Former hedge fund manager and Mad Money host Jim Cramer suggests it’s better to purchase Bitcoin than shares of MicroStrategy, The Block reports.

“If you want to hold the first cryptocurrency, go for it. I hold some digital gold. […] It’s a great asset to have in your portfolio. Not MicroStrategy,” he explained.

From January 21–26, MicroStrategy bought 10,107 BTC for approximately $1.1 billion at an average price of around $105,596, bringing its total Bitcoin reserves to 471,107 BTC.

Since August 2020, MicroStrategy has invested $30.4 billion in Bitcoin, averaging $64,511 per coin.

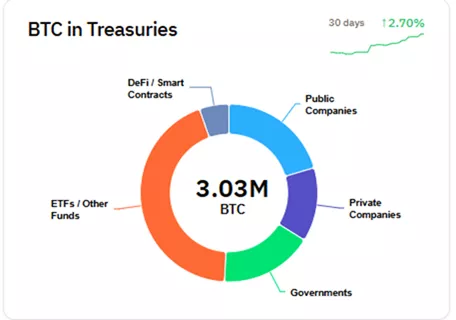

The firm alone accounts for 76% of all Bitcoin held by public companies, which equates to 2.24% of Bitcoin’s circulating supply.

Meanwhile, Bitcoin ETFs collectively hold 1.325 million BTC (6.3%), nearly half of which sits in IBIT wallets managed by BlackRock.

Context

- In March 2024, media outlets revisited Cramer’s track record of unfulfilled predictions. He once labeled Bitcoin a scam and recommended selling it at around $24,000.

- Nor was last spring an exception, when he doubted Bitcoin’s continued rally.

- In December, billionaire Ray Dalio, who had been similarly skeptical in the past, referred to Bitcoin as “hard money.” A year earlier, he admitted to holding BTC himself, though he still prefers gold.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.