Non-profit organization Ethereum Foundation (EF) implemented part of its ether reserves, converting 1000 ETH (approximately $4.48 million) in stablecoins. the transaction was carried out as part of the Treasury Management Strategy and aimed at supporting scientific research, grant programs and defi-projects in the Ethereum ecosystem.

The operation was carried out through Decentralized Cow Swap Protocolthat aggregates liquidity from various sites, allowing users to make transactions at the most favorable rates without the participation of intermediaries.

the exact list of stablecoins received in exchange for ETH, not revealed.

Source: Ethereum Foundation X

This is not the first such step on the part of the fund. In September, the organization announced plans to sell up to 10 000 ETH in the coming weeks, however, the current transaction carried out October 3, according to observers, not directly related to those plans And probably was independent.

In its treasury policy, EF notes that it seeks Combine the safety of assets with moderate returns, while remaining a ‘reliable ecosystem guardian of the Ethereum’ and actively use DeFi tools.

The growth of the share of stablecoins in the portfolio coincided with temporary suspension of the Ecosystem Support Program open grantscaused by a large number of applications. In this regard, the fund intends to focus on key areas of network developmentwhere financial support is needed.

In April, the Ethereum Foundation held Reorganization of the management structure to improve work efficiency. The new co-executive directors were Xiao-Wei Wang and Tomash Stanchakwho previously held leadership positions in the organization. In June, the fund also Reduced some of the employees and restructured the main development teams.

Vitalik Buterin: ‘Defi is the key to Ethereum’s stability’

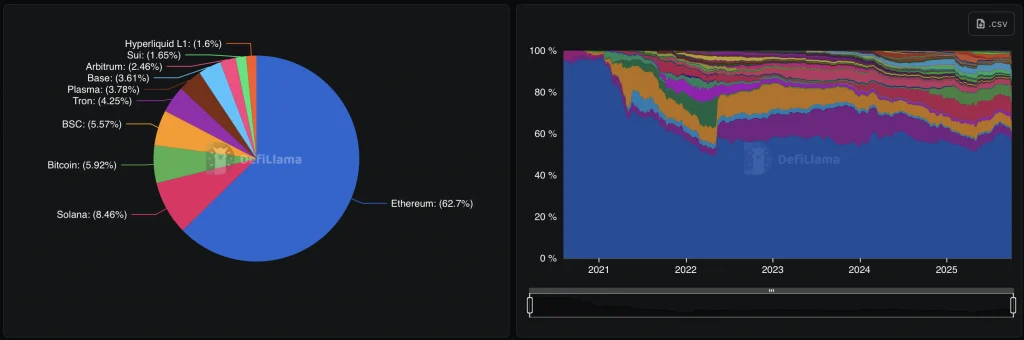

Ethereum continues to hold leadership among platforms for decentralized finance. According to analytical services, the Ethereum ecosystem accounts for About 68% of total blocked assets (TVL) in the DeFi sector.

Source: defillama

Project co-founder Vitalik Buterin once again emphasized that decentralized finance is The main driver of sustainable network development. He compared the DeFi application to the Google search engine core, which provides a stable income for the entire corporation.

“Low-core defi applications can perform the same basic function for Ethereum — creating stable and predictable revenue streams for the ecosystem,” Buterin said.

He also noted the importance basic financial instruments – payments, savings, synthetic assets and fully secured lending, which, in his opinion, will become the basis for the long-term stability of Ethereum.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.