Kaiko described 2024 as a landmark year for cryptocurrency markets, summarizing its highlights in ten key charts.

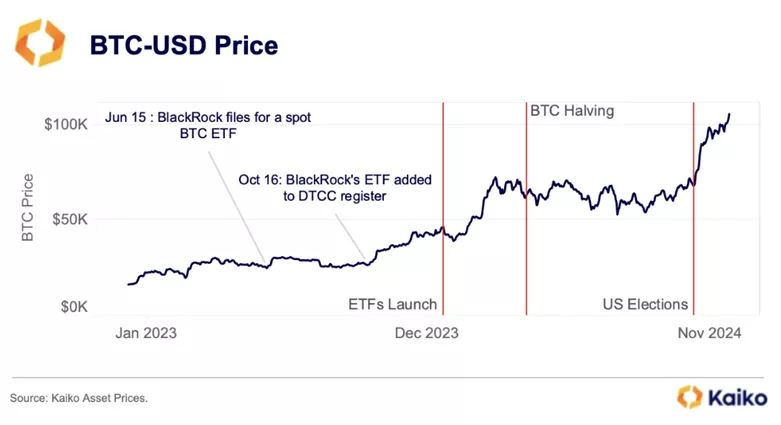

Bitcoin’s Journey to $100,000

The market strengthened following the launch of BTC-ETFs, with the fourth halving proceeding without surprises. Despite waves of billion-dollar liquidations, Bitcoin achieved ~140% growth since the start of the year.

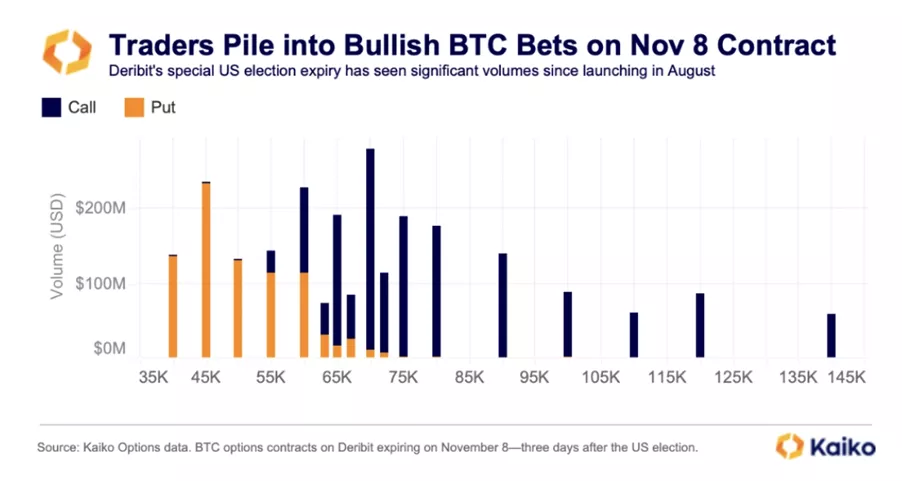

U.S. Elections Fuel a Bullish Surge

Cryptocurrencies played a pivotal role in the U.S. presidential election rhetoric. Bitcoin became a “Trump bet” ahead of the November 5 vote. Results from Senate elections further boosted momentum, propelling Bitcoin above $80,000 by November 11 and setting a new ATH of over $108,000 in December.

