On January 20, Donald Trump officially assumed office as the 47th president of the United States. During his campaign, he promised sweeping crypto-friendly policies and, on the eve of his inauguration, launched one of the most talked-about meme coins.

Cryptol looks at key developments surrounding the leader of the world’s largest economy, his involvement in digital assets, and the “new era” he might herald for crypto.

Trump’s Campaign Platform

Between his first and second terms, Trump evolved from a critic of digital assets into a self-styled “crypto president”—the first head of state with his own meme coin.

Experts say Trump’s main concern is preserving the U.S. dollar’s dominant global role. He once viewed cryptocurrencies as a threat to the status quo, explaining his initial skepticism. But as discontent grew over the Biden administration’s approach to regulating crypto, Trump’s stance softened. By early 2024, he had become an outspoken supporter of the sector.

“It appears he realized the economic potential of cryptocurrencies, America’s role in this industry, and its challenges. He understands that crypto won’t threaten U.S. hegemony if the country can control the market and set the trends,” noted Fedor Ivanov, analytics director at “SHARD.”

The candidate’s team targeted the pro-crypto voter base and focused its rhetoric accordingly.

“Undoubtedly, Trump sought to win over voters who favor cryptocurrencies. He was likely also appealing to Elon Musk fans, who hoped for concrete actions and statements benefiting them,” Nikita Zuborev, an analyst at aggregator BestChange, told Cryptol.

The expert believes that Trump still harbors personal doubts about crypto’s long-term potential. However, advisors convinced him of the asset class’ benefits—namely, its possible role in reducing the U.S. national debt.

“For him, it’s just another ‘toy,’ akin to how Elon Musk treats it, except that this one can generate millions of dollars, which Trump won’t dismiss. Even so, his official support for the crypto market remains limited,” Zuborev added.

What Trump might actually deliver remains uncertain, but observers note that the impact could be felt soon.

“Trump moves rapidly—typical for his leadership style. If rumors of newly signed crypto directives are accurate, it could be a turning point for the sector. But impulsive moves carry both upsides and unforeseen risks,” said Gleb Kostarev, CEO at Blum.

Some of the promised changes are already in motion.

Leadership Shake-Ups

One pillar of Trump’s pro-crypto campaign was reorganizing key government agencies.

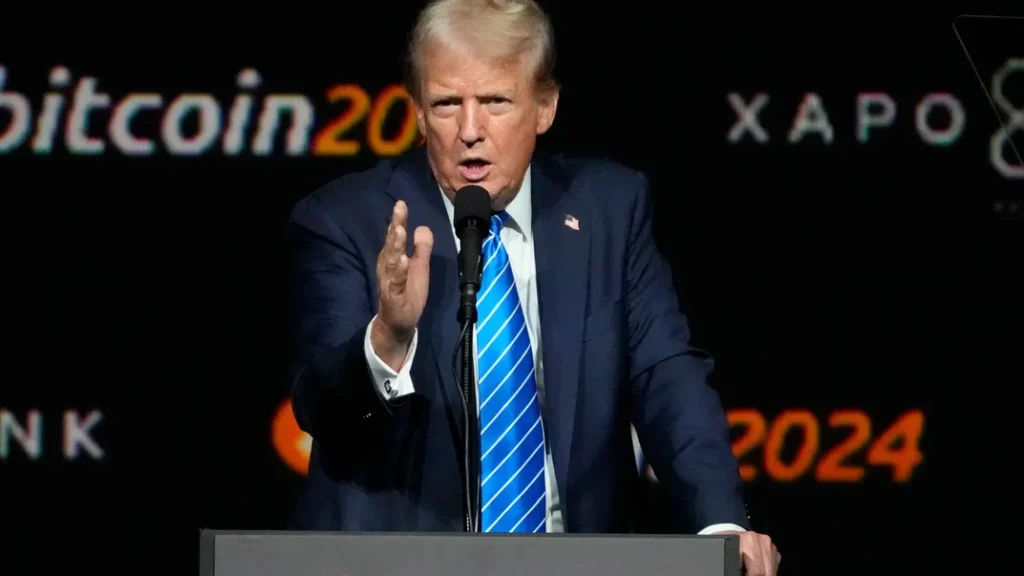

One standout pledge: to remove Gary Gensler, then-head of the SEC, a figure widely disliked in crypto circles for his tough stance. Trump made the promise during his June 2024 appearance at Bitcoin 2024, drawing huge applause.

