The current Bitcoin bull market is weaker than previous ones but shows similarities to the 2015–2018 cycle, leaving room for further acceleration in the near future, according to analysts at Glassnode.

Experts analyzed Bitcoin’s price dynamics relative to cycle lows and identified a declining growth rate with each new bull run. They believe this reflects market maturation and the increasing capital required to push asset prices higher.

The current cycle, starting from the late 2022 low, aligns with the transition into the second phase of euphoria. In the last two bull markets, this stage saw a significant acceleration in price appreciation due to new demand inflows.

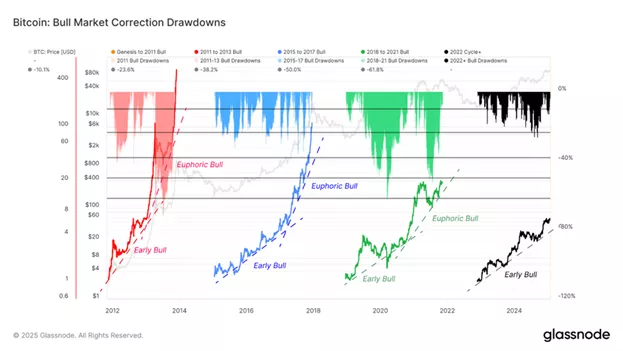

The next chart, illustrating the range of pullbacks, shows that corrections in the current cycle are between Fibonacci levels of 10.1% and 23.6%. This pattern is similar to the 2015–2018 cycle.

Analysts attribute the relatively shallow pullbacks (which have not exceeded 25% from ATH) to strong demand driven by Bitcoin’s recognition as a macro asset and the growing popularity of spot BTC ETFs.

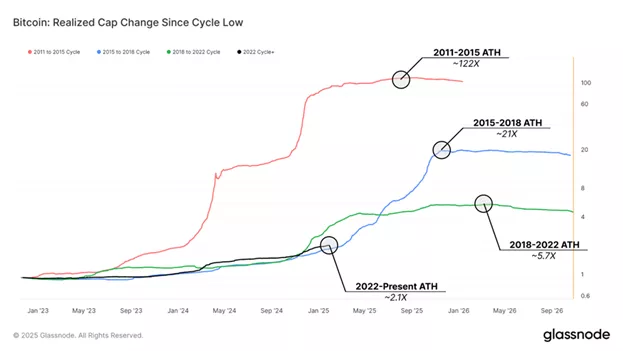

Experts also examined realized capitalization trends, an indicator that helps visualize net capital inflows into the market.

In the current cycle, this metric has increased 2.1x, significantly below the previous cycle’s peak of 5.7x, but once again resembling the 2015–2018 cycle.

From this perspective, the market has yet to enter an exponential growth phase, suggesting further potential for upward momentum.

Previously, analyst Ali Martinez identified $91,700 and $97,877 as key support levels for maintaining the bullish trend.

Bitwise has forecasted “less severe” Bitcoin price corrections, citing initiatives from the Trump administration.

Meanwhile, Bitcoin futures recently entered bearish territory for the first time since August 2023 due to uncertainty surrounding DeepSeek and the upcoming Federal Reserve meeting.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.