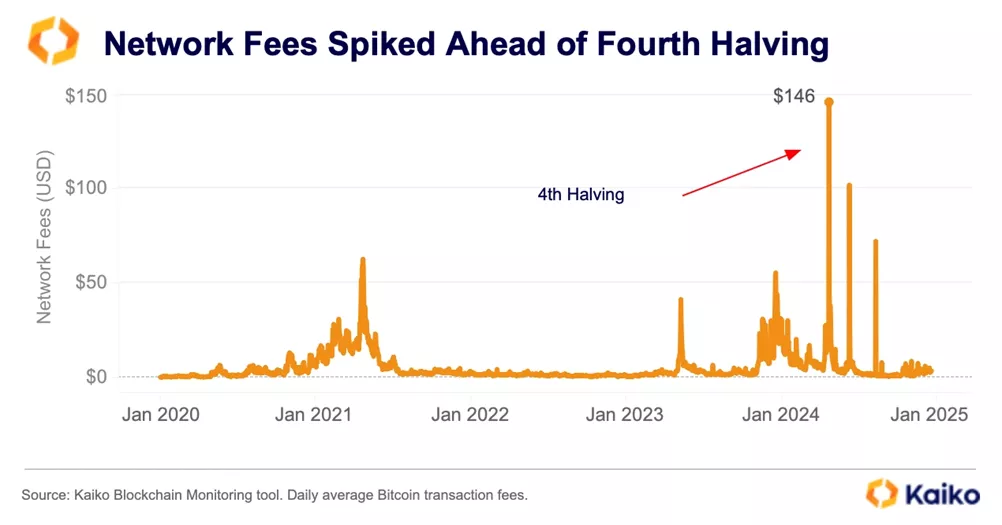

Bitcoin Network Fees Soar Before the Halving

Ahead of the April 19 halving, Bitcoin’s average transaction fees spiked to a record $146, compared to Ethereum’s $3. The launch of Runes contributed significantly to this surge.

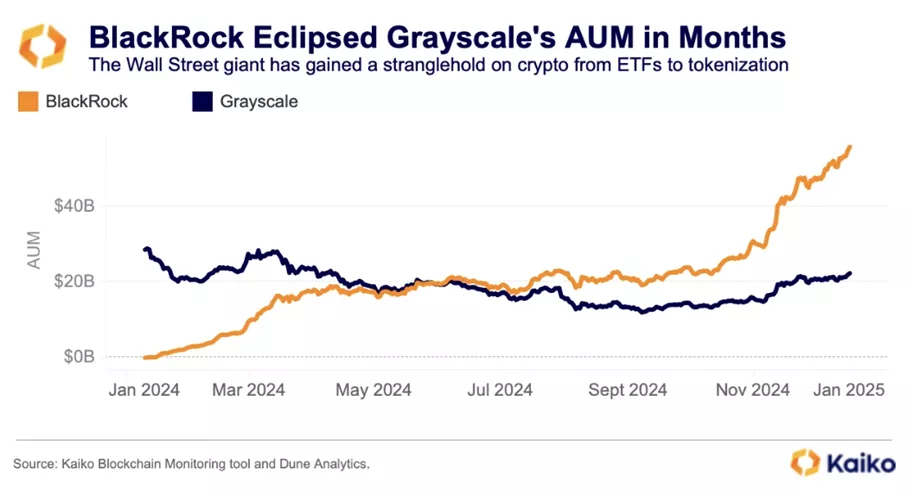

IBIT by BlackRock Outpaces GBTC by Grayscale

The iShares Bitcoin Trust ETF (IBIT) by BlackRock surpassed $50 billion in AUM since BTC-ETF approval in January. GBTC lost its leadership position due to uncompetitive conditions for buying/redeeming shares.

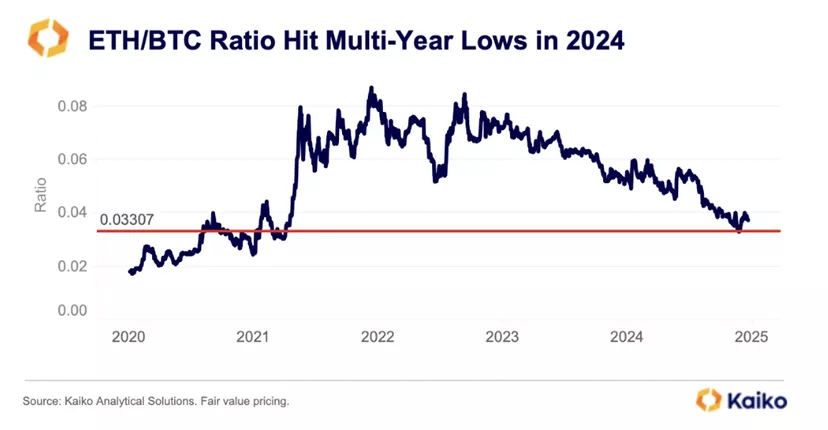

ETH/BTC Ratio Hits a Low

Throughout 2024, the ETH/BTC exchange rate declined, reaching its lowest point since March 2021 (0.033). Kaiko attributed this to capital shifting into Solana due to Ethereum’s high fees in March and meme-coin hype in Q4. Additional pressure came from the absence of staking in the launched ETFs.

