A potential Bitcoin correction to $70,000 could be a natural part of the ongoing bull market, according to Nansen analyst Aurélie Barter, who shared her view with Cointelegraph.

She believes Bitcoin is following the broader macro trend, with the next range set at $71,000-$72,000—levels above those recorded before the U.S. elections in November.

Uncertainty surrounding tariffs and the Fed’s rate cuts is putting pressure on both traditional and digital assets, while recession fears persist, Barter noted.

Further Correction Inevitable?

Bitcoin may fall below $70,000 in its search for a stable recovery base, suggested Nexo analyst Ilya Kalchev.

Former BitMEX CEO Arthur Hayes believes a drop to this level is highly likely, noting that a 36% correction from the $110,000 high is normal in a bull market.

Currently, Bitcoin is trading around $80,000, having tested this level in recent days.

Investor Anxiety Peaks

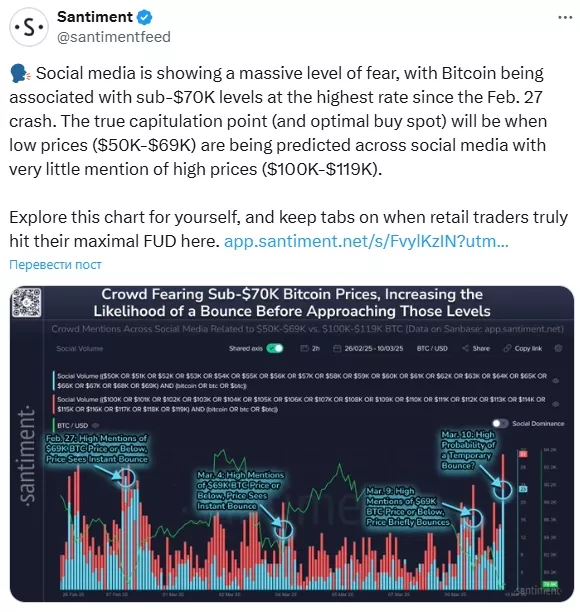

Social media analysis by Santiment indicates that market anxiety peaked on February 27, following the market crash, as traders worried about a potential drop to $70,000.

However, analysts at Santiment believe the real “capitulation point” will come when the market focuses on a $50,000-$69,000 range, and mentions of $100,000-$119,000 become rare.

Investors Are Missing the Point

Market disappointment also stems from Donald Trump’s executive order to create a crypto reserve, noted Bitwise CIO Matt Hougan in a weekly note.

Some traders expected the government to start buying Bitcoin immediately, pushing prices higher. However, the reserve will be formed from confiscated cryptocurrencies.

Hougan believes many misinterpreted the document. Instead of selling 200,000 BTC seized by authorities, the order instructs the Treasury and Commerce Departments to develop strategies for additional Bitcoin acquisitions.

“The document doesn’t say officials ‘may’ or ‘can’—it says they ‘must.’ I’ve worked as a speechwriter for federal officials, and I can tell you that word choices in official statements are deliberate,” Hougan emphasized.

He argues that Bitcoin’s current price moves are irrelevant. The real question is whether Bitcoin will become a global financial macro asset like gold, with a market capitalization of $10-50 trillion.

“If not, it will remain a historical footnote, fluctuating below $150,000, supported only by a small cohort of libertarians, cypherpunks, and speculators. There is no middle ground,” Hougan concluded.

Crypto Summit Disappointment

The March 7 White House Crypto Summit, attended by Trump, also failed to boost the market, as investors were disappointed by the lack of concrete government plans for the industry.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.