The 30-day skew of bitcoin options on the CME increased to 4.4%—its highest level since Donald Trump won the U.S. presidential election on November 5, according to CF Benchmarks, as reported by CoinDesk.

This metric measures the degree of bullish sentiment by examining the implied volatility difference between call and put options.

Thomas Erdosi, Head of Products at CF Benchmarks, noted that the “bullish scenario” applies to contracts across all maturities.

He expects the skew to decline by month’s end, but foresees continued upward pressure on the price of Bitcoin in the near future.

On January 20, Bitcoin set a new all-time high above $109,000.

The next day, a wave of profit-taking occurred due to a lack of cryptocurrency mentions in President Donald Trump’s inauguration speech. The leading crypto briefly dropped to $100,120.

In his inaugural address, Trump did not mention forming a “national Bitcoin reserve,” a pledge from his campaign.

At press time, Bitcoin’s price has bounced back to around $105,440, accompanied by sustained demand for BTC-ETF products.

On January 21, crypto funds linked to Bitcoin attracted $802.5 million in new capital. Total inflows for the past three days have reached $2.46 billion.

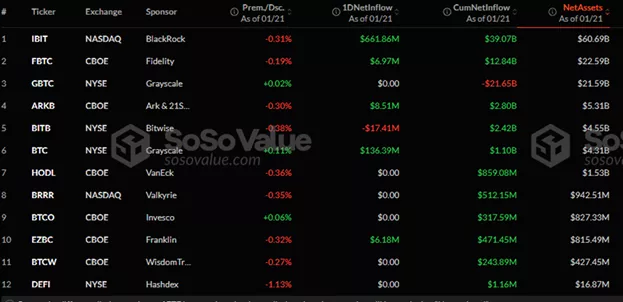

Since spot BTC-ETFs were approved in January 2024, total inflows have approached $39 billion. Overall assets under management (AUM) in these products have grown to $123.6 billion.

Roughly 49.1% ($60.7B) belongs to IBIT. Alongside GBTC from Grayscale ($21.59B) and FBTC from Fidelity ($22.59B), BlackRock’s ETF collectively holds 84.8% of sector assets.

ETH-ETF

On January 21, ETH-ETF inflows reached $74.4 million, maintaining a positive trend for the fifth straight day—totaling $325.8 million.

Since these products launched, they have accumulated $2.74 billion in total. AUM has risen to $12.1 billion.

The top inflows come from ETHE by Grayscale ($4.61B) and ETHA by BlackRock ($3.91B).

ConsenSys Founder Joseph Lubin predicted “imminent” approval of staking features for ETH-ETF.

Previously, CF Benchmarks experts suggested that by 2025, investment advisors will increase their positions in Bitcoin- and Ethereum-based ETFs by more than 50%.

Context

- In 2024, BTC-ETF issuers and public companies bought 859,454 BTC, equivalent to 4.3% of the circulating supply and matching approximately eight years of miner issuance, according to K33 Research.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.