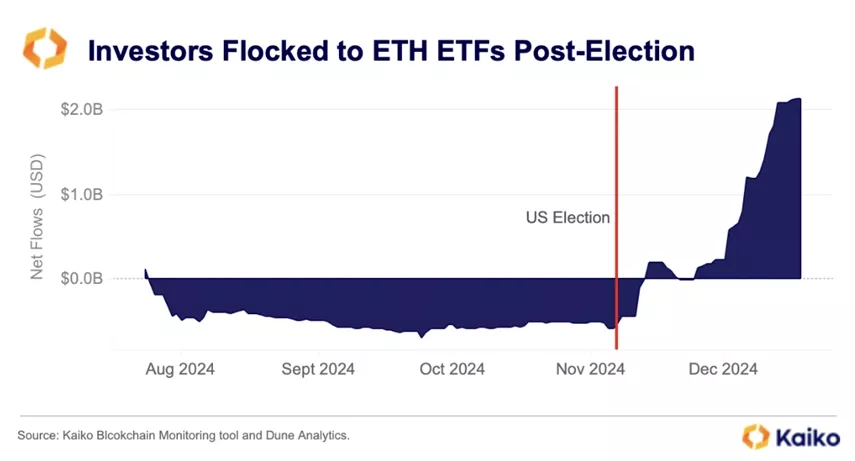

Slow Start for Ethereum ETFs

Launched in July, Ethereum ETFs initially gained traction slowly due to discount arbitrage in Grayscale’s product. The situation changed after November’s elections, sparking optimism for a better regulatory landscape. This triggered an 18-day inflow wave, with $2.45 billion invested in the funds.

Kaiko called Ethereum “one of the biggest winners” of the U.S. elections, forecasting regulatory clarity on its status and the inclusion of staking in ETF products.

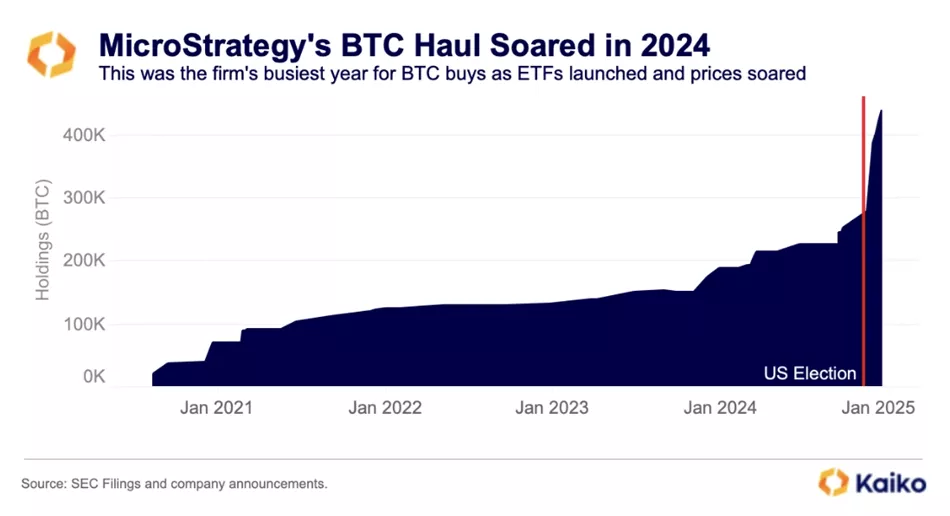

MicroStrategy’s Record Bitcoin Purchases

Since January, MicroStrategy acquired over 249,850 BTC, doubling its holdings in the last month alone. The company issued convertible bonds, raising concerns about its financial stability.

Kaiko highlighted U.S. Senator Cynthia Lummis’s proposal for a national Bitcoin reserve, suggesting up to 1 million BTC purchases over five years.

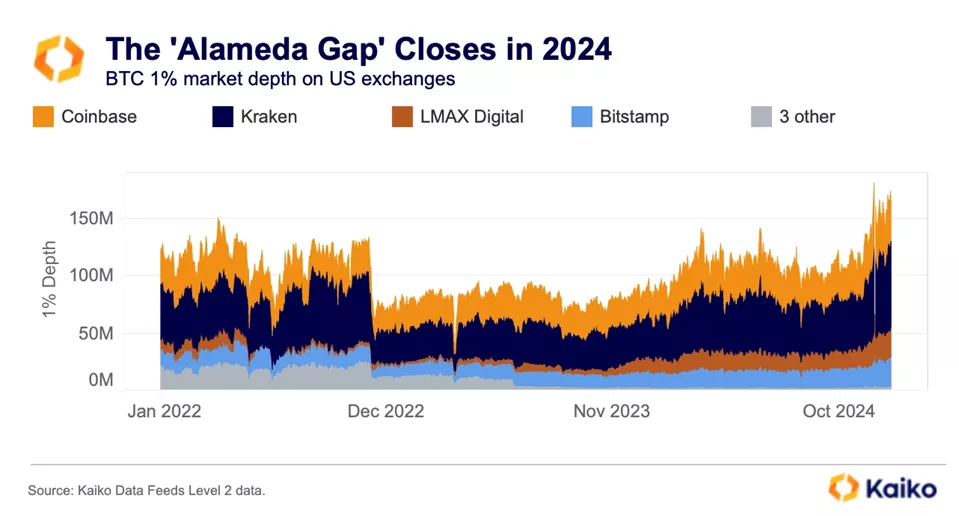

Liquidity Recovery Post-FTX Collapse

Kaiko observed the filling of the “Alameda gap,” referring to the decline in market depth within 1% of average price on U.S. platforms after FTX and Alameda Research’s collapse. The market mitigated the impact through price growth and new participants.