In November 2024, Gensler confirmed he would step down on the day of the 47th president’s inauguration—one year ahead of his typical term’s end.

Candidates for Gensler’s seat included Dan Gallagher, general counsel at Robinhood; Christopher Giancarlo, ex-chair of the CFTC; Hester Peirce, an SEC commissioner; Robert Stebbins, the SEC’s former general counsel; billionaire Mark Cuban; and Binance executive Tigran Gambaryan.

In December 2024, Trump nominated Paul Atkins—a former SEC commissioner who is crypto-friendly and serves on the board of The Digital Chamber of Commerce—to be the agency’s next chair. The crypto community and many politicians welcomed Atkins’ nomination.

Until Congress confirms Atkins, Mark Uyeda will serve as acting chair of the SEC.

The CFTC also faces a leadership overhaul: Chairman Rostin Behnam announced his resignation. Under Behnam, the agency showed itself more lenient than Gary Gensler’s SEC. Though it did bring major enforcement actions against FTX and Binance, Behnam repeatedly called for greater oversight, including of decentralized exchanges and DeFi.

The front-runner to take over the CFTC is Brian Quintenz, a former commissioner and Andreessen Horowitz (a16z) policy lead for crypto. Quintenz calls himself a crypto advocate and has criticized the SEC’s approach. Until the Senate confirms a new chair, Commissioner Caroline Pham—a former Citibank executive—will lead the commission on an interim basis.

“The appointment of new agency heads—like the SEC or CFTC chairs—is a chance to reset the industry’s relationship with regulators. If knowledgeable crypto advocates enter the administration, this could speed regulatory clarity,” Kostarev noted.

In November 2024, the president-elect named hedge fund manager Scott Bessent as Treasury Secretary.

He also tapped other crypto-friendly figures for high-level posts:

- Robert Francis Kennedy Jr. at the Department of Health,

- Pete Hegseth, a political commentator and National Guard officer, at the Department of Defense,

- Howard Lutnick, CEO of Cantor Fitzgerald, at the Department of Commerce.

In addition, Trump created the U.S. Department of Government Efficiency (DOGE), co-headed by billionaire Elon Musk and ex-presidential candidate Vivek Ramaswamy.

The Bitcoin Reserve

Another headline from Trump’s campaign is the concept of a “national strategic Bitcoin reserve.”

Trump revealed intentions to add Bitcoin to the U.S. balance sheet at Bitcoin 2024—along with firing Gensler. He also vowed not to sell the 213,239 BTC the federal government now holds through asset forfeiture, calling it the “foundation of a national strategic reserve.”

Shortly thereafter, reports emerged about a draft bill by Senator Cynthia Lummis that would purchase up to 200,000 BTC annually over five years to accumulate 1 million coins. The measure would use U.S. gold reserves and require a 20-year lockup.

In December 2024, Dennis Porter, CEO of Satoshi Action Fund, said Trump might sign an executive order creating a strategic Bitcoin reserve funded by the Exchange Stabilization Fund (ESF). Shortly after, some U.S. states announced their own moves to stash Bitcoin reserves.

Binance founder Changpeng Zhao endorsed the idea, stating that other nations would “inevitably” follow. Ex–Treasury Secretary Lawrence Summers criticized it, calling Bitcoin a “sterile commodity” and saying Trump likely only did this to reward campaign donors.

Trader Vladimir Cohen remains skeptical about the plan, calling it a “populist slogan.”

“Right now, a national Bitcoin reserve is just rhetoric used to attract donations and the ‘crypto vote.’ Even if Trump signs such an order, Congress must still agree to Senator Lummis’ proposal, and that’s unlikely,” he explained.

