On December 18, Ethereum spot ETFs saw inflows of $2.45 million, bringing the 18-day total to $2.45 billion.

Since their launch, these products have attracted a cumulative $2.46 billion. Assets under management (AUM) have grown to $14.3 billion, with Grayscale’s ETHE leading at $5.31 billion and BlackRock’s ETHA close behind at $3.88 billion, now holding over 1 million ETH.

Bitcoin ETF

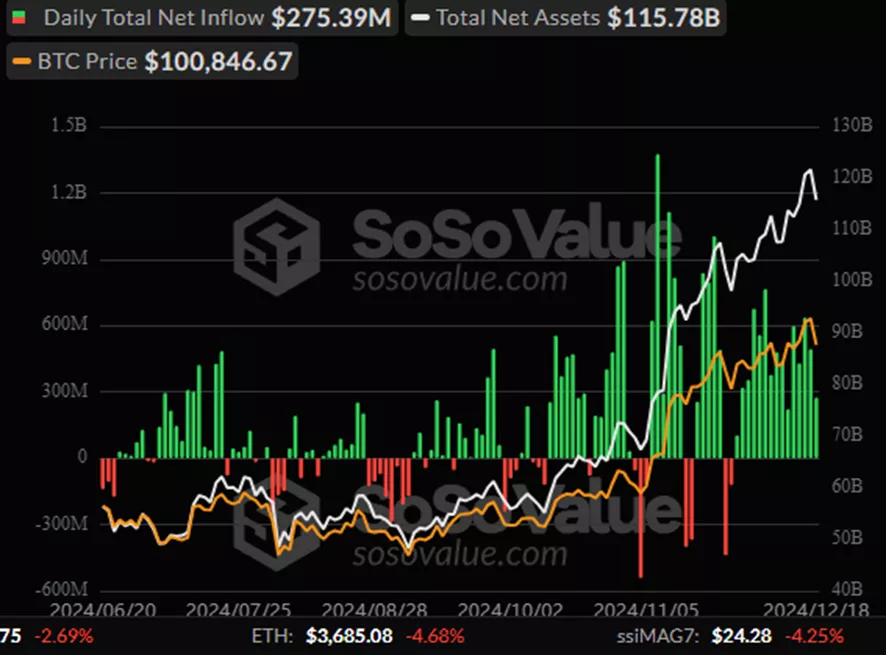

On the same day, BTC-ETFs recorded inflows of $275.4 million, marking 15 consecutive days of positive momentum. During this period, inflows totaled $6.73 billion.

Since BTC-ETF approvals in January, cumulative inflows have reached $37 billion, pushing AUM for these products to $120.7 billion.

48.4% of this amount ($56.1 billion) is concentrated in IBIT, while Grayscale’s GBTC ($21 billion) and Fidelity’s FBTC ($21 billion) account for another significant portion. Together with BlackRock’s ETF, these funds hold 84.8% of the sector’s capital.

According to Sygnum, every $1 billion of inflows into BTC-ETFs drives Bitcoin’s price up by 3–6%.

Earlier, YouHodler executive Ruslan Lienha highlighted the potential inclusion of staking in Ethereum ETFs, a sentiment echoed by Bernstein analysts.

Some experts believe that the success of ETH-ETFs could propel Ethereum to a new all-time high.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.