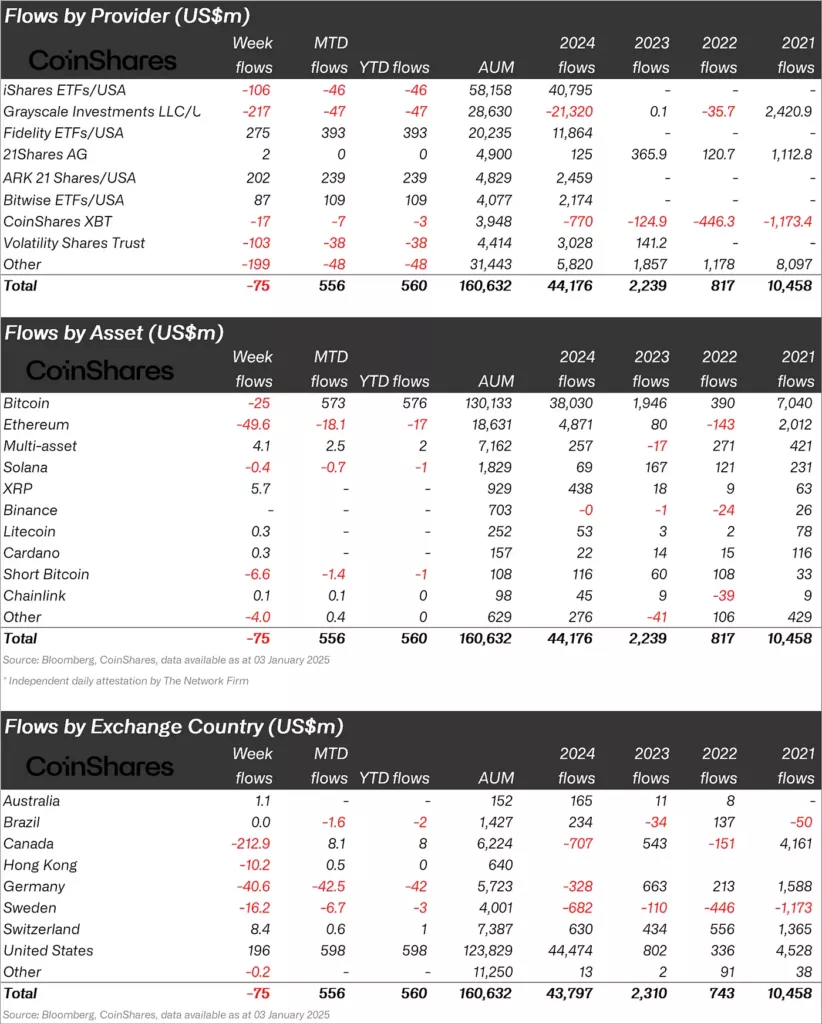

According to James Butterfill, Head of Research at CoinShares, 2024 saw a record-breaking $44 billion in inflows to crypto asset-based funds. This figure is four times higher than the previous high of $10.5 billion in 2021.

Bitcoin-based funds accounted for $38 billion in inflows (29% of their AUM), while products tied to altcoins attracted $813 million (18% of their AUM).

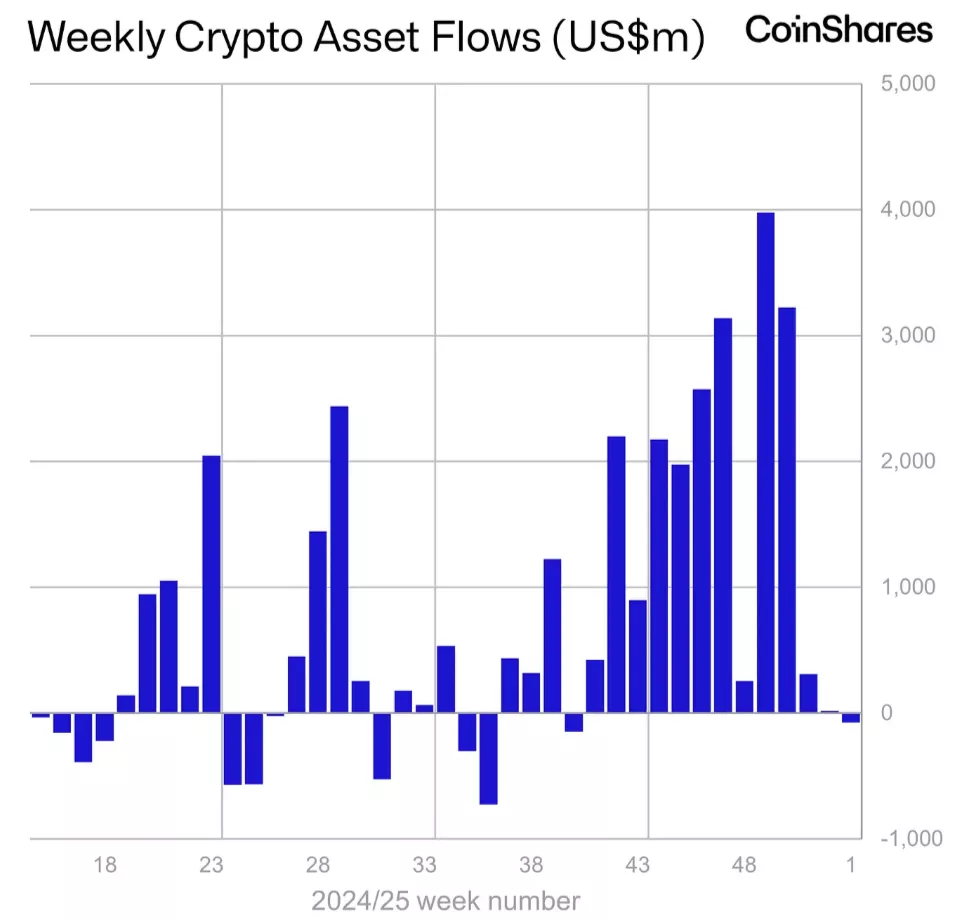

“Digital asset investment products received $585 million in the first three days of this year. However, looking at the entire week, including the final two trading days of 2024, there was a net outflow of $75 million,” Butterfill noted.

He added that Ethereum made a notable comeback in 2024, with a total of $4.8 billion pouring into ETH funds (26% of their AUM). This is 2.4 times more than in 2021, and 60 times above 2023’s inflows.

“But Ethereum overshadowed Solana, which saw only $69 million in inflows—just 4% of its AUM,” the expert concluded.

Context

- Butterfill has forecast a Bitcoin price of $150,000 in 2025.

- In his view, the asset’s market cap could grow from its current 10% of gold’s market value to 25% in the long term.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.