Cohen believes there are too many obstacles: Bitcoin’s volatility could hurt bond ratings, the lack of legal frameworks, and security risks around custody. He suggests the U.S. might instead issue “Bitcoin-denominated Treasuries,” though it still wouldn’t solve Washington’s need for control.

“They use the dollar as a lever against other countries; that’s impossible with Bitcoin. If the U.S. can’t control it, they won’t put it in reserves,” Cohen concluded.

Opposition to CBDC

During his campaign, Trump pledged to block any U.S. central bank digital currency (CBDC). As early as 2020, U.S. officials contemplated a digital dollar to keep pace with similar global initiatives.

In 2022, the Federal Reserve published a paper highlighting that a digital dollar might preserve the greenback’s global standing, improve cross-border payments, and enhance financial inclusion. Yet, officials worried a CBDC could trigger deposit outflows from private banks and compromise privacy—and that such a system would be “extremely complex.”

Robert Francis Kennedy Jr., Scott Bessent, and Congressman Tom Emmer have also opposed a digital dollar, arguing it would be invasive and hamper financial freedom. Libertarian economist Evgeny Romanenko views CBDC as “Fiat 2.0,” giving the government even more control. He suggests a gold standard would be a better remedy.

Impact on the Traditional Economy

Romanenko sees the national debt of $36 trillion as the U.S. economy’s Achilles’ heel, fueling inflation and devaluing the dollar. He believes the “existing system’s inertia” will hamper Trump’s reforms:

“To halt debt growth, Trump would need to slash federal spending drastically—abandon overseas interventions and revert to something akin to 250 years of isolationism.”

But stepping away from global policing might spark conflict.

“Radical cuts won’t happen, so fundamental problems remain,” said Romanenko.

He suggests crypto might help with creative debt financing, but the administration must still slash “parasitic” bureaucracy.

“Presidential Meme Coins”

On January 18, Trump launched TRUMP, a meme coin on Solana, rallying 220% in FDV to $62 billion in its first day—despite a generally stagnant market.

SOL surged to a record $270, and major centralized exchanges—Binance, Bybit, HTX, Gate, Bitget—listed the token.

The next day, Melania Trump introduced MELANIA, which skyrocketed in its debut, overshadowing her husband’s coin and sending TRUMP from $61 down to $38.9.

Over that two-day stretch, Solana saw a “crazy weekend”: DEX volume soared to $27 billion daily, TVL rose to $11 billion, and network fees reached $57 million in a single day.

By January 21, TRUMP and MELANIA had declined 29.8% and 53.8% respectively from their peaks, partly due to disappointment over Trump’s inaugural speech that failed to mention crypto.

Many in the crypto community see potential ethical and legal issues with “presidential meme coins.” Some call it mere greed, while experts wonder whether the SEC should intervene.

Umar Ashraf, founder of TradeZella, believes launching or endorsing meme tokens is improper for someone holding the nation’s highest office.

CNBC/Yahoo Finance journalist Zack Guzman questions whether it violates the U.S. Constitution, suspecting it may have been done before the inauguration to avoid potential criminal liability.

Exved CEO Sergey Mendeleev says the SEC could see the Trump family’s meme coins as violating securities laws:

“Why can Trump ‘earn’ billions while others would be labeled ‘scammers’? It’s a double standard.”

“It Won’t Get Any Worse Than It Was”

Allbridge.io co-founder Andrey Velikiy sees the U.S. crypto landscape as already “worst-case scenario.” He believes Trump “clearly understands” that overregulation stifles innovation, referencing how Europe’s approach to AI led firms to flee. He expects the U.S. climate for crypto to improve.

“We may not get the ‘Wild West’ that the market wants, but nearly all of Congress is pro-crypto. They criticize Gensler, and they know losing crypto to Asia would be a strategic blow,” Velikiy explains.

He doesn’t expect the president’s personal views to shift drastically but hopes actual policy changes are more “level-headed” than campaign promises:

“Crypto firms will likely operate in the U.S. with fewer restrictions. The market will respond positively because Trump, like any businessman, values capital inflows,” said Velikiy.

Context

- In January, rumors indicated Trump might release an executive order labeling cryptocurrencies a “national priority.”

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.