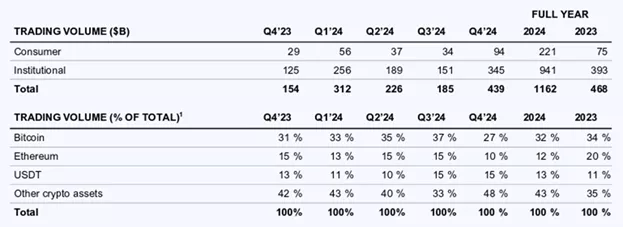

The trading volume on Coinbase surged to $439 billion in October–December, up from $185 billion in the previous quarter. Earnings per share (EPS) reached $4.31, 2.6 times higher than analysts’ average estimate ($1.81), according to Reuters.

Reuters attributed the surge to Donald Trump’s victory in the U.S. presidential election and expectations of more crypto-friendly regulations. SEC Chairman Gary Gensler, known for his harsh stance on crypto, stepped down, and Paul Atkins, a pro-crypto figure, is seen as his likely successor.

Coinbase CEO Brian Armstrong commented:

“We are entering a golden age for digital assets. We have an unprecedented opportunity to upgrade the financial system and enhance economic freedom worldwide.”

The increase in market volatility, rising crypto prices, and new listings also contributed to the boost in trading activity.

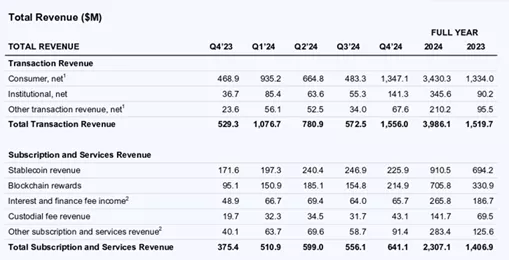

Over the past three months, Coinbase’s transaction revenue jumped 172% to $1.56 billion, while its subscriptions and services division grew 15% to $641 million.

Coinbase’s Outlook

Observers noted that Coinbase’s retail business margin was 35 times higher than that of institutional clients: 1.43% vs. 0.037%.

Following the strong quarterly report, JPMorgan raised its fair value estimate for Coinbase stock from $400 to $475. On February 13, Coinbase shares closed up 8.4% at $298.1. The bank maintained its “overweight” rating.

coinbase take rates on retail crypto trading are insane — they made 35x more on retail relative to institutional trading

— jay (@0xjaypeg) February 14, 2025

they took 1.43% from retail in q4 vs. 0.041% on institutional trading pic.twitter.com/MtrVLPamJD

JPMorgan expects Coinbase to significantly expand its operations in the next five years due to a more favorable regulatory environment.

Ava Labs President John Wu pointed out that Coinbase offers a much wider range of tokens than Robinhood, along with additional services like staking and stablecoin access. However, he believes Coinbase will need to diversify beyond retail trading and focus more on institutional clients to maintain its market position.

Robinhood’s Report

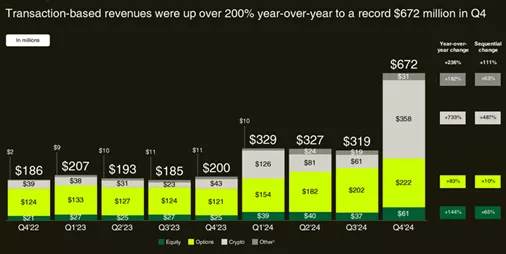

On February 12, Robinhood reported that crypto trading revenue skyrocketed 487% quarter-over-quarter, reaching $358 million (53% of total revenue).

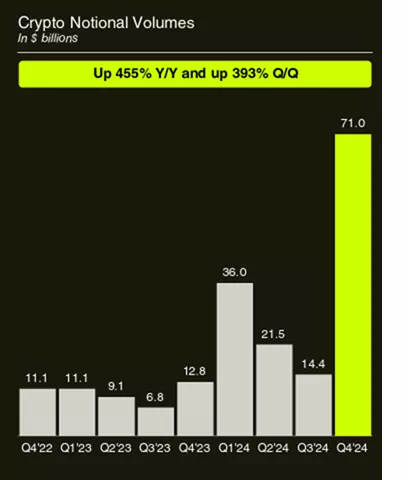

Crypto trading volume surged 4.9x to $71 billion.

Robinhood also added seven new cryptocurrencies to its platform and launched Ethereum staking in the EU.

In June 2024, Robinhood announced the acquisition of Bitstamp, with the deal expected to close in 2025 pending regulatory approval.

Previously, Bernstein called Robinhood stock one of the most promising in the CEX sector, citing expected deregulation.

Reminder: Coinbase could be considered the 21st largest bank in the U.S., according to its CEO.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.