The administration of Donald Trump could create conditions where staking in Ethereum-based ETFs attracts significant capital inflows to U.S. exchange-traded funds, said YouHodler exchange executive Ruslan Lienha in an interview with The Block.

“Under the Trump administration, staking is likely to receive the necessary legal framework, paving the way for broader adoption, including institutional participation,” Lienha noted.

However, he believes institutional adoption will be gradual, as volatility and operational risks may not suit all institutions.

According to analysts at Bernstein, the new SEC leadership is expected to approve Ethereum ETFs with staking capabilities. They estimate Ethereum’s yield of 3%, with potential growth to 4–5%, as an attractive proposition amid declining rates in traditional finance.

Head of research at CryptoQuant, Julio Moreno, emphasized staking as a significant driver of inflows to Ethereum ETFs.

“Institutional demand for Ethereum could increase significantly as staking-enabled ETFs provide a direct incentive for long-term holding, reducing the circulating supply and enhancing Ethereum’s appeal as a yield-generating investment,” the expert explained.

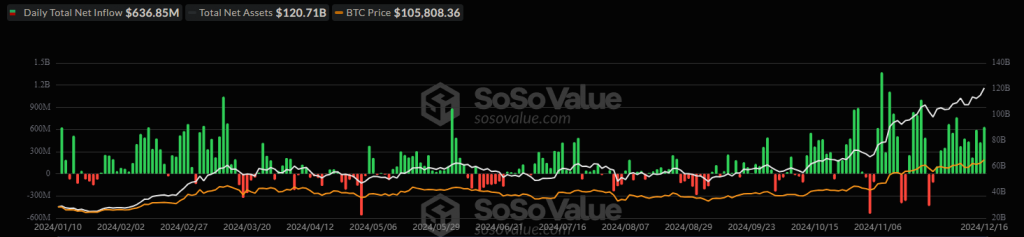

In the first 16 days of December, cumulative inflows into spot Ethereum ETFs totaled $2.3 billion, with the combined balance reaching $14.28 billion.

According to K33 Research, on December 17, spot Bitcoin ETFs surpassed gold-backed ETFs in assets under management, dethroning funds that had dominated the market for 20 years.

gm!

— Vetle Lunde (@VetleLunde) December 17, 2024

U.S. Bitcoin ETFs flipped U.S. gold ETFs AUM yesterday. pic.twitter.com/OVYjKGXtuv

In November, assets in Bitcoin-based ETFs were half of those in similar gold-based structures.

The surge in capital inflows into ETFs coincides with growing market optimism fueled by the Trump administration’s return.

Some experts believe the success of Ethereum ETFs could push the second-largest cryptocurrency to a new all-time high, surpassing its record price of $4,878 set on November 10, 2021.

Notably, between December 10 and 11, the iShares Ethereum Trust (ETHA) by BlackRock and the Fidelity Ethereum Fund (FETH) purchased $500 million worth of Ethereum.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.