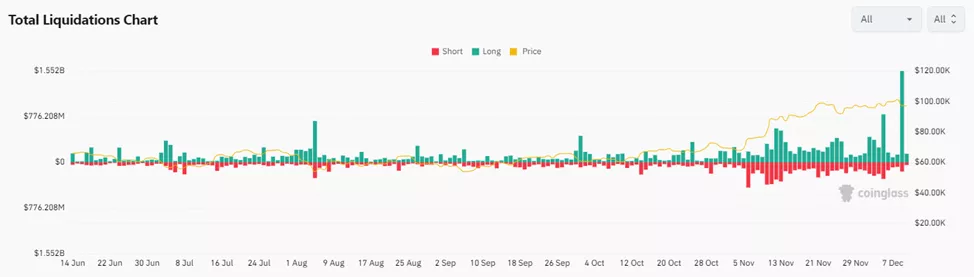

From December 9 to 10, forced liquidations in the cryptocurrency market totaled $1.75 billion, including $1.57 billion in long positions, according to Coinglass.

A total of 582 traders were liquidated.

The majority of liquidations occurred in altcoins, with Bitcoin accounting for just $189.2 million.

The current figures surpass the $1.1 billion in liquidations recorded on December 5.

What Caused the Spike?

The primary driver was a sharp market correction: Bitcoin dropped from $101,200 to $94,150, before recovering to $97,000. Altcoins experienced even steeper declines.

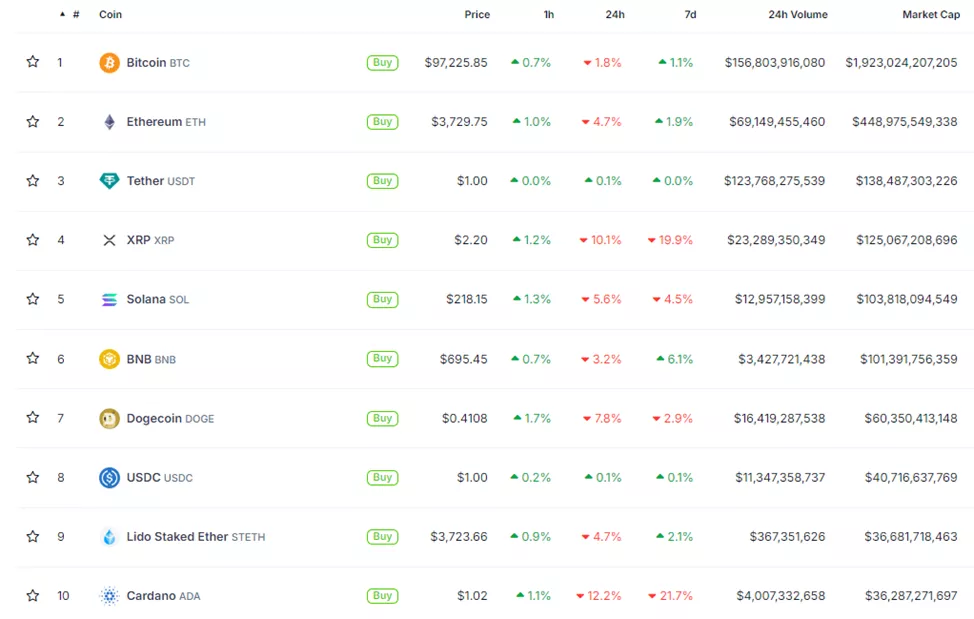

As of writing, Bitcoin’s daily losses have eased to 1.8%, while other top-10 assets (excluding stablecoins) posted losses ranging from 3.2% to 12.3%.

Market Outlook

CryptoQuant recently warned of a potential pause in Bitcoin’s rally.

Additionally, Real Vision chief analyst Jamie Coates has predicted a possible correction for Bitcoin in the next two to three months.

Earlier, it was reported that from December 1 to 7, crypto investment funds saw inflows of $3.85 billion, marking an all-time high.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.