The team behind the Mantra Layer 1 blockchain has announced the launch of the Mantra Ecosystem Fund (MEF), a $108.9 million initiative aimed at supporting startups focused on real-world asset (RWA) tokenization and decentralized finance (DeFi).

Today, we’re announcing the launch of the MEF – a $108,888,888 million investment initiative designed to propel real world asset innovation, adoption and growth.

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 7, 2025

But we’re not doing this alone. We’ve got leading incubators, accelerators and capital partners by our side;… pic.twitter.com/oyeCOJ9QrE

MEF will invest in companies at any stage of development across global markets, leveraging Mantra’s partner network and supporting infrastructure. The fund seeks to foster both new ventures and existing projects within the RWA and DeFi sectors.

Funding for the initiative was provided by a group of major players, including Laser Digital, Shorooq, Brevan Howard Digital, Valor Capital, Three Point Capital, and Amber Group.

The fund’s launch comes a month after Mantra became the first DeFi platform to receive a Virtual Asset Service Provider license from Dubai’s Virtual Assets Regulatory Authority (VARA).

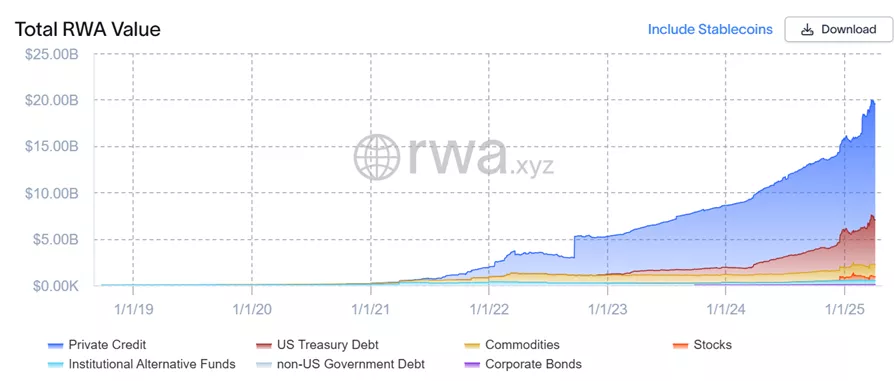

According to data from RWA.xyz, the total value locked (TVL) in the RWA sector has grown to $19.7 billion, underscoring the increasing momentum behind asset tokenization.

Meanwhile, Fidelity Investments is reportedly preparing to launch its own stablecoin as part of its broader push into the digital assets space. The move is seen as an effort to strengthen the company’s position in the growing RWA market.

Prior to this, Fidelity filed documentation for the registration of a tokenized version of its U.S. money market fund, the Fidelity Treasury Digital Fund.

In related developments, RWA-focused project Ondo Finance recently joined Mastercard’s Multi-Token Network — a blockchain initiative aimed at building a more robust infrastructure for tokenized assets.

Let me know if you’d like a tweet version or summary too.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.