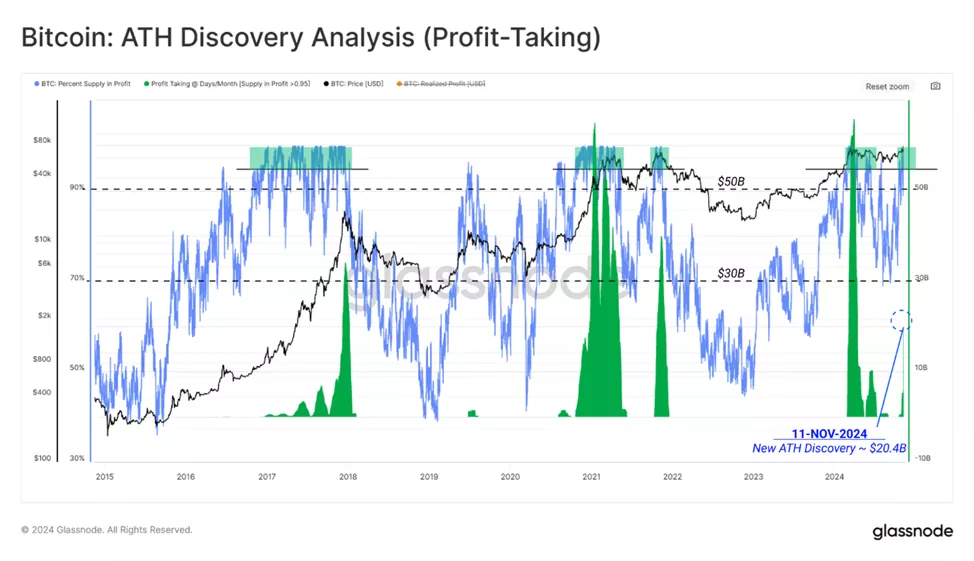

Glassnode сообщает, что реализованная прибыль как краткосрочных, так и долгосрочных держателей биткоина остается ниже предыдущих пиков исторических максимумов (ATH). Это говорит о том, что многие инвесторы, скорее всего, предпочитают дождаться более высоких цен для продажи.

#Bitcoin’s rally to a new ATH is driven by strong spot demand and institutional inflows, with over 95% of supply in profit. This article explores on-chain indicators, highlighting robust spot buying momentum, rising ETF AUM, futures premiums, and the potential for sustained gains… pic.twitter.com/N8gJENt5kL

— glassnode (@glassnode) November 12, 2024

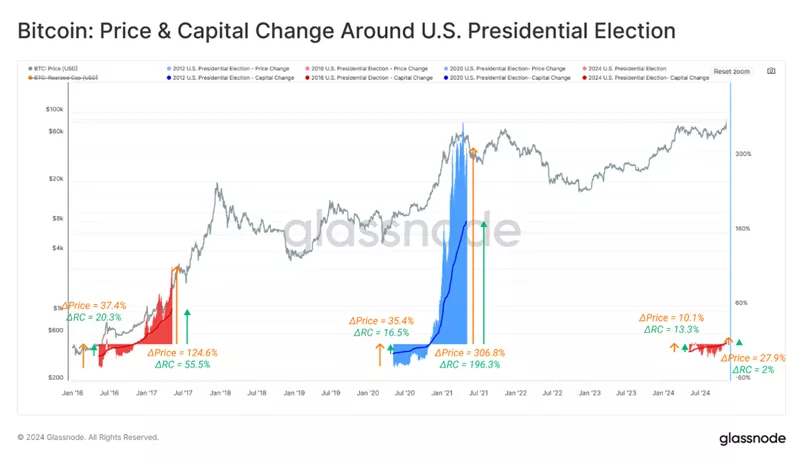

Аналитики Glassnode отмечают, что реализованная капитализация биткоина увеличилась на 13,3% до выборов и на 2% после них. В контексте цены это изменение составило 10,1% и 27,9% соответственно. Эти данные свидетельствуют о более сдержанной реакции рынка по сравнению с предыдущими циклами.

