From December 16 to 22, MicroStrategy acquired 5,262 BTC for approximately $561 million at an average price of $106,662 per coin.

MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, we hodl 444,262 $BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin. $MSTR https://t.co/asDGerBV7q

— Michael Saylor⚡️ (@saylor) December 23, 2024

During the same period, the company sold 1,317,841 shares for about $561 million. MicroStrategy still holds additional shares worth approximately $7.1 billion available for sale.

The firm’s Bitcoin holdings have reached 444,262 BTC, valued at around $78 billion at the time of writing.

Since August 2020, MicroStrategy has invested about $27.7 billion in Bitcoin, with an average purchase price of $62,257 per coin.

Despite Bitcoin’s significant price increases and MicroStrategy’s inclusion in the Nasdaq 100 index, the company continues to face criticism for its strategy of building shareholder value by accumulating Bitcoin, even through debt financing.

Euro Pacific Capital President Peter Schiff predicted MicroStrategy’s bankruptcy if Bitcoin’s price plummets.

However, Anthony Scaramucci, founder and managing partner of SkyBridge Capital, refuted these concerns in an interview with Bloomberg. He believes that only a prolonged “systemic collapse” of Bitcoin, lasting six to seven years, could pose serious risks to Michael Saylor’s strategy. Scaramucci also noted the company’s favorable debt structure, characterized by long-term repayment schedules.

MicroStrategy’s shares are the third-largest holding in the portfolio of the First Trust SkyBridge Crypto Industry and Digital Economy ETF, managed by SkyBridge.

In December, Michael Saylor reaffirmed that the company would continue purchasing Bitcoin regardless of price fluctuations. The most recent acquisition occurred at levels close to Bitcoin’s recent all-time highs of around $108,000.

Japan-based public company Metaplanet, which mirrors MicroStrategy’s Bitcoin strategy, announced on December 23 its purchase of an additional 619.7 BTC at an average price of $97,546.

*Metaplanet purchases additional 619.70 BTC* pic.twitter.com/5npflMJ3kW

— Metaplanet Inc. (@Metaplanet_JP) December 23, 2024

The total transaction value was approximately $61 million. In November, Metaplanet issued options for acquiring its shares to raise a similar amount.

Metaplanet’s Bitcoin holdings have now reached 1,762 BTC, purchased at an average price of about $75,380.

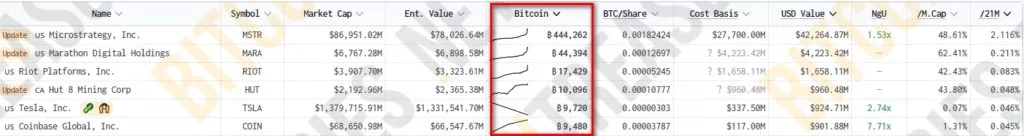

According to Bitcoin Treasures, MicroStrategy continues to lead among corporations in Bitcoin holdings.

Second in the rankings is MARA Holdings (formerly Marathon Digital) with 44,384 BTC, followed by two other mining companies, Riot Platforms and Hut 8 Corp.

Context

In the latter half of the year, public Bitcoin miners increasingly adopted MicroStrategy’s strategy of accumulating digital gold, as noted by analysts at JPMorgan.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.