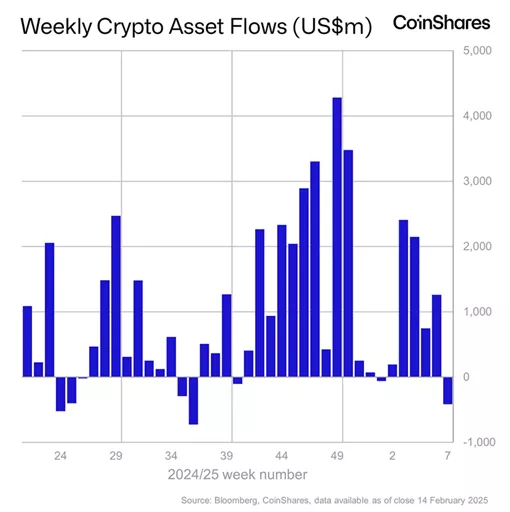

From February 8 to 14, cryptocurrency investment funds saw $415 million in outflows, following a $1.3 billion inflow the previous week, according to CoinShares.

This marks the first outflow after 19 consecutive weeks of inflows, during which funds attracted $29.4 billion—a trend driven by the market’s reaction to Donald Trump’s victory in the U.S. presidential election.

The shift was triggered by higher-than-expected consumer price index (CPI) data and hawkish comments from Federal Reserve Chair Jerome Powell in Congress.

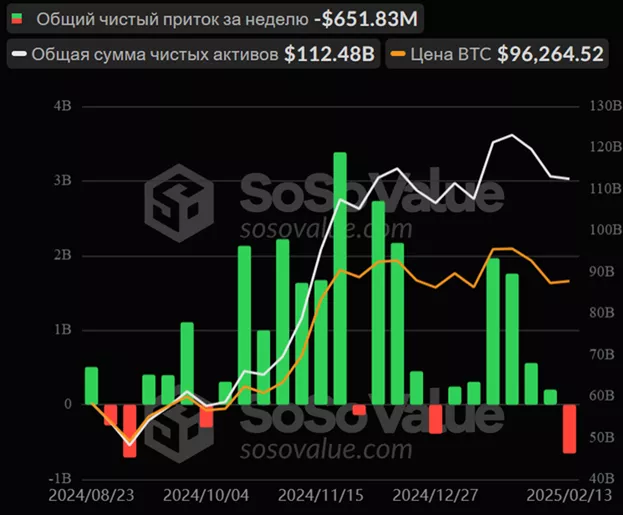

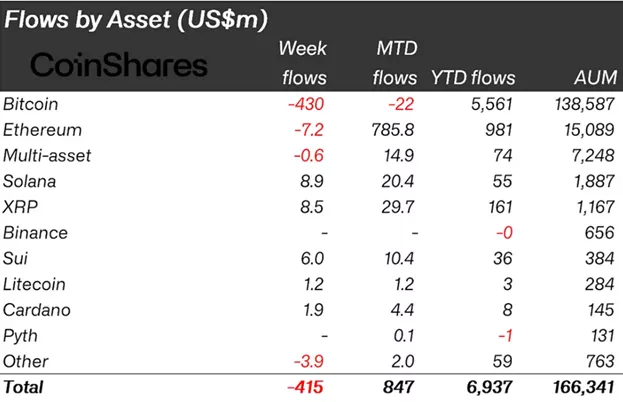

Funds focused on Bitcoin recorded $430 million in outflows, compared to a $407 million inflow the previous week.

Investors pulled $157.8 million from U.S. spot Bitcoin ETFs, ending a six-week streak of positive inflows.

Short Bitcoin investment products saw $9.6 million in outflows, reversing the $0.1 million inflow from the previous period.

After a $783 million inflow into Ethereum funds, the latest data showed $7.2 million in outflows.

XRP-based funds saw a slowdown in inflows from $21.1 million to $8.5 million.

Meanwhile, funds focused on Solana, Sui, and Cardano attracted $8.9 million, $6 million, and $1.9 million, respectively.

Earlier, CryptoQuant warned that Bitcoin could enter a bearish phase due to a decline in investor risk appetite.

According to CoinDesk, traders are increasingly buying Bitcoin call options with a $110,000 strike price, set to expire on March 28.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.

Cryptol – your source for the latest news on cryptocurrencies, information technology, and decentralized solutions. Stay informed about the latest trends in the digital world.