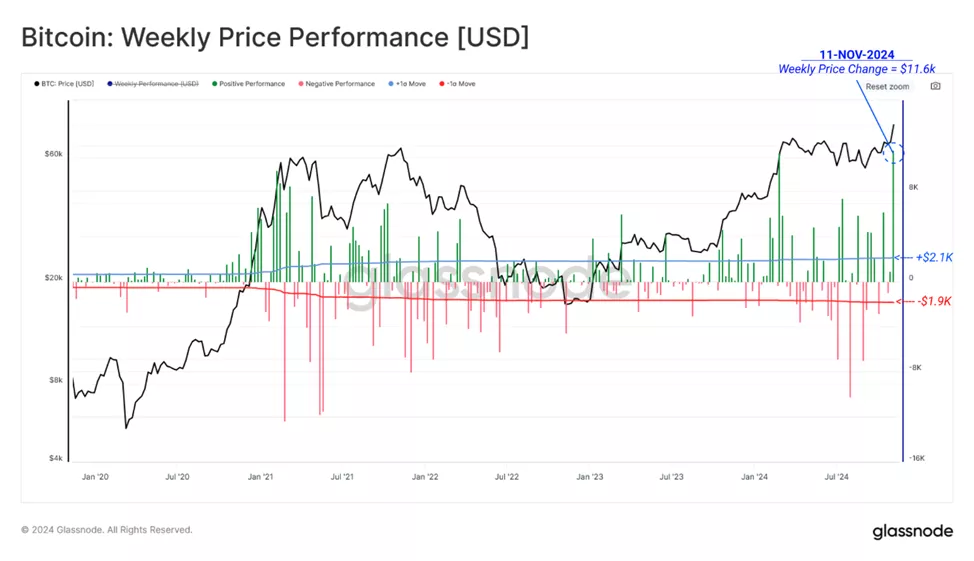

В последнюю неделю цена биткоина подскочила на $11 600, что вывело его за верхний предел статистического диапазона (одно стандартное отклонение) в пять раз. Это указывает на «беспрецедентную бычью силу», связанную с ожиданиями изменений в нормативной среде.

«Хотя фиксация прибыли значительна, она остается ниже исторических максимумов, что позволяет предположить наличие дополнительных возможностей для дальнейшего роста до потенциального исчерпания спроса», — говорится в отчете.

Приток в BTC-ETF и рост фьючерсов

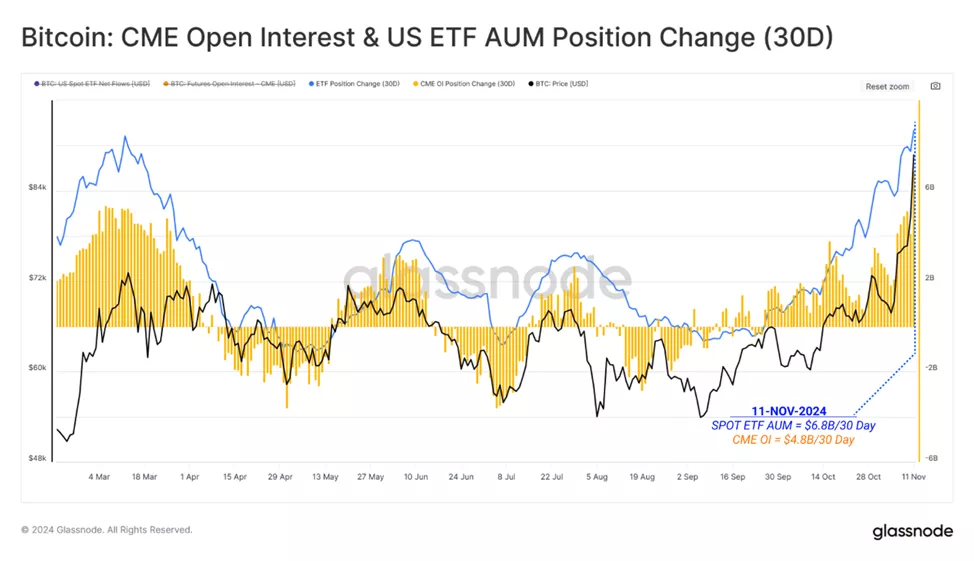

Glassnode также подчеркивает выраженное давление покупателей на Coinbase, а также приток в BTC-ETF на сумму $6,8 млрд за последние 30 дней. Увеличение открытого интереса по биткоин-фьючерсам на CME на $4,8 млрд за тот же период указывает на предпочтение спотовой торговли через биржевые фонды.

Объем реализованной прибыли на суточной основе составил около $1,56 млрд, из которых 46% ($720 млн) пришлось на долгосрочных держателей (ходлеров). Это примерно половина от уровня предыдущих циклических ATH ($3 млрд), где более 50% прибыли приходилось на долгосрочных инвесторов.

Потенциал для роста

«Если спрос сохранится, остаются возможности для продолжения роста цены. Потребуется большее давление со стороны продавцов, прежде чем котировки выйдут на типичные уровни для реализации прибыли», — заключили специалисты.

Ранее аналитики Copper назвали временные рамки формирования пика биткоина. Напоминаем, что Bernstein рекомендовала инвестировать в криптовалюты как можно скорее, предложив включить в портфель BTC, ETH, SOL, OP, ARB, POL, UNI, AAVE и LINK.

Cryptol — новости о криптовалютах, информационных технологиях и децентрализованных решениях. Оставайтесь в курсе актуальных событий в мире цифровых технологий.

Cryptol — новости о криптовалютах, информационных технологиях и децентрализованных решениях. Оставайтесь в курсе актуальных событий в мире цифровых технологий.