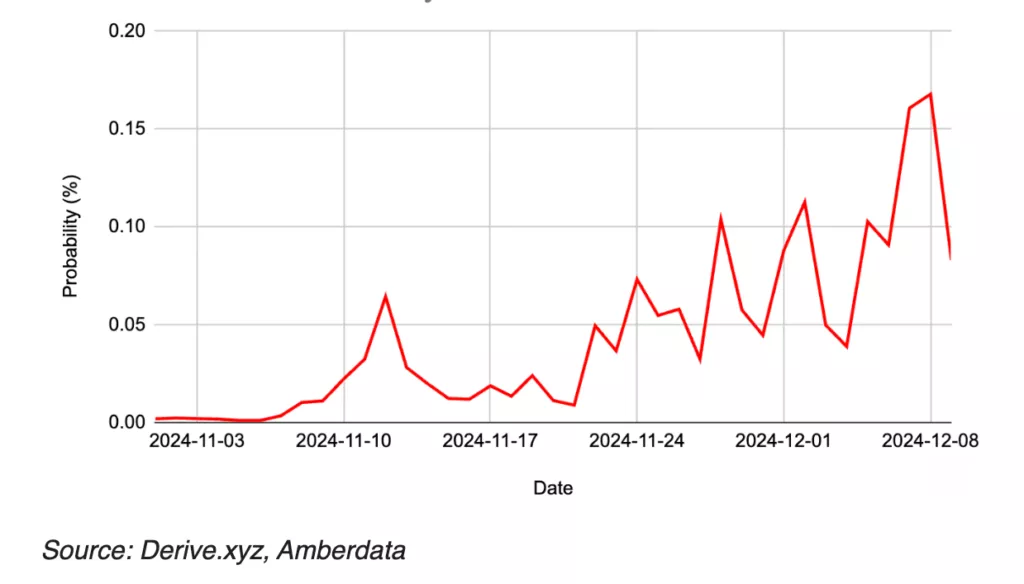

The probability of Ethereum hitting the $5,000 mark by the end of the year has dropped to less than 10%, according to Cointelegraph, citing data from Derive.

“At its peak, the probability rose to 16%, but it has recently declined to just over 8%,” noted Sean Dawson, Head of Research at the options exchange, in a report.

Dawson also highlighted that the balanced trading of Ethereum put and call options indicates neutral market sentiment.

As of now, Ethereum is trading near $3,720, approximately 24% below its all-time high of $4,878, according to CoinGecko.

Trader CoinMamba expressed a more optimistic outlook, stating that $5,000 remains his target price for Ethereum by year-end.

My target for $ETH is still $5k by the end of this year. Do what you will with that information..

— CoinMamba (@coinmamba) December 10, 2024

“Do what you will with this information,” he added.

Eric Conner, founder of EthHub, pointed out that Ethereum ETFs attracted $305 million on December 10 alone. He warned of an impending “supply crisis” for ETH.

$305mn into ETH ETFs today

— eric.eth (@econoar) December 11, 2024

Supply side crisis incoming

“TradeFi is scooping up cheap ETH,” commented researcher Anthony Sassano on the inflows into Ethereum ETFs.

According to SoSoValue, daily inflows into spot-based Ethereum ETFs have remained positive since November 22.

It’s worth noting that some experts recently identified signals pointing to Ethereum potentially reaching new all-time highs soon, citing sustained capital flows into ETFs.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.