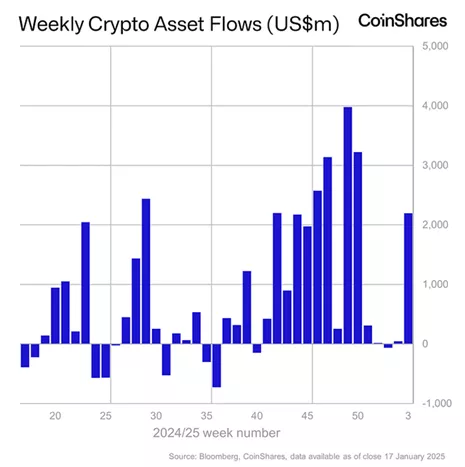

From January 11 to January 17, crypto investment funds saw $2.2 billion in inflows, up from $44.2 million the week before, according to CoinShares.

Analysts credited the increase to “euphoria” leading up to Donald Trump’s inauguration as U.S. President.

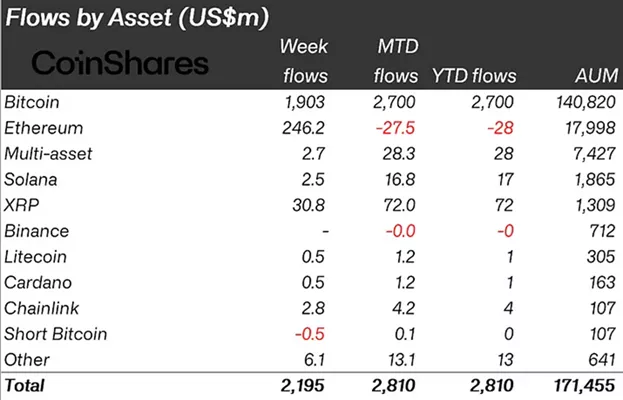

Along with improved market conditions, total assets under management (AUM) in these products jumped to $171.5 billion.

Bitcoin-based instruments attracted $1.9 billion—totaling $2.7 billion so far this year.

Short-Bitcoin funds had outflows of $0.5 million.

Instruments tied to Ethereum brought in $246.2 million, nearly offsetting last week’s $255.6 million outflow.

XRP funds added $30.8 million, slightly down from $41.2 million the previous week, pushing total inflows to $484 million since mid-November.

Competitors based on Chainlink, Solana, and Stellar recorded inflows of $2.8 million, $2.5 million, and $2.1 million, respectively.

JPMorgan estimates that spot exchange-traded funds (ETFs) for SOL and XRP could see inflows of $3–6 billion and $4–8 billion, respectively, within six months of going live—potentially surpassing the numbers for Ethereum products.

The SEC faces a January 23–25 deadline to provide an initial response to Solana-ETF proposals from VanEck, 21Shares, Canary, Bitwise, and Grayscale.

Also under review are documents from prospective issuers of spot XRP ETFs, including Bitwise and 21Shares.

Context

- Several experts predict spot Solana ETFs will be available before the end of 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.