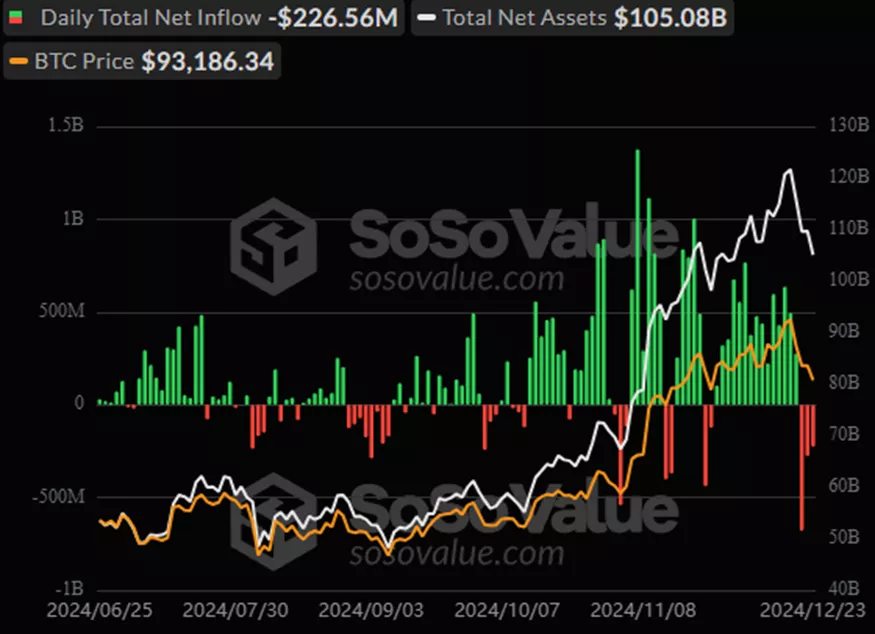

On December 23, spot Bitcoin ETFs experienced an outflow of $226.6 million, marking the third consecutive day of withdrawals totaling $1.18 billion.

The cumulative inflow since the approval of BTC ETFs in January has decreased to $35.83 billion.

The assets under management (AUM) for Bitcoin ETFs now stand at $105.1 billion, representing 5.7% of Bitcoin’s market capitalization.

Ethereum ETFs On the same day, investors allocated $130.8 million to spot Ethereum ETFs, following two days of outflows. Prior to this, there had been 18 consecutive days of inflows totaling $2.45 billion.

Since their launch, Ethereum ETFs have attracted $2.46 billion in total.

The AUM for these funds is now $12.05 billion.

Market Insights According to Sygnum’s estimates, every $1 billion in BTC ETF inflows pushes Bitcoin’s price up by 3–6%.

Previously, YouHodler executive Ruslan Lienha highlighted the potential benefits of staking-enabled Ethereum ETFs. This view is echoed by Bernstein analysts.

Some experts believe that the success of Ethereum ETFs could drive the second-largest cryptocurrency to a new all-time high.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.