The transparency of Hyperliquid has enabled “people’s whale hunting” with leverage, aimed at liquidating large positions. This was highlighted by 10x Research.

HYPE Reloaded: Is the Dip a New Entry Point?

— 10x Research (@10x_Research) March 17, 2025

👇1-14) March has historically been a turning point for asset prices, and last year was no exception. While consensus remained bullish, we turned cautious in March 2024, correctly anticipating the start of an eight-month consolidation… pic.twitter.com/2THlqUSIAe

Experts believe that this initiative could spark a new trend.

Hyperliquid’s monitoring feature allows the public to track whale trades, analyze their liquidation levels, and theoretically coordinate efforts to “hunt” them. Traders can intentionally push the price toward whales’ stop levels, leveraging the platform’s transparency to their advantage.

10x Research noted that this could shift the balance of power among market participants. However, the extent of this phenomenon’s impact remains to be seen.

Analysts drew parallels with the Reddit WallStreetBets vs. Wall Street hedge fund battle during the GameStop saga.

Confrontation with a Whale

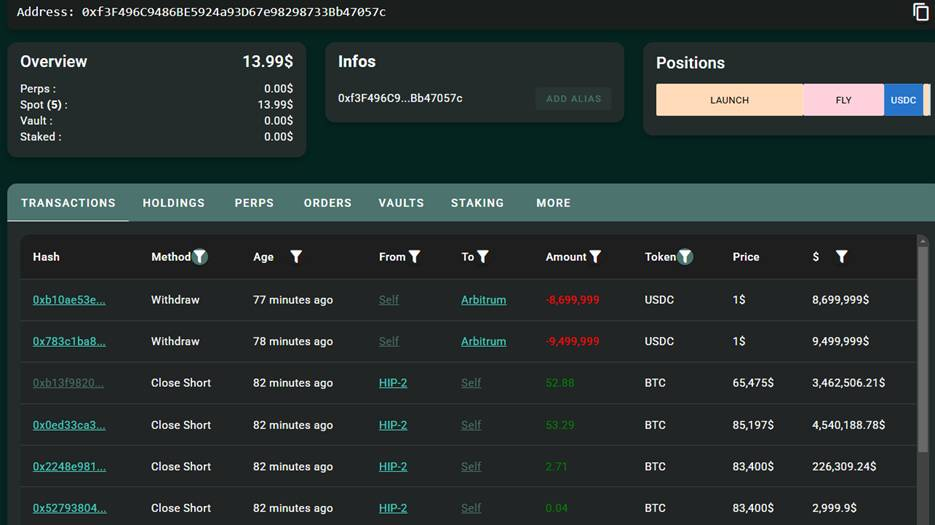

10x Research’s comment came in response to a proposal by user CBB to collectively liquidate a major trader.

lmfao we might have some ammo coming in https://t.co/GS68ksb4aC pic.twitter.com/ExYHfg36M0

— CBB (bera era) (@Cbb0fe) March 16, 2025

The player in question opened a short position of 4,442 BTC with 40x leverage at a price of $84,043 on March 16, with a liquidation level at $85,592.

According to analysts, the call was answered—within minutes, Bitcoin surged by 2.5%, driven in part by traders who supported CBB’s idea.

To avoid liquidation, the whale increased their position to 6,210 BTC (~$524 million).

A (Not So) Happy Ending

On March 18, the large trader closed the short position manually, securing a ~$7.9 million profit.

He has closed all his short positions.👀👀https://t.co/q5hI0vx0ZX https://t.co/cRVjcEeR3X pic.twitter.com/zv8Z5tOAGi

— CoinGlass (@coinglass_com) March 18, 2025

Spot market prices did not reach their liquidation level of $85,556.99.

The Role of Whales

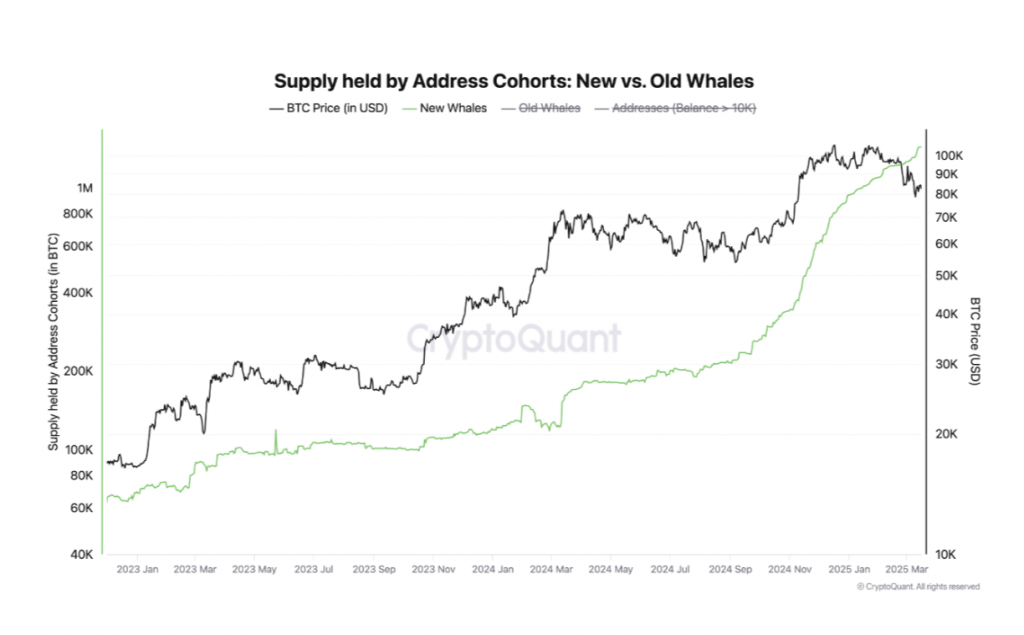

CryptoQuant highlighted the crucial role of large holders in the current market cycle. Analysts discovered an “unprecedented accumulation” of Bitcoin by addresses holding at least 1,000 BTC for over six months.

According to experts, this suggests a strong conviction among institutional investors in Bitcoin’s long-term prospects.

Since November 2024, these wallets have collectively acquired over 1 million BTC. In recent weeks, accumulation has accelerated significantly, increasing by more than 200,000 BTC in March alone.

Analysts see this trend as reflecting the growing participation of institutional investors and high-net-worth individuals.

Earlier, experts reported an increase in the share of Bitcoin held for three to six months. They believe this mirrors accumulation trends seen during the prolonged market downturn in the summer of 2024.

Reminder: Matrixport previously predicted that Bitcoin’s correction would end between March and April. Glassnode suggested that the asset’s redistribution phase could last longer.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.