Bitcoin and gold are gradually becoming more prominent in investor portfolios, supporting a long-term trend of “inflation trade,” according to JPMorgan analysts, The Block reports.

“Gold prices have risen considerably over the past year—beyond what can be explained by changes in the U.S. dollar and bond yields. This likely signals a renewed focus on risk-hedging strategies,” the experts noted.

A record inflow into the cryptocurrency market in 2024 also indicates that Bitcoin has become structurally significant for market participants.

JPMorgan called the past year a “turning point” for the digital asset industry. They estimate a total of around $78 billion in capital inflows into crypto over the last 12 months:

- $27 billion into ETFs

- $14 billion into CME futures

- $14 billion into crypto venture funds

- $22 billion via MicroStrategy’s Bitcoin purchases

- $1 billion from mining deals

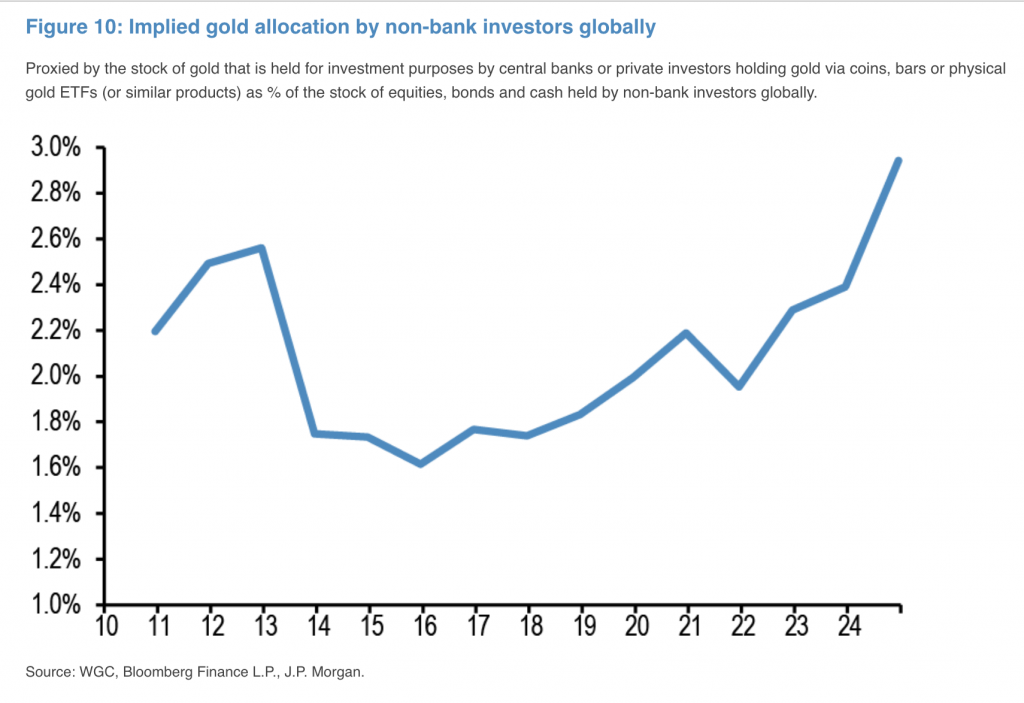

According to the analysts, the growing share of gold in portfolios is “obvious” when examining the amount of the precious metal held by central banks and private investors worldwide.

This latter group employs various derivative instruments—physical gold, gold ETFs, and other investment products—which now constitute a significant portion of the global non-bank investor market.

Context

- In November 2024, JPMorgan analysts expressed confidence in the “strong performance” of both Bitcoin and gold during Donald Trump’s presidential term in the United States.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.