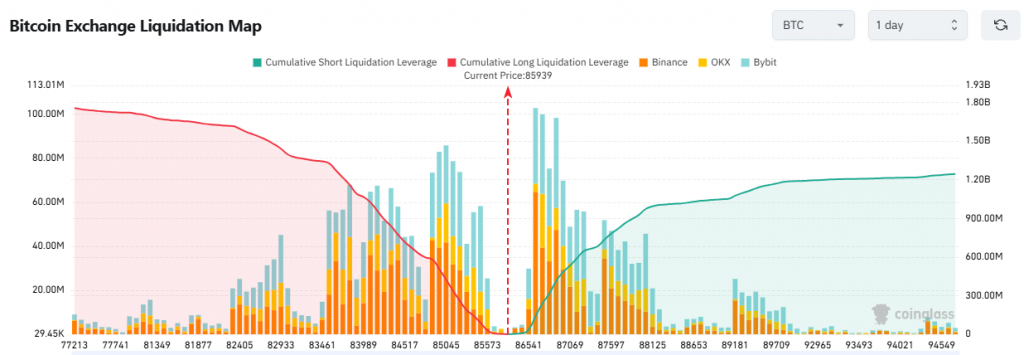

A correction of Bitcoin below $84,000 would trigger over $1 billion in liquidations, but the market is showing signs of reaching a bottom, according to experts.

Analysts at IntoTheBlock believe that increasing network activity indicates a potential trend reversal.

As of February 28, the number of active addresses had risen to 912,300—the highest since December 2024, when Bitcoin was priced at $105,000.

“Historically, spikes in on-chain activity often coincide with market tops and bottoms, driven by seller panic and opportunistic buyers,” IntoTheBlock noted.

Experts call this a “critical turning point,” although there are no direct guarantees of a trend reversal.

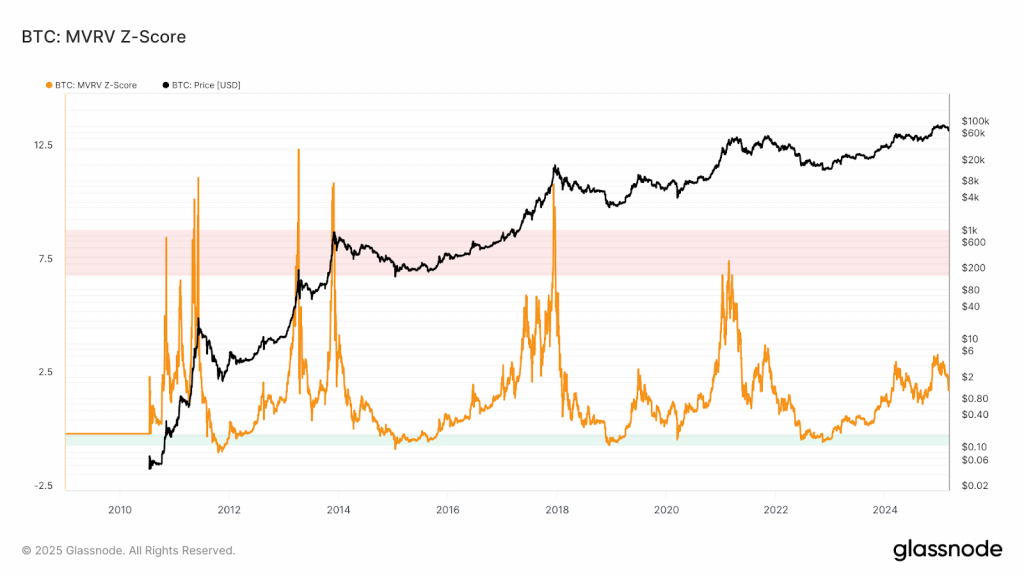

The possible approach of a bottom and increasing Bitcoin oversold conditions are also signaled by the MVRV Z-score, which stood at 2.01 on March 1.

CryptoQuant CEO Ki Young Ju highlighted the indicator’s movement, noting that on-chain metrics still appear “incomplete.”

#Bitcoin on-chain indicators feel like this—like something unfinished. pic.twitter.com/NFFu7q1BPu

— Ki Young Ju (@ki_young_ju) March 2, 2025

Previously, Nexo analyst Ilya Kalchev suggested that Bitcoin could correct to $72,000.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.