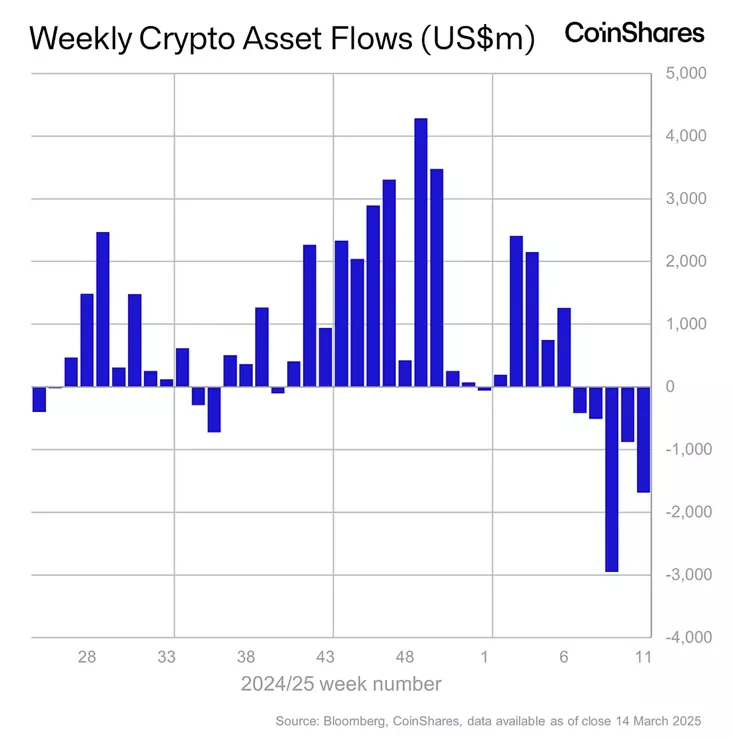

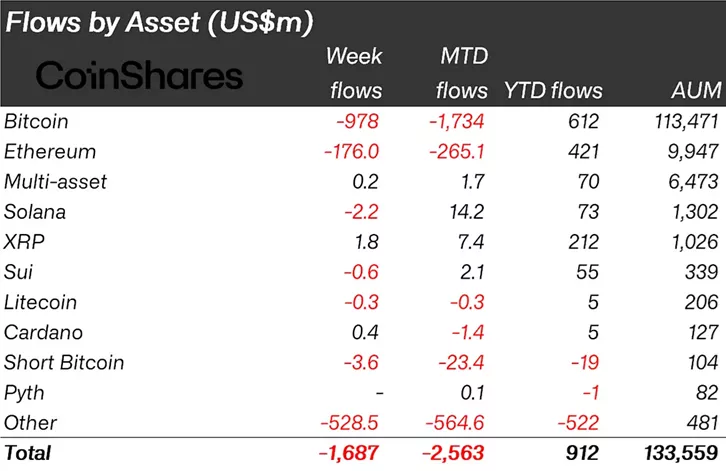

From March 8 to March 14, outflows from crypto investment funds totaled $1.69 billion, up from $876 million in the previous reporting period, according to CoinShares.

This marks the fifth straight week of negative flows, with investors pulling $6.44 billion from crypto products over this period. Despite this, the year-to-date balance remains positive at $912 million.

Outflows from Bitcoin-based investment products rose from $756 million to $978 million, bringing the five-week total to $5.4 billion.

In the U.S. spot Bitcoin ETF segment, investors withdrew $838.3 million, continuing the negative trend for the fifth consecutive week.

Short Bitcoin investment products also saw outflows of $3.6 million, down from $19.8 million in the previous week.

Ethereum funds experienced accelerated outflows, rising from $89.2 million to $176 million.

In XRP-based products, inflows slowed from $5.6 million to $1.8 million.

Solana and Sui funds, which previously saw inflows, recorded outflows of $2.2 million and $0.6 million, respectively.

Earlier, CryptoQuant CEO Ki Young Ju suggested that Bitcoin could undergo a prolonged consolidation phase within a $75,000–$100,000 range, similar to early 2024 before resuming an upward trajectory.

Matrixport analysts predict that Bitcoin’s correction could end by March or April, while Glassnode experts warned that the asset’s redistribution phase may extend further.

Some analysts, including former BitMEX CEO Arthur Hayes, have speculated that Bitcoin’s price could drop to $70,000 before continuing its bull run.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.