MicroStrategy has announced the early redemption of convertible notes worth about $1.05 billion with a 2027 maturity date.

MicroStrategy to Redeem $1.05B of 2027 Convertible Notes and Settle All Conversion Requests in Shares $MSTR https://t.co/yVBb06wkBY

— Michael Saylor⚡️ (@saylor) January 24, 2025

Until February 20, bondholders can exchange each $1000 of the debt for 7.02 Class A common shares at the preset conversion rate of $142.38—with any fractional shares paid in cash.

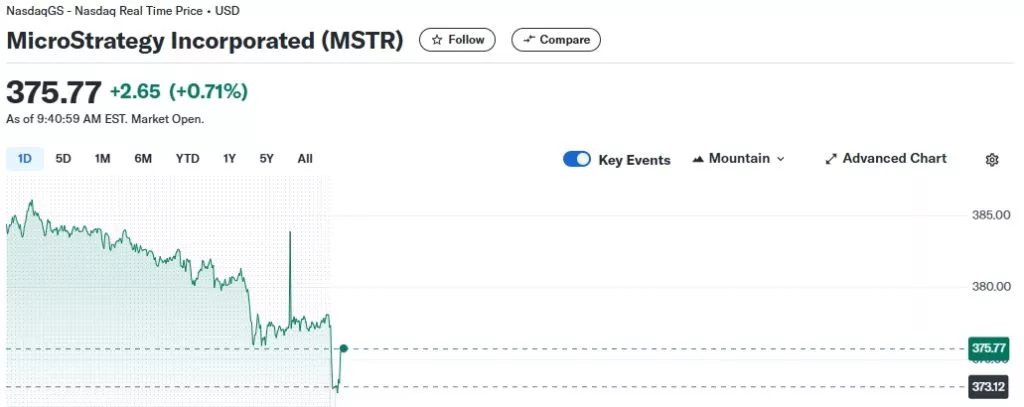

At the time of writing, MicroStrategy’s stock price stands at about $375.80, up 0.71% from its previous closing.

After purchasing an additional 11,000 BTC in January, the company grew its Bitcoin reserves to 461,000 BTC, currently valued at $47 billion with an unrealized profit of about $18 billion.

Potential New Tax Liabilities

According to a report in The Wall Street Journal, starting in 2026, MicroStrategy could face billion-dollar tax liabilities due to new IRS legislation. The Corporate Alternative Minimum Tax (CAMT) of 15% would apply to companies with annual revenue exceeding $1 billion.

The publication stated that MicroStrategy is in discussions with the IRS to seek an exemption from these levies.

Context

- In October 2024, the firm unveiled its “21/21 Plan” to raise $42 billion in equity and debt over three years to purchase more Bitcoin.

- In December, MicroStrategy decided to boost the maximum number of shares available for sale by over $10 billion, pending shareholder approval.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.