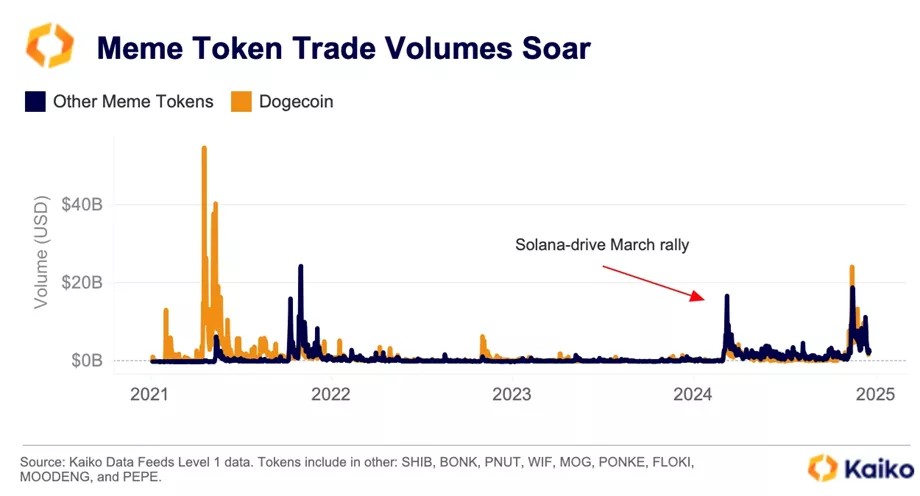

Meme-Coin Hype

The launch of the Pump.fun platform on Solana ignited a boom in the meme-coin market. The election of Donald Trump as U.S. president revived interest in Dogecoin. Later, it was announced that the newly created Department of Government Efficiency (DOGE) would be led by billionaire Elon Musk and former presidential candidate Vivek Ramaswamy.

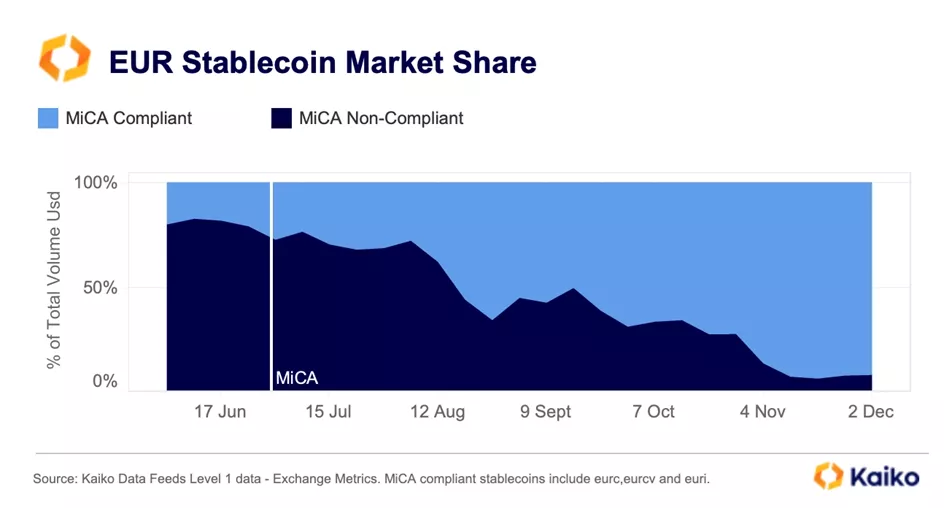

Stablecoin Market Transformation Post-MiCA

MiCA’s implementation spurred delistings of non-compliant stablecoins on centralized exchanges. By November 2024, MiCA-compliant stablecoins like EURC (Circle), EURCV (Societe Generale), and EURI (Banking Circle) reached a record 91% market share.

Additional Notes

- CoinGecko identified meme-coins as the top trend among traders in 2024.

- The community remains skeptical about the long-term appeal of AI agents.

Happy Holidays!

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.