The increasing use of Bitcoin as a treasury asset by corporations will drive the development of income-generating strategies for the cryptocurrency, according to CoinShares’ 2025 outlook.

📣 Our Outlook 2025 is out ! Between record-breaking inflows into #Bitcoin ETFs in 2024 and policy shifts, there's a lot to look forward to in crypto in 2025.

— CoinShares (@CoinSharesCo) December 10, 2024

Our researchers share their visions for the year ahead: https://t.co/PzuA3UaDsi pic.twitter.com/MCHHUogNDJ

“This trend reflects a broader acknowledgment of Bitcoin’s potential to serve not only as a store of value but also as a source of profit,” stated analyst Satish Patel.

Patel highlighted three primary strategies:

- Increasing Bitcoin reserves relative to company shares.

- Lending Bitcoin for interest.

- Exploring alternative yield options, including derivatives based on crypto reserves.

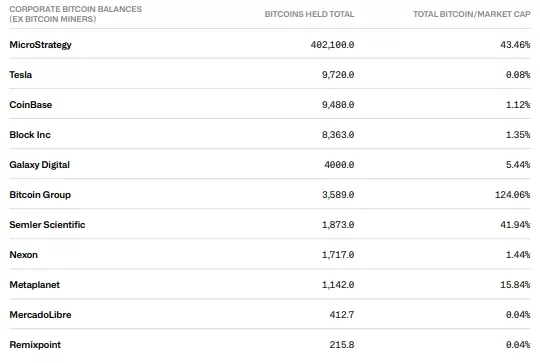

Patel referred to MicroStrategy as “synonymous” with corporate Bitcoin investments. As of December 9, the company holds 423,650 BTC and has implemented its proprietary BTC Yield metric to evaluate the impact of its Bitcoin acquisitions on shareholder value.

Mining firm MARA has followed MicroStrategy’s lead, using low-interest debt financing through convertible bond issuances to acquire Bitcoin. In November, MARA raised $1 billion at a 0% coupon rate, reporting a 36.7% yield per share on its crypto holdings year-to-date.

Japanese firm Metaplanet, which has adopted a similar approach, has amassed 1,142 BTC and actively generates income using options on digital gold.

“Throughout 2024, several large companies began accepting cryptocurrency for payments, signaling a potential trend toward including Bitcoin in treasury reserves by 2025,” Patel noted.

Examples include luxury carmaker Ferrari, alongside prominent retailers like AT&T, Whole Foods, Home Depot, and AMC Theatres. Major e-commerce platforms such as Amazon, Shopify, Nike, Expedia, and PayPal are already involved in cryptocurrency through payments or investments, Patel added.

This growing trend will likely expand the pool of corporate Bitcoin reserve holders, with the number expected to increase significantly in the coming year, Patel predicted.

Background

In early December, MicroStrategy founder Michael Saylor presented a Bitcoin strategy to Microsoft’s board of directors, suggesting it could add $5 trillion to the company’s market capitalization.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.