hackers stole assets worth about $20 million from one of the users of the trading platform Hyperliquidby hacking his private key. The incident was the first to be reported by a community member under the nickname MLM.

According to preliminary data, the hack came shortly after the trader closed the large long position on the token hype on $16 million And sold more 100,000 HYPE about $4.4 million.

How did the hack happen?

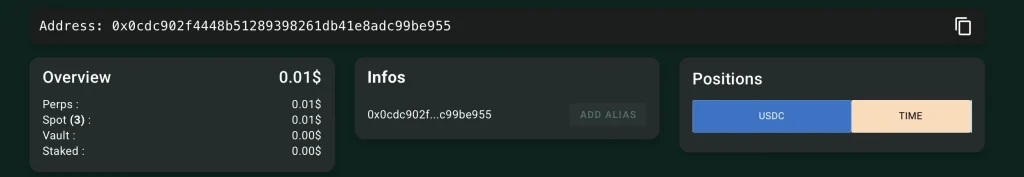

According to the data hypurrscan, address owner 0x0CDC Performed the last major operation about 11 hours before the attack. After that, the attackers completely cleaned his wallet.

As a result, the hackers brought $17 million from the Hyperliquid account, as well as around $3.1 millionplaced in a decentralized liquidity pool Plasma Syrup Vault.

Source: hypurrscan

The stolen assets were transferred to the address 0xf4be, after which the attackers converted USDC in DAI and distributed the funds received between two new wallets – 0xc1ee and 0x37FC.

Additionally $3.11 million in tokens msyruppusdp were sent to the third address – 0x3E2E.

According to the user Luke Cannon, the hacked trader could lose around $300,000 in the main Ethereum network, on related addresses, which also turned out to be compromised.

Experts believe that Private key leak could happen through phishing attack Or installing malware that has access to the wallet.

Not all losses are the result of hackers

It should be noted that not all major losses on Hyperliquid caused by hacks. Many traders lose millions due to high volatility and overuse of the shoulder.

so, October 1st Taiwanese musician and investor Jeffrey Huang fixed almost $9 million unrealized loss on Hyperliquid.

And September 25th Trader Machi Big Brother Lost $31.6 million in just six days. At the same time, in the previous four months, he managed to increase the balance from scratch to $42.8 millionbefore a series of failed transactions completely reset the profit.

📍The incident raises the issue of crypto wallet security and the importance of protecting private keys, even on advanced platforms with decentralized architecture.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.