The critical support level for Bitcoin stands at $97,877, where over 101,000 BTC have been accumulated in wallets. Staying above this threshold is essential to maintaining bullish momentum, according to analyst Ali Martinez.

The key support level for #Bitcoin is at $97,877, where more than 101,000 $BTC were accumulated. Holding above this level is crucial to sustaining the bullish momentum. pic.twitter.com/4kMR5ZtkWa

— Ali (@ali_charts) January 25, 2025

If Bitcoin breaks below $91,700, it could trigger a sharp drop to $74,000, Martinez warned. He emphasized that the next few weeks will be decisive in shaping the trend.

Market Pressure and On-Chain Data

Several factors have contributed to recent selling pressure:

– Miners dumped 20,000 BTC (~$2B) in mid-January.

– Hodlers offloaded 75,000 BTC (~$7.5B) over the past week.

– Active addresses dropped to their lowest level since November.

– Fresh capital inflows collapsed by 63.3% since December 10, plunging from $134.7B to $43.4B.

Bullish Scenarios

Martinez outlined two major price targets if Bitcoin holds above $97,877 and $91,700:

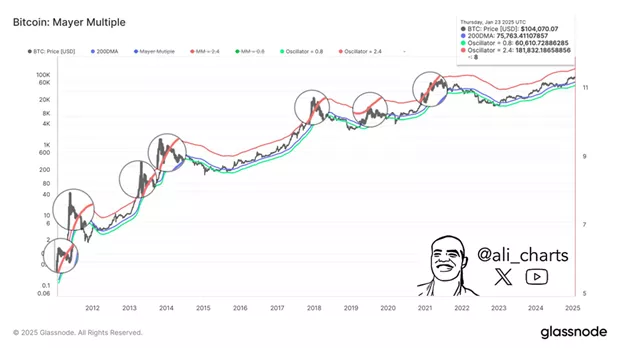

– $182,000 based on the Mayer Multiple.

– $276,400 using the Cup & Handle pattern.

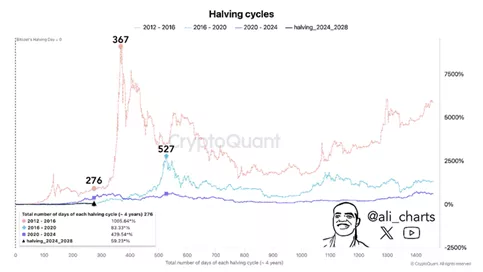

He projected Bitcoin’s potential market peak between May and October, citing past post-halving trends:

– 2013: Market peak 367 days after halving.

– 2017 & 2021: Peaks formed 527 days post-halving.

Currently, it’s 276 days since the last halving, meaning the next peak could be 90 to 250 days away.

Market Leverage and Hodler Behavior

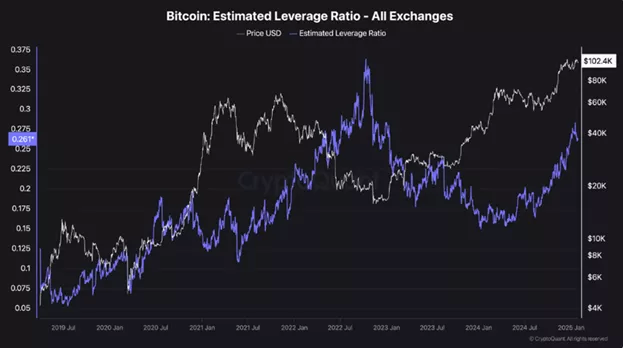

CryptoQuant highlighted that Bitcoin derivatives leverage hasn’t reached the extreme levels seen in 2021’s bull run, signaling room for continued growth.

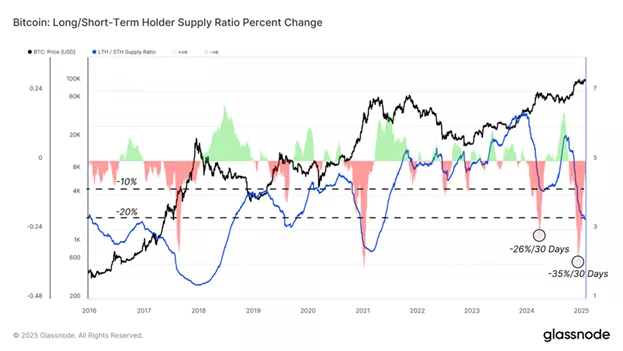

Meanwhile, long-term holders (LTHs) have slowed selling. Glassnode reported a -35% drop in LTH-to-STH supply shift post-New Year, with levels now stabilizing.

BTC Exchange Balances at Multi-Year Lows

Bitcoin balances on centralized exchanges (CEX) dropped from 3.1M BTC to 2.74M BTC over the past six months. Lower exchange reserves indicate a supply squeeze, often a bullish indicator.

Glassnode noted that much of this BTC outflow is flowing into ETFs, with custodians like Coinbase managing the assets. Adjusting for ETF balances, CEX reserves sit at ~3M BTC.

Macroeconomic & Institutional Drivers

– M2 Money Supply in the U.S. hit $21.5T in December, nearing record levels—an optimistic sign for risk assets, per CoinDesk.

– Bitwise expects “less severe” Bitcoin corrections due to Trump administration’s pro-crypto stance.

– Bitcoin futures flipped bearish for the first time since August 2023, amid DeepSeek hype and Fed uncertainty.

Bottom Line

If $97,877 and $91,700 hold, Bitcoin’s bull run remains intact, with price targets of $182K–$276K. However, a break below $91,700 could lead to a deep correction.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.