Bitcoin is holding the psychological $100,000 mark thanks to high risk appetite among investors, fueled by central bank monetary easing. This view was expressed by Bitfinex Head of Derivatives Jag Kuner in a conversation with The Block.

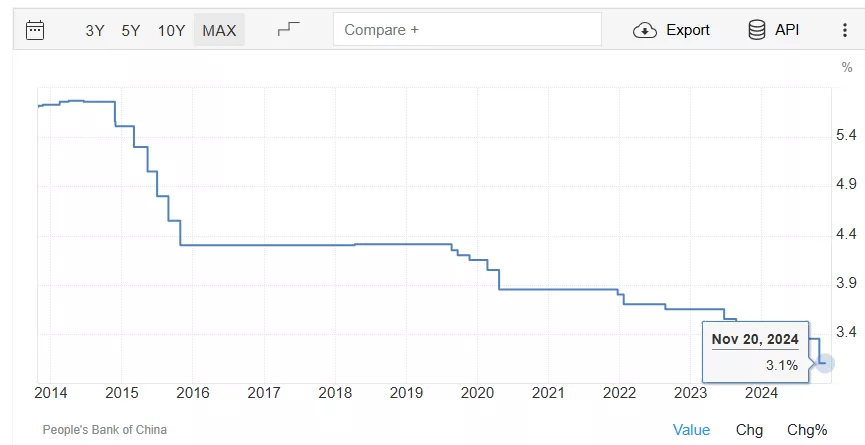

“The European Central Bank (ECB) and the People’s Bank of China (PBoC) recently cut rates for the first time in 14 years. A rate cut by the Federal Reserve could improve global liquidity conditions,” Kuner said. “This easing could encourage capital inflows into risk markets, including cryptocurrencies.”

The ECB reduced its interest rate by 25 basis points following a meeting on December 12. However, the regulator is not yet ready to declare victory over inflation, according to ECB President Christine Lagarde.

The key interest rate determines borrowing costs for banks, which impacts loan costs for businesses and households.

PBoC Outlook

Speculation about further monetary easing by the PBoC is growing. Wall Street players like Goldman Sachs and Morgan Stanley anticipate additional rate cuts in 2025, totaling 40 basis points.

What About the Fed?

Markets are eagerly awaiting the Federal Reserve’s decision on interest rates at the FOMC meeting scheduled for December 18.

Kuner highlighted a strong likelihood of a 25 basis point rate cut by the Fed, combined with easing measures in the EU and China, boosting optimism in risk asset markets, including cryptocurrencies. This could trigger a “Santa rally,” pushing Bitcoin and other digital assets higher.

Kuner also pointed to increased bullish momentum following a cascade of liquidations in derivative markets.

“Now that overly leveraged long positions have been flushed out, the foundation for the next phase is set to emerge in the coming weeks,” the expert concluded.

At the time of writing, Bitcoin is trading at approximately $101,580, with a dominance index of 52.9%.

Inflation and Broader Context

As of November, annual inflation in the U.S. stood at 2.7%, aligning with market expectations.

Previously, Matrixport experts identified a favorable macroeconomic environment as one of the factors that could drive Bitcoin’s price to $160,000 by 2025.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.