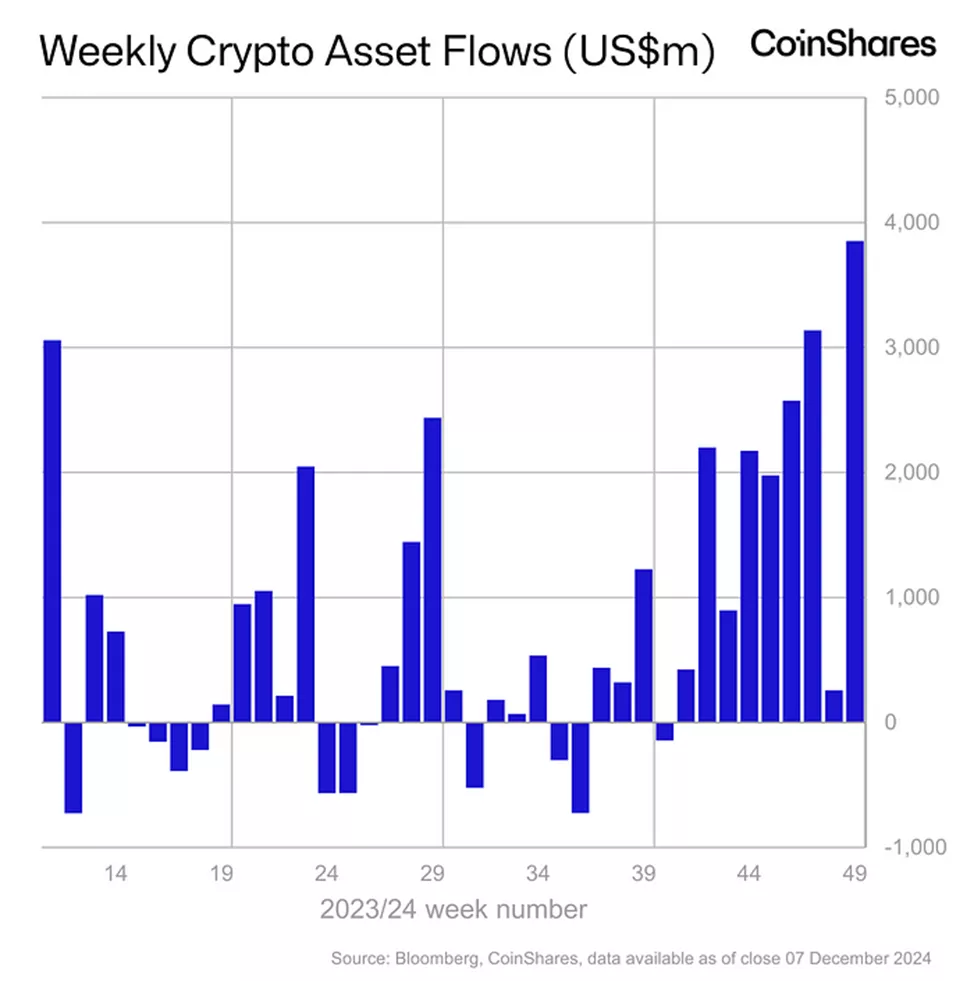

Between December 1 and 7, cryptocurrency investment funds recorded $3.85 billion in inflows, marking a historic peak, according to CoinShares. This sustained growth marks the ninth consecutive week of positive inflows.

In comparison, the prior week’s inflows stood at $270 million. Year-to-date, the total inflows into crypto funds have reached an unprecedented $41.1 billion, while assets under management (AUM) surged to an all-time high of $165 billion.

Fund Breakdown by Asset

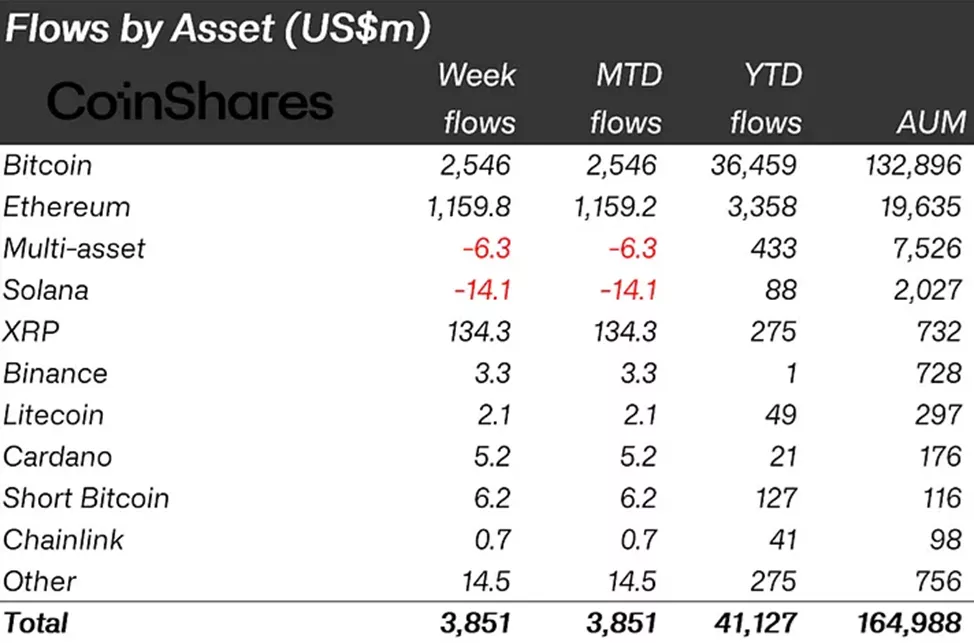

- Bitcoin funds: Inflows of $2.55 billion this week, reversing an outflow of $457 million in the previous period. Year-to-date inflows reached $36.46 billion.

- Short Bitcoin products: Added $6.2 million in new capital.

- Ethereum funds: Weekly inflows grew from $634 million to a record $1.16 billion.

- XRP funds: Investors allocated a record $134.3 million, the highest in history.

- Solana funds: Outflows totaled $14.1 million, signaling reduced interest.

XRP’s ATH and Market Optimism

On December 3, XRP hit a new all-time high of $2.909, representing a staggering 478.4% gain over the past month. Market participants anticipate further expansion of crypto-ETF offerings to include XRP-based products.

Currently, the SEC is reviewing multiple XRP-related ETF applications, including those filed by 21Shares and WisdomTree. Other contenders in this race include Canary Capital and Bitwise.

This consistent capital influx demonstrates growing institutional confidence in the crypto sector, with investors seeking to diversify across flagship assets and emerging contenders.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.