Bitcoin miner MARA has sent 7,377 BTC (16.4% of its Bitcoin reserves) to crypto lending services in order to earn a “modest” additional yield.

According to Vice President Robert Samuels, the company will focus on short-term agreements “with well-established third parties” active throughout 2024. The expected contract yield is no more than 10% annually.

MARA Holdings’ long-term goal is to generate sufficient cash flow to cover operational expenses.

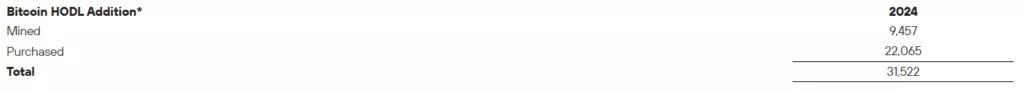

A report published on January 3 shows that the company acquired 22,065 BTC in 2024 at an average price of $87,205 per coin and mined 9,457 BTC.

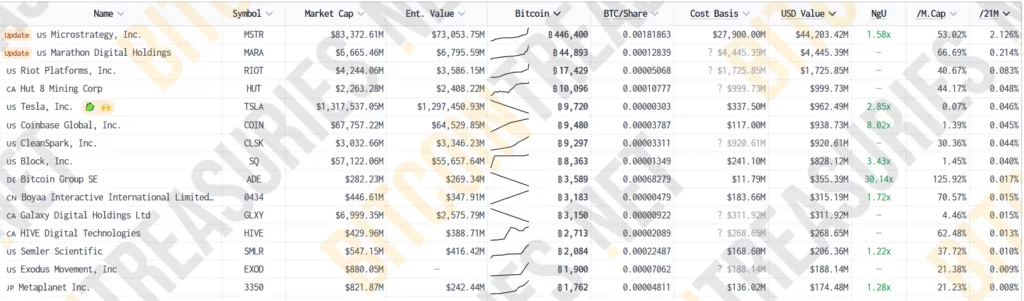

In December, MARA surpassed its hash rate target of 50 EH/s, bringing its total Bitcoin reserves to 44,893 BTC—valued at $4.45 billion at current prices.

MARA Holdings CEO and Chairman Fred Thiel noted that the hybrid approach of both mining and buying Bitcoin gives the company considerable flexibility to acquire the asset at favorable prices. According to him, this strategy bolsters the firm’s position and enhances its ability to deliver long-term shareholder value.

Earlier, MARA Holdings purchased 11,774 BTC for ~$1.1 billion at an average price of around $96,000 per coin. The coins were acquired using proceeds from zero-coupon convertible bond